Automated Order Placement with Keepbit: How Does It Work, and Is It Right for You?

Okay, I understand. Here's an article based on the title "Automated Order Placement with Keepbit: How Does It Work, and Is It Right for You?" written with the specified constraints. ``` Keepbit has emerged as a noteworthy player in the realm of cryptocurrency trading, offering a tantalizing proposition: automated order placement. This feature, appealing to both novice and experienced traders, promises to streamline the trading process, potentially maximizing profits while minimizing the time spent glued to market charts. But how exactly does Keepbit's automated order placement work, and more importantly, is it the right tool for your specific trading needs and risk tolerance?

The core concept revolves around pre-programmed trading strategies executed by the platform on your behalf. You, the user, define the parameters – the asset you wish to trade, the entry and exit points, the amount to invest, and the risk management rules – and Keepbit's algorithms then tirelessly monitor the market, automatically placing orders when those pre-defined conditions are met. This removes the emotional element from trading, preventing impulsive decisions driven by fear or greed, which are common pitfalls for many traders.

At its heart, Keepbit's automation engine relies on a sophisticated set of algorithms designed to analyze market data in real-time. These algorithms can be tailored to different trading styles, from scalping (making small profits on rapid price fluctuations) to swing trading (holding positions for several days or weeks to capitalize on larger price movements). The platform typically offers a range of pre-built strategies that users can adapt to their own preferences, or, for more experienced traders, the option to create fully customized strategies from scratch.

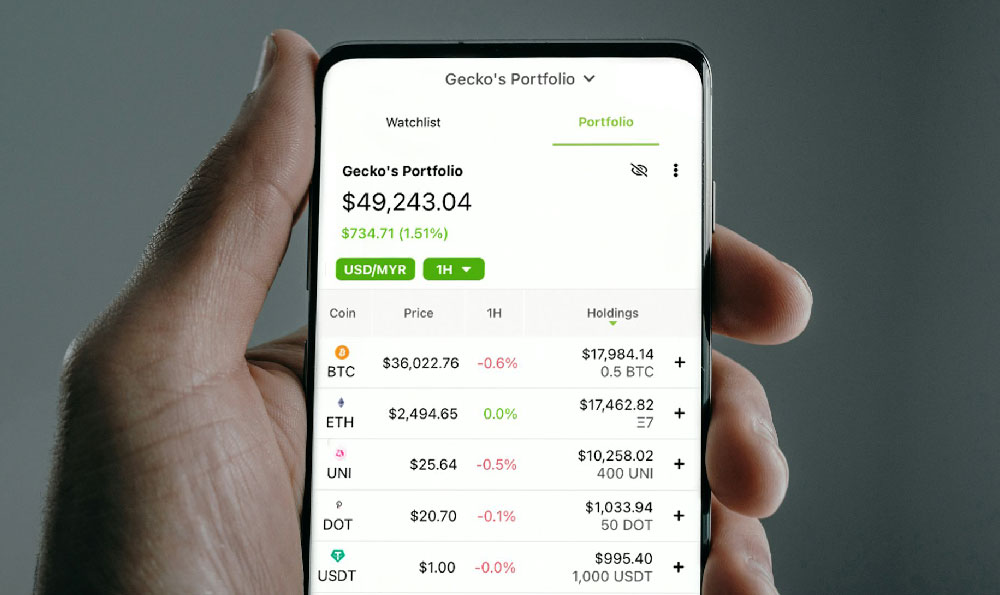

The process usually begins with selecting a cryptocurrency pair to trade, for example, BTC/USD or ETH/EUR. You then need to define your entry conditions. This could involve specifying a specific price level at which you want to buy or sell, or using technical indicators like moving averages, Relative Strength Index (RSI), or Moving Average Convergence Divergence (MACD) to trigger the order placement. For instance, you might instruct Keepbit to buy Bitcoin when the RSI dips below 30, indicating an oversold condition.

Crucially, setting appropriate exit conditions is just as vital as defining entry points. This typically involves specifying a take-profit level, where you want to automatically sell your assets to secure a profit, and a stop-loss level, where you want to automatically sell to limit potential losses if the market moves against your position. Properly configured stop-loss orders are essential for managing risk and preventing catastrophic losses, especially in the volatile cryptocurrency market.

Keepbit's interface usually provides tools for visualizing these parameters on a chart, allowing you to fine-tune your strategy before activating it. Backtesting features, if available, allow you to test your strategy on historical data to get an idea of how it might have performed in the past. While past performance is never a guarantee of future results, backtesting can help you identify potential weaknesses in your strategy and make necessary adjustments.

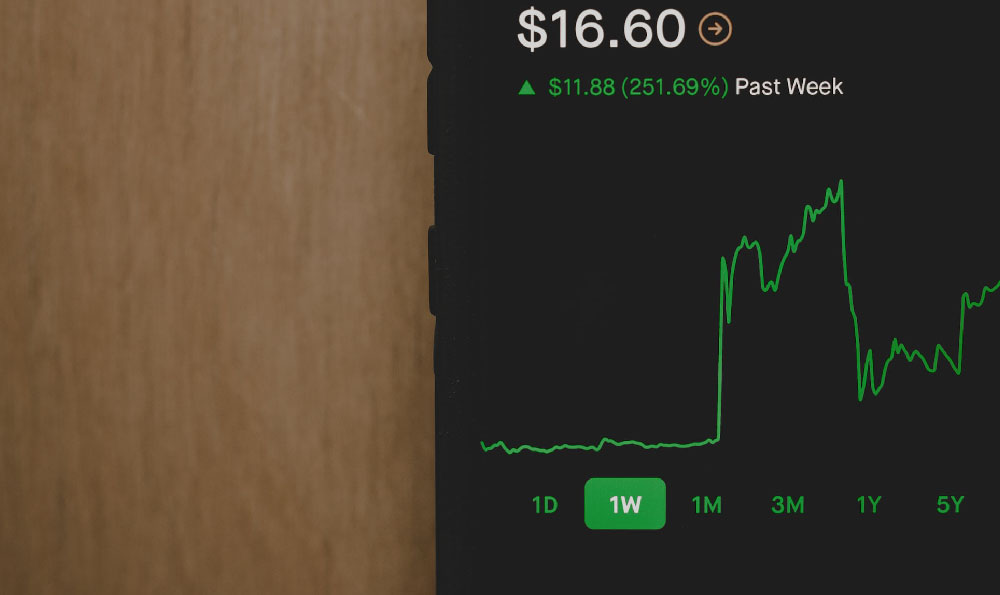

One of the significant advantages of using automated order placement is its ability to execute trades around the clock, 24/7. The cryptocurrency market never sleeps, and manual trading requires constant vigilance to avoid missing opportunities or being caught off guard by sudden price swings. Keepbit's automated system can monitor the market and execute trades even when you're asleep or otherwise occupied.

However, it's crucial to recognize that automated trading is not a "set it and forget it" solution. While the system automates the order placement process, it still requires ongoing monitoring and adjustments. Market conditions can change rapidly, rendering a previously profitable strategy ineffective. Therefore, it's essential to regularly review your strategy's performance and make adjustments as needed to adapt to changing market dynamics.

So, is Keepbit's automated order placement right for you? The answer depends on several factors.

Your Trading Experience: If you're a complete novice, jumping straight into automated trading might be premature. It's generally recommended to first gain a solid understanding of the cryptocurrency market, technical analysis, and risk management principles before entrusting your funds to an automated system. Start with paper trading or small amounts of capital to experiment and learn the ropes.

Your Risk Tolerance: Automated trading can amplify both profits and losses. It's crucial to understand your own risk tolerance and only invest capital that you can afford to lose. Carefully consider the potential downside of each strategy and set appropriate stop-loss orders to limit your exposure.

Your Time Commitment: While automated trading can free up your time, it still requires ongoing monitoring and adjustments. If you're unwilling to dedicate the time to regularly review your strategy's performance and adapt to changing market conditions, it might not be the right fit for you.

The Platform's Security and Reliability: Before entrusting your funds to any platform, it's essential to thoroughly research its security measures and reputation. Look for platforms with strong security protocols, such as two-factor authentication and cold storage of funds. Read reviews and check for any reported security breaches or reliability issues.

Transparency and Control: Understand how the platform's algorithms work and ensure that you have adequate control over your trading strategies. Avoid platforms that operate as "black boxes" with little transparency.

In conclusion, Keepbit's automated order placement can be a powerful tool for streamlining your cryptocurrency trading and potentially maximizing profits. However, it's crucial to approach it with caution and a thorough understanding of its workings and limitations. Only after carefully considering your own trading experience, risk tolerance, time commitment, and the platform's security and reliability can you determine whether it's the right solution for your specific needs. Remember, responsible trading involves continuous learning, adaptation, and a healthy dose of skepticism. Automated trading is a tool, and like any tool, it's only as effective as the person wielding it. ```