What is Capital, and How is it Used in Investment?

Capital, in the realm of finance and investment, represents much more than just money. It’s the lifeblood of economic activity, the fuel that drives innovation, and the foundation upon which individuals and institutions build wealth. Understanding what constitutes capital and how it's employed in investment strategies is crucial for anyone seeking to navigate the complexities of the financial world. At its core, capital encompasses any resource, tangible or intangible, that can be used to generate future income or benefit. This broad definition includes physical assets like machinery, equipment, and real estate, but also extends to financial assets like stocks, bonds, and cash. Even intangible assets like intellectual property, brand reputation, and human capital (the skills and knowledge possessed by individuals) can be considered forms of capital. The defining characteristic is its potential to create future value.

The utilization of capital in investment is a multifaceted process, tailored to specific goals, risk tolerances, and time horizons. A fundamental principle is the allocation of capital across different asset classes to achieve a desired balance between risk and return. This process, known as asset allocation, is a cornerstone of portfolio management. For instance, an investor with a long-term investment horizon and a high-risk tolerance might allocate a larger portion of their capital to equities (stocks), which historically have offered higher returns but also come with greater volatility. Conversely, an investor nearing retirement with a lower risk tolerance might favor bonds, which offer more stable returns but generally lower growth potential.

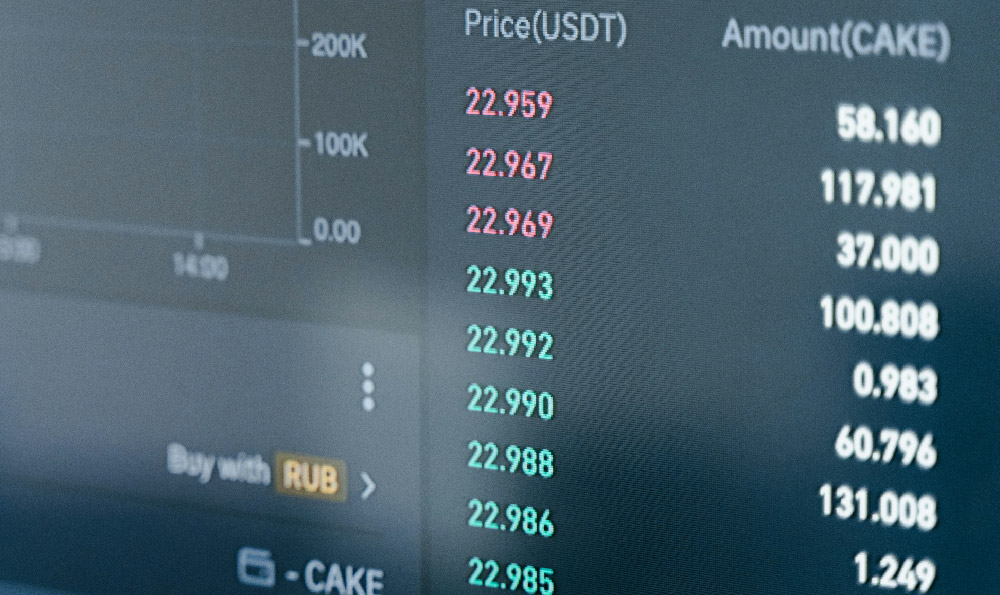

Beyond asset allocation, the specific instruments used to deploy capital are diverse and numerous. Direct investment in companies through stocks is a common approach. By purchasing shares of a company, investors become partial owners and participate in the company's profits (through dividends) and growth (through appreciation in share price). This strategy carries inherent risks, as the value of a stock can fluctuate significantly based on company performance, industry trends, and broader economic conditions. Bonds, on the other hand, represent loans made to governments or corporations. Bondholders receive regular interest payments and the principal amount upon maturity. Bonds are generally considered less risky than stocks, but their returns are also typically lower. Real estate is another significant avenue for capital investment. Investing in properties, whether residential or commercial, can generate rental income and potential appreciation in value. However, real estate investments require significant capital outlay and are subject to market fluctuations, property management responsibilities, and illiquidity (difficulty in quickly converting the asset to cash).

Furthermore, capital can be deployed through various investment vehicles like mutual funds and exchange-traded funds (ETFs). These funds pool capital from multiple investors to invest in a diversified portfolio of assets, offering instant diversification and professional management. Mutual funds are actively managed, meaning a fund manager selects the investments with the goal of outperforming a specific benchmark. ETFs, on the other hand, are typically passively managed, tracking a specific index or sector, and generally have lower expense ratios. The choice between mutual funds and ETFs depends on the investor's preference for active versus passive management and their desired level of diversification. Alternative investments, such as hedge funds, private equity, and venture capital, represent another category of capital deployment. These investments are typically less liquid and more complex than traditional investments, often requiring significant expertise and capital. They can offer the potential for higher returns but also carry greater risks. Venture capital, in particular, involves investing in early-stage companies with high growth potential. This is a high-risk, high-reward strategy, as many startups fail, but the successful ones can generate significant returns.

Effective capital utilization also necessitates a thorough understanding of risk management. Risk is an inherent part of investing, and managing it effectively is crucial for protecting capital and achieving investment goals. Diversification, as mentioned earlier, is a key risk management technique. By spreading capital across different asset classes, sectors, and geographic regions, investors can reduce the impact of any single investment performing poorly. Another important aspect of risk management is assessing and mitigating various types of risks, such as market risk (the risk of losses due to changes in market conditions), credit risk (the risk of a borrower defaulting on their debt), and liquidity risk (the risk of not being able to sell an asset quickly at a fair price). Stop-loss orders, which automatically sell an asset when it reaches a certain price level, can also be used to limit potential losses.

Beyond the specific investment instruments and risk management techniques, the efficient allocation of capital requires a sound financial plan. This plan should outline the investor's financial goals, time horizon, risk tolerance, and investment strategy. It should also consider factors such as income, expenses, debt, and taxes. A well-defined financial plan provides a roadmap for capital deployment, ensuring that investment decisions are aligned with the investor's overall financial objectives. Continuous monitoring and rebalancing of the portfolio are also essential. Market conditions change constantly, and the performance of different asset classes can vary over time. Rebalancing involves periodically adjusting the portfolio to maintain the desired asset allocation, selling assets that have outperformed and buying assets that have underperformed. This helps to ensure that the portfolio remains aligned with the investor's risk tolerance and investment goals.

In conclusion, capital is a versatile resource that can be employed in numerous ways to generate wealth. From investing in stocks and bonds to real estate and alternative assets, the possibilities are vast. The key to successful capital utilization lies in understanding the different investment options, assessing their risks and rewards, developing a sound financial plan, and managing risk effectively. Whether you are an individual investor or a large institution, the principles of capital allocation and risk management are fundamental to achieving long-term financial success. Ultimately, prudent investment of capital is a cornerstone of economic growth and individual prosperity, enabling individuals to achieve their financial goals and contribute to a thriving economy.