Why Invest: Does It Really Matter For Your Future?

Investing is not merely a pastime for the wealthy; it's a cornerstone of long-term financial security and a pathway to achieving your life goals. While saving money is undoubtedly important, relying solely on savings accounts can leave you struggling to keep pace with inflation and missing out on significant growth opportunities. Understanding why investing matters is the first step towards taking control of your financial future.

One of the most compelling reasons to invest is to combat the insidious effects of inflation. Inflation erodes the purchasing power of your money over time. Think about it: what $100 could buy a decade ago can likely purchase significantly less today. Holding cash in a savings account that earns minimal interest may seem safe, but in reality, your money is losing value as prices rise. Investing, on the other hand, offers the potential to generate returns that outpace inflation, preserving and even increasing your purchasing power. Equities, for example, historically offer returns that exceed inflation over the long term, although they come with higher volatility. Fixed income investments, such as bonds, can also provide a steady stream of income and help mitigate the impact of inflation, particularly when interest rates are rising.

Beyond simply preserving capital, investing allows you to grow your wealth exponentially through the power of compounding. Compounding is essentially earning returns on your returns. When you invest, your initial investment generates income, and that income is then reinvested, allowing it to generate its own income. Over time, this snowball effect can lead to substantial wealth accumulation. For example, imagine investing $10,000 in a diversified portfolio that yields an average annual return of 7%. After 30 years, your initial investment could potentially grow to over $76,000, assuming all returns are reinvested. This demonstrates the profound impact of compounding over time, especially when you start early and consistently contribute to your investment portfolio. The longer your investment horizon, the more powerful compounding becomes.

Furthermore, investing provides a crucial means of achieving long-term financial goals, such as retirement, homeownership, funding your children's education, or starting a business. These goals often require significant sums of money, and relying solely on savings may not be sufficient to reach them within a reasonable timeframe. Investing allows you to strategically allocate your resources towards assets that have the potential to generate higher returns, accelerating your progress towards your goals. For instance, if your goal is to retire comfortably in 30 years, investing in a mix of stocks, bonds, and real estate could provide the necessary growth to accumulate the required retirement savings. Tailoring your investment strategy to your specific goals and time horizon is essential for maximizing your chances of success.

Another important aspect to consider is the opportunity cost of not investing. Opportunity cost represents the potential benefits you forgo when you choose one option over another. By keeping your money idle in a low-yielding savings account, you are missing out on the potential gains you could have earned by investing in assets that offer higher returns. This lost potential can be substantial over the long run, especially given the power of compounding. While the perceived safety of savings accounts can be appealing, it's crucial to weigh that against the potential for significantly greater wealth accumulation through strategic investing.

Investing also allows you to diversify your income streams. Relying solely on a single source of income, such as your salary, can leave you vulnerable to financial hardship if you lose your job or experience a decrease in income. Investing in dividend-paying stocks, rental properties, or other income-generating assets can provide a supplementary source of income, creating a financial safety net and enhancing your overall financial stability. This diversification of income can also provide greater financial freedom and flexibility, allowing you to pursue your passions and achieve greater financial independence.

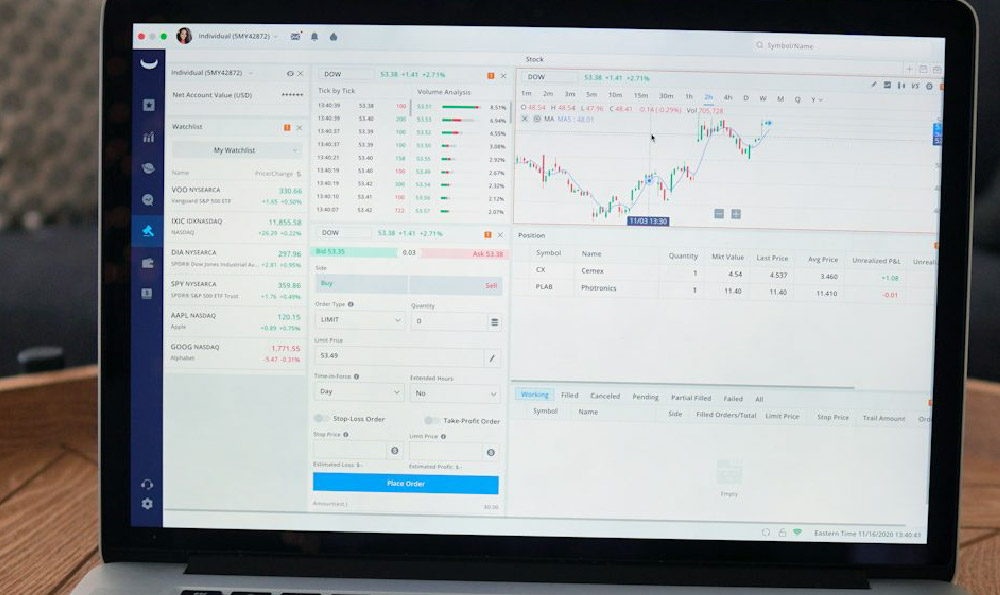

However, it's crucial to acknowledge that investing involves risk. No investment guarantees returns, and market fluctuations can lead to temporary losses. Therefore, it's essential to approach investing with a long-term perspective and a well-defined risk tolerance. Diversifying your investment portfolio across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk. Furthermore, conducting thorough research and seeking professional financial advice can help you make informed investment decisions that align with your goals and risk profile.

In conclusion, investing is not just about making money; it's about securing your future, achieving your goals, and building financial freedom. It's a powerful tool that can help you combat inflation, grow your wealth through compounding, diversify your income streams, and ultimately, live the life you desire. While investing involves risk, the potential rewards far outweigh the risks for those who approach it strategically and with a long-term perspective. By understanding the importance of investing and taking proactive steps to build a diversified investment portfolio, you can empower yourself to achieve financial security and create a brighter future for yourself and your loved ones. So, start small, learn as you go, and embrace the journey of building wealth through smart and informed investing.