? is alex's investment strategy effective?

Is Alex's Investment Strategy Effective? A Comprehensive Analysis

The question of whether Alex's investment strategy is effective hinges on several crucial factors: Alex's financial goals, risk tolerance, investment timeline, and the consistency with which the strategy is implemented. A blanket statement about effectiveness is impossible without understanding these underlying components. This analysis will delve into key considerations to assess the efficacy of Alex's approach, exploring potential strengths and weaknesses.

Defining "Effective": What Does Success Look Like for Alex?

Before even examining the strategy itself, it's vital to define what Alex considers "effective." Is the goal rapid wealth accumulation, steady income generation, capital preservation, or a combination of these? A young professional saving for retirement will have drastically different needs and a different definition of success than a retiree seeking a stable income stream. Understanding Alex's objectives provides the benchmark against which the strategy will be measured. Without a clear target, any investment strategy is essentially aimless.

Understanding the Foundation: Risk Tolerance and Investment Timeline

Risk tolerance plays a pivotal role. A high-risk, high-reward strategy might generate impressive returns in a bull market but could also lead to significant losses during downturns. Alex's comfort level with volatility directly impacts the suitability of various investment vehicles. Conversely, a conservative strategy might offer stability but could underperform inflation or fail to meet ambitious financial goals.

The investment timeline is equally critical. A longer timeline allows for greater exposure to riskier assets like stocks, which historically offer higher returns over extended periods. A shorter timeline, such as saving for a down payment on a house within a few years, necessitates a more conservative approach focused on preserving capital and minimizing risk.

Deconstructing Alex's Investment Portfolio: Assets and Allocation

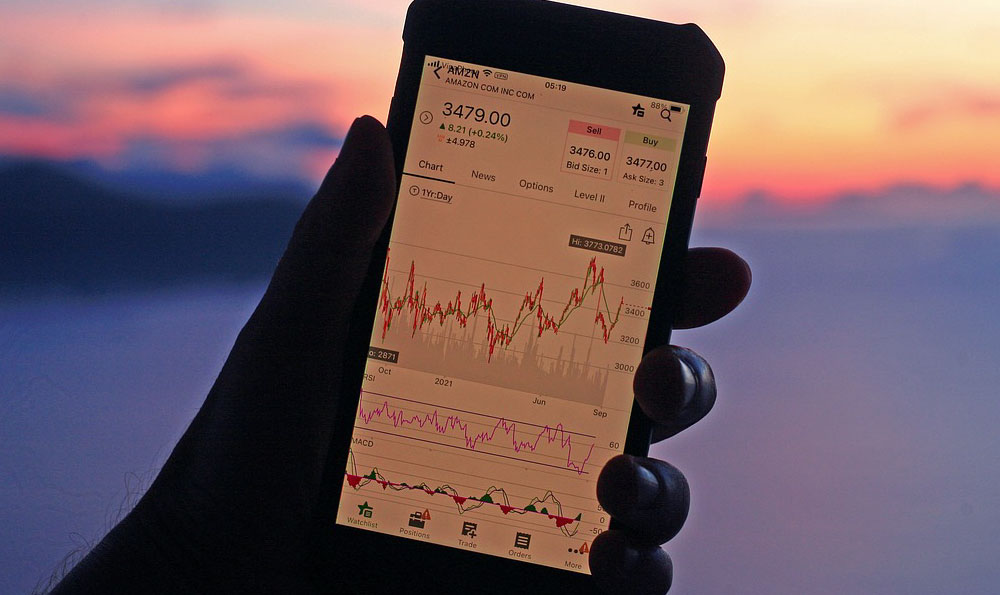

To assess effectiveness, a detailed analysis of Alex's investment portfolio is essential. What types of assets are included? Does the portfolio primarily consist of stocks, bonds, real estate, alternative investments, or a diversified mix?

The allocation between asset classes is just as important as the assets themselves. A portfolio heavily weighted towards a single asset class is inherently riskier than a diversified portfolio. Diversification helps mitigate risk by spreading investments across different sectors and asset classes, reducing the impact of any single investment performing poorly.

Examining Investment Choices: Individual Stocks vs. Index Funds

The specifics of Alex's investment choices warrant scrutiny. Are they selecting individual stocks, investing in index funds or ETFs (Exchange Traded Funds), or actively managing their portfolio?

Investing in individual stocks can offer the potential for high returns but requires significant research, analysis, and monitoring. It also carries a higher risk of underperformance if the selected stocks don't perform well. Index funds and ETFs, on the other hand, provide instant diversification at a low cost and track the performance of a specific market index, such as the S&P 500. This approach generally requires less active management and offers a more passive investment strategy.

Active Management vs. Passive Investing: The Cost-Benefit Analysis

The debate between active management and passive investing is a long-standing one. Active management involves actively selecting and trading investments to outperform the market, while passive investing aims to match the market's performance.

Active management often comes with higher fees, as fund managers charge for their expertise and efforts. However, there's no guarantee that active management will outperform passive investing, and studies have shown that many actively managed funds underperform their benchmark indices over the long term. A passive approach, utilizing index funds and ETFs, often proves more cost-effective and can deliver comparable or even superior returns.

The Importance of Rebalancing: Maintaining the Target Allocation

Rebalancing is a crucial aspect of any investment strategy. Over time, market fluctuations can cause the asset allocation to drift away from its target. For example, if stocks perform exceptionally well, the portfolio might become overweighted in stocks, increasing the overall risk.

Rebalancing involves periodically selling some of the overperforming assets and buying underperforming assets to restore the portfolio to its original target allocation. This helps maintain the desired risk level and ensures that the portfolio remains aligned with Alex's financial goals.

Tax Efficiency: Minimizing the Impact of Taxes

Taxes can significantly impact investment returns. Strategies to minimize taxes, such as investing in tax-advantaged accounts (e.g., 401(k)s, IRAs), holding investments for the long term to qualify for lower capital gains tax rates, and strategically locating assets in different accounts to minimize tax liabilities, can substantially improve after-tax returns.

The Role of Continuous Learning and Adaptation

The investment landscape is constantly evolving. Market conditions change, new investment opportunities emerge, and Alex's own financial circumstances may shift over time. Therefore, continuous learning and adaptation are essential for maintaining an effective investment strategy.

Staying informed about market trends, economic developments, and new investment products can help Alex make informed decisions and adjust the strategy as needed. Regularly reviewing the portfolio's performance and making necessary adjustments is crucial for staying on track towards achieving financial goals.

Seeking Professional Advice: When to Consult a Financial Advisor

While many investors can manage their own investments effectively, there are situations where seeking professional advice from a qualified financial advisor is beneficial. A financial advisor can provide personalized guidance based on Alex's specific circumstances, help develop a comprehensive financial plan, and offer expertise in areas such as retirement planning, estate planning, and tax optimization.

However, it's essential to choose a financial advisor carefully and ensure that they are fee-only and have a fiduciary duty to act in Alex's best interests.

Conclusion: A Holistic Assessment of Alex's Strategy

Determining whether Alex's investment strategy is effective requires a holistic assessment of their financial goals, risk tolerance, investment timeline, asset allocation, investment choices, tax efficiency, and commitment to continuous learning and adaptation. By carefully considering these factors, Alex can gain a better understanding of the strengths and weaknesses of their current approach and make informed decisions to improve their investment outcomes. Ultimately, an effective investment strategy is one that aligns with Alex's individual needs and helps them achieve their financial aspirations. Only through rigorous self-assessment and potentially professional guidance can its true efficacy be determined.