Staying Home: How Can You Earn? What Opportunities Await?

The traditional image of climbing the corporate ladder, commuting daily, and sacrificing personal time for financial stability is rapidly fading. We live in an era where staying home doesn't equate to financial stagnation. In fact, it can unlock a plethora of opportunities to earn income, build wealth, and achieve financial freedom. This shift is fueled by technological advancements, the rise of the gig economy, and a growing desire for work-life balance. The key is to identify the right opportunities, cultivate the necessary skills, and adopt a strategic approach.

One avenue that has garnered significant attention, albeit with inherent risks, is the world of cryptocurrencies and digital assets. While the volatility and complexity can be daunting, a well-informed and cautious approach can potentially lead to substantial returns. However, it's crucial to dispel the myth of overnight riches. Investing in cryptocurrencies requires diligent research, a strong understanding of market dynamics, and a willingness to accept potential losses.

Before diving into the specifics, it's imperative to establish a solid financial foundation. This includes having an emergency fund, paying off high-interest debt, and understanding your risk tolerance. Cryptocurrencies are inherently speculative assets, and investing money you can't afford to lose is a recipe for disaster. Think of it as allocating a small percentage of your overall investment portfolio to high-risk, high-reward ventures, rather than betting the farm.

Now, let's explore some specific cryptocurrency-related opportunities.

-

Long-Term Investing (HODLing): This strategy involves identifying cryptocurrencies with strong fundamentals, solid use cases, and a dedicated development team. The idea is to purchase these assets and hold them for the long term, weathering the inevitable market fluctuations. Bitcoin and Ethereum are often considered foundational cryptocurrencies for this approach. However, even with established coins, thorough research is paramount. Analyze their technology, adoption rates, regulatory landscape, and competitive advantages. Don't just follow the hype; understand the underlying value proposition.

-

Staking and Lending: Many cryptocurrencies operate on Proof-of-Stake (PoS) consensus mechanisms. This allows holders to "stake" their tokens to help validate transactions and secure the network. In return, they receive staking rewards, effectively earning passive income. Similarly, some platforms allow you to lend your cryptocurrency holdings to borrowers in exchange for interest. While these options offer potential returns, they also carry risks. Staking periods often require locking up your tokens for a specified duration, limiting your liquidity. Lending platforms can be vulnerable to hacks and smart contract exploits. Always research the security protocols and reputation of the platforms you use.

-

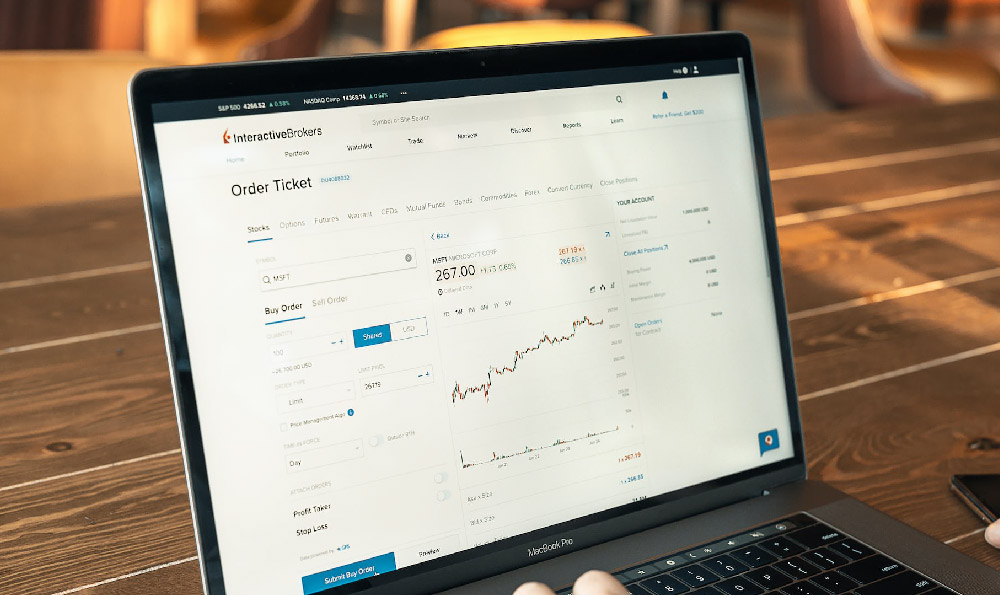

Trading: Actively trading cryptocurrencies can be highly lucrative, but it's also extremely risky and requires significant time and expertise. Day trading, swing trading, and arbitrage are all strategies employed by active traders. Success in this arena demands a deep understanding of technical analysis, chart patterns, and market sentiment. You need to be able to interpret price movements, identify trends, and manage risk effectively. Furthermore, the 24/7 nature of the cryptocurrency market can be demanding, requiring constant monitoring and quick decision-making. Beginners are advised to start with paper trading (using virtual money) to practice their skills before risking real capital.

-

Participating in Decentralized Finance (DeFi): DeFi is a rapidly evolving ecosystem of financial applications built on blockchain technology. It offers opportunities to earn yield through various activities, such as providing liquidity to decentralized exchanges, participating in yield farming, and lending and borrowing assets. While DeFi holds immense potential, it's also a complex and often unregulated space. Smart contract risks, impermanent loss, and rug pulls are just some of the challenges that investors face. Before engaging in DeFi, thoroughly research the projects, understand the risks involved, and only invest what you can afford to lose.

-

Mining (While Less Accessible): Traditionally, cryptocurrency mining involved using powerful computers to solve complex mathematical problems to validate transactions and earn block rewards. However, mining has become increasingly competitive and energy-intensive, making it less accessible to individual investors. While cloud mining services exist, they often come with high fees and questionable returns.

Beyond specific investment strategies, there are several crucial principles to follow to protect yourself and maximize your chances of success:

-

Do Your Own Research (DYOR): Never rely solely on the opinions of others. Conduct thorough research on any cryptocurrency or project you're considering investing in. Read whitepapers, analyze tokenomics, assess the team's credentials, and evaluate the community support.

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your cryptocurrency holdings across different projects and asset classes. This can help mitigate risk and increase your chances of capturing gains.

-

Use Secure Wallets and Exchanges: Choose reputable cryptocurrency exchanges with strong security measures. Store your cryptocurrency holdings in secure wallets, such as hardware wallets or reputable software wallets. Enable two-factor authentication (2FA) and use strong, unique passwords.

-

Be Wary of Scams and Ponzi Schemes: The cryptocurrency space is rife with scams and Ponzi schemes. Be skeptical of projects that promise guaranteed returns or unrealistic profits. Avoid investing in projects with vague business models or anonymous teams.

-

Stay Informed: The cryptocurrency market is constantly evolving. Stay up-to-date on the latest news, trends, and regulations. Follow reputable sources of information and engage with the cryptocurrency community.

-

Start Small: Begin with a small investment and gradually increase your exposure as you gain experience and confidence.

Staying home and earning through cryptocurrency investing is a viable option, but it requires a significant commitment to education, risk management, and responsible investing practices. It's not a get-rich-quick scheme, but a potentially rewarding path for those willing to put in the time and effort. Remember, knowledge is your most powerful weapon in the volatile world of digital assets. Always prioritize security, diversification, and responsible investing principles.