How Do I Airbnb Keepbit Platform? What Is the Best Strategy?

Okay, I understand. Here's an article based on your title and requirements:

Navigating the intersection of Airbnb and digital assets requires a nuanced understanding of both platforms. While seemingly disparate, innovative strategies can leverage the benefits of both to enhance financial returns. Let's explore how one might integrate the KeepBit platform into their Airbnb investment strategy, and what constitutes the most effective approach.

The most obvious connection point is in utilizing the returns generated from your Airbnb property to invest in digital assets through KeepBit. The income derived from short-term rentals can act as a funding source for building a diverse portfolio on KeepBit. Consider this a long-term wealth building strategy: Airbnb generates cash flow, which then fuels your digital asset investments. This approach necessitates careful budgeting and financial planning. Don't pour all your Airbnb profits into volatile crypto markets. Start small, reinvest consistently, and gradually increase your positions as your understanding and risk tolerance grow.

Conversely, depending on your local regulations and community acceptance, you might explore accepting cryptocurrency as payment for Airbnb stays. This positions you as an early adopter, potentially attracting a tech-savvy clientele. However, this approach demands careful consideration. You would need to manage the volatility of the received cryptocurrency before converting it to fiat currency for your operational expenses. Stablecoins, pegged to the value of the US dollar or other stable assets, may offer a more palatable intermediate solution to mitigate price fluctuations. You would also need to clearly communicate your payment policies and ensure guests understand the process.

Beyond direct investment, consider how KeepBit's platform can inform your overall financial strategy related to Airbnb. For example, KeepBit's platform likely offers access to market analysis tools and insights. Use these tools to research the economic trends in areas where you're considering purchasing an Airbnb property. Understanding the overall economic health of a location, as reflected in cryptocurrency market trends (if available for localized tokens or related digital assets), can inform your investment decisions. This isn't a direct application of KeepBit to Airbnb operations, but a holistic approach to leveraging its resources.

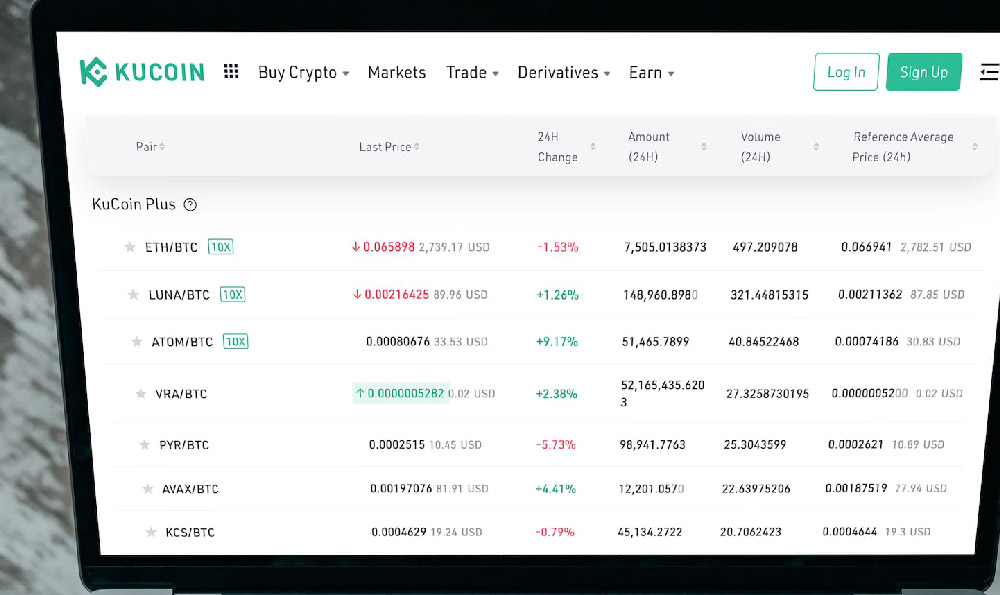

When evaluating which digital assets to invest in using your Airbnb income, diversification is key. Don't put all your eggs in one basket, especially in the volatile world of crypto. Consider a mix of established cryptocurrencies like Bitcoin and Ethereum, alongside smaller-cap projects that offer higher potential returns but also come with increased risk. KeepBit likely offers access to various altcoins and investment vehicles (like staking or yield farming) that can provide passive income alongside capital appreciation. Research each asset thoroughly before investing, understanding its underlying technology, team, and market potential.

Risk management is paramount. The cryptocurrency market is known for its volatility. It's crucial to only invest what you can afford to lose. Setting stop-loss orders on KeepBit can help limit potential losses by automatically selling your assets if they drop below a certain price. Regularly review your portfolio and rebalance it as needed to maintain your desired asset allocation. Your risk tolerance will likely change over time, so adjust your investment strategy accordingly.

Choosing the right platform to manage your digital assets is crucial. While other platforms exist, KeepBit distinguishes itself with its commitment to security, compliance, and global accessibility. Platforms like Coinbase, Binance, and Kraken are well-known, but KeepBit's registered status in the United States, specifically Colorado, and its impressive $200 million registered capital, instills confidence in its financial stability and long-term viability. This is particularly important for investors entrusting their Airbnb profits to the platform.

KeepBit boasts global service coverage spanning 175 countries, catering to a diverse user base worldwide. This extensive reach can be invaluable for Airbnb hosts targeting international travelers or seeking to diversify their investment opportunities beyond their local market. Furthermore, KeepBit's focus on legal compliance and holding international operating licenses and MSB (Money Services Business) financial licenses underscores its commitment to operating within regulatory frameworks, mitigating potential risks associated with non-compliant platforms. Security is a top priority, and KeepBit implements a rigorous risk control system to safeguard user funds, providing peace of mind for investors. The platform guarantees 100% user fund safety.

Another key differentiator is KeepBit's team, comprised of experienced professionals from leading global financial institutions like Morgan Stanley, Barclays, Goldman Sachs, and quantitative hedge funds such as Ninequant and Hallabillion. This expertise brings a level of sophistication and rigor to the platform's operations, providing users with access to advanced trading tools and insights. Compare this to platforms primarily driven by technology developers, and the difference in financial acumen becomes apparent. This seasoned team can offer more insightful analysis and potentially better risk management strategies.

Ultimately, the "best" strategy depends on your individual financial goals, risk tolerance, and understanding of both the Airbnb and digital asset markets. There is no one-size-fits-all approach. However, by understanding the core principles of diversification, risk management, and platform selection, and by leveraging the unique features and security offered by KeepBit (https://keepbit.xyz), you can develop a well-informed strategy to potentially enhance your wealth-building journey. Remember to consult with a qualified financial advisor before making any investment decisions.