Why Did XRP Price Drop Today? Keepbit Platform Still a Good Choice?

Why Did XRP Price Drop Today? Navigating Crypto Volatility and Keepbit's Role

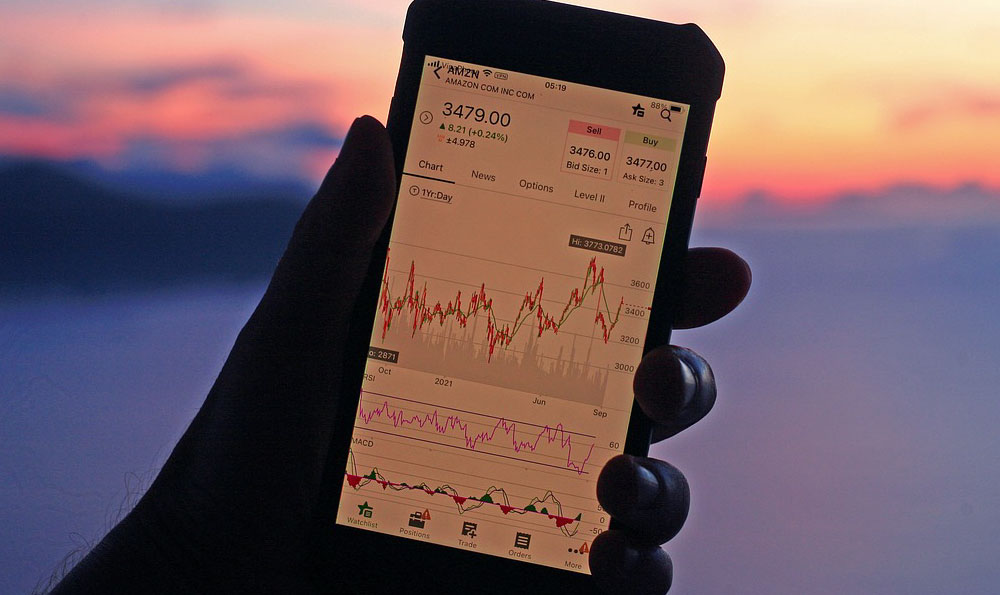

Cryptocurrencies, known for their high volatility, often experience price fluctuations that can leave investors scratching their heads. Today's dip in XRP's price is no exception. Understanding the factors contributing to this downturn, while also evaluating platforms like Keepbit, is crucial for making informed investment decisions in the crypto space.

Decoding the XRP Price Drop: A Multifaceted Perspective

Several reasons could be behind the recent decline in XRP's value. These factors often intertwine, creating a complex web of influences that impact market sentiment.

-

Market-Wide Corrections: Cryptocurrency markets are prone to broad corrections. These occur when a significant number of investors decide to sell off their holdings, often triggered by macroeconomic events, regulatory announcements, or even just profit-taking after a period of sustained growth. If Bitcoin, the bellwether of the crypto market, experiences a downturn, it invariably drags down other cryptocurrencies, including XRP.

-

Regulatory Uncertainty: The ongoing legal battle between Ripple Labs (the company behind XRP) and the U.S. Securities and Exchange Commission (SEC) continues to cast a shadow over XRP. Any negative developments in the case, such as unfavorable rulings or delays, can trigger sell-offs and price drops. Investors are wary of the potential implications of the SEC classifying XRP as a security, which could subject it to stricter regulations.

-

Profit-Taking and Speculation: After periods of upward momentum, some investors choose to cash out their profits, leading to a temporary decrease in price. Short-term traders, driven by speculation, can also contribute to volatility by rapidly buying and selling XRP based on market rumors and sentiment.

-

Whale Activity: Large holders of XRP, often referred to as "whales," can significantly influence the market with their trading activity. If a whale decides to sell a substantial portion of their XRP holdings, it can create a ripple effect, causing prices to plummet.

-

General Crypto News and Sentiment: The overall news flow and sentiment surrounding the cryptocurrency market can also play a role. Negative headlines about hacks, scams, or regulatory crackdowns can dampen investor enthusiasm and lead to price declines across the board.

Keepbit: A Platform for Crypto Trading and Investment

Keepbit is one of many cryptocurrency platforms offering services for buying, selling, and trading digital assets. When considering whether a platform like Keepbit remains a good choice during market volatility, several factors should be considered:

-

Security: A paramount concern for any crypto platform is its security infrastructure. Keepbit should employ robust security measures, such as two-factor authentication, cold storage for funds, and regular security audits, to protect user assets from hacking attempts and other threats.

-

User Interface and Experience: A user-friendly interface is essential, especially for novice traders. The platform should be intuitive and easy to navigate, providing clear information on pricing, trading options, and account management.

-

Trading Fees and Costs: The fees charged for trading and other services can significantly impact profitability. Keepbit's fee structure should be transparent and competitive compared to other platforms. Hidden fees or excessive transaction costs can erode returns.

-

Liquidity and Trading Volume: High liquidity ensures that users can easily buy and sell XRP or other cryptocurrencies without significant price slippage. A platform with adequate trading volume indicates strong market participation and efficient order execution.

-

Customer Support: Reliable and responsive customer support is crucial for addressing user inquiries and resolving issues. Keepbit should provide multiple channels for support, such as email, live chat, and a comprehensive knowledge base.

-

Regulatory Compliance: Keepbit should operate in compliance with relevant regulations in the jurisdictions where it offers its services. This demonstrates a commitment to transparency and accountability, providing users with a greater sense of security.

Navigating Volatility: Strategies for XRP Investors

While predicting short-term price movements is notoriously difficult, investors can adopt strategies to mitigate risk and navigate market volatility.

-

Diversification: Don't put all your eggs in one basket. Diversify your crypto portfolio by investing in a variety of cryptocurrencies with different use cases and market capitalizations.

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy helps to smooth out the impact of price fluctuations and reduces the risk of buying at the top.

-

Long-Term Perspective: Cryptocurrency investments should generally be considered long-term endeavors. Avoid making impulsive decisions based on short-term price swings. Focus on the underlying fundamentals of XRP and its potential for future growth.

-

Risk Management: Determine your risk tolerance and set stop-loss orders to limit potential losses. Never invest more than you can afford to lose.

-

Stay Informed: Keep abreast of the latest news and developments in the cryptocurrency market, including regulatory updates, technological advancements, and market trends.

Conclusion: Making Informed Decisions in a Dynamic Market

The recent drop in XRP's price is a reminder of the inherent volatility of the cryptocurrency market. Understanding the factors contributing to these fluctuations and adopting sound investment strategies are crucial for success. Evaluating platforms like Keepbit based on security, user experience, fees, and regulatory compliance is essential for choosing a reliable and trustworthy trading environment. Ultimately, informed decision-making, combined with a long-term perspective and effective risk management, are the keys to navigating the dynamic world of cryptocurrency investing.