How can I earn, and what are the best ways to make money from home?

In today's digital age, the allure of earning from the comfort of one's home has never been stronger, particularly within the rapidly evolving landscape of virtual currencies. While the potential rewards are substantial, navigating this domain requires a blend of knowledge, strategic thinking, and a healthy dose of caution. Let's delve into the best approaches for generating income from home through virtual currencies, emphasizing both profit maximization and risk mitigation.

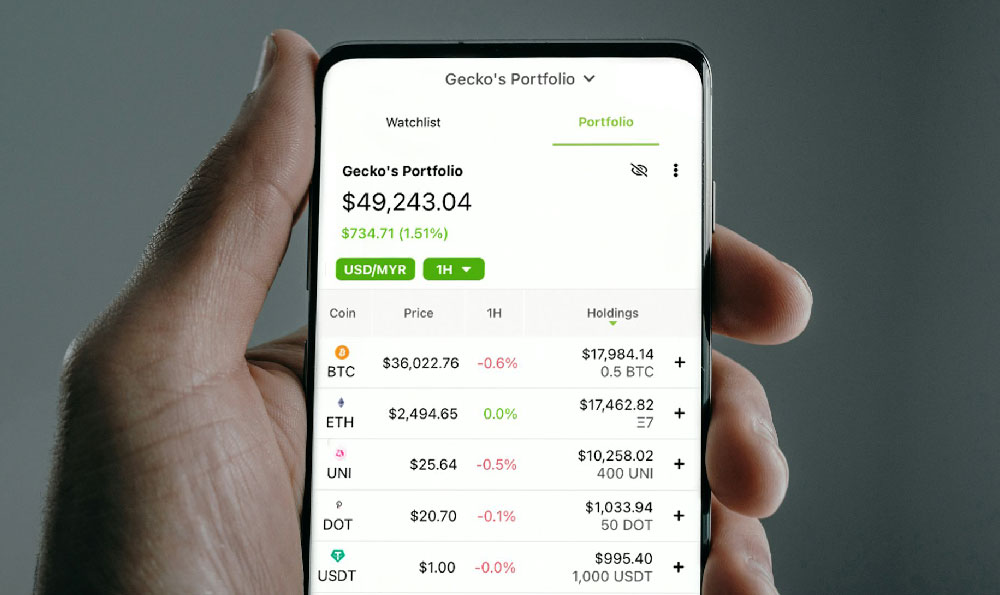

One fundamental strategy lies in long-term investing (Hodling). This involves identifying fundamentally strong cryptocurrencies with promising long-term growth prospects and holding them for an extended period, regardless of short-term market fluctuations. This strategy necessitates thorough research into the project's underlying technology, its team, its market adoption, and its long-term potential. Consider cryptocurrencies that are addressing real-world problems, possess a strong development community, and demonstrate a clear roadmap for future growth. Bitcoin and Ethereum are prime examples of established cryptocurrencies with long-term potential, but always diversify your portfolio to mitigate the risk of any single cryptocurrency failing. The key here is patience and a disciplined approach, resisting the urge to panic sell during market dips.

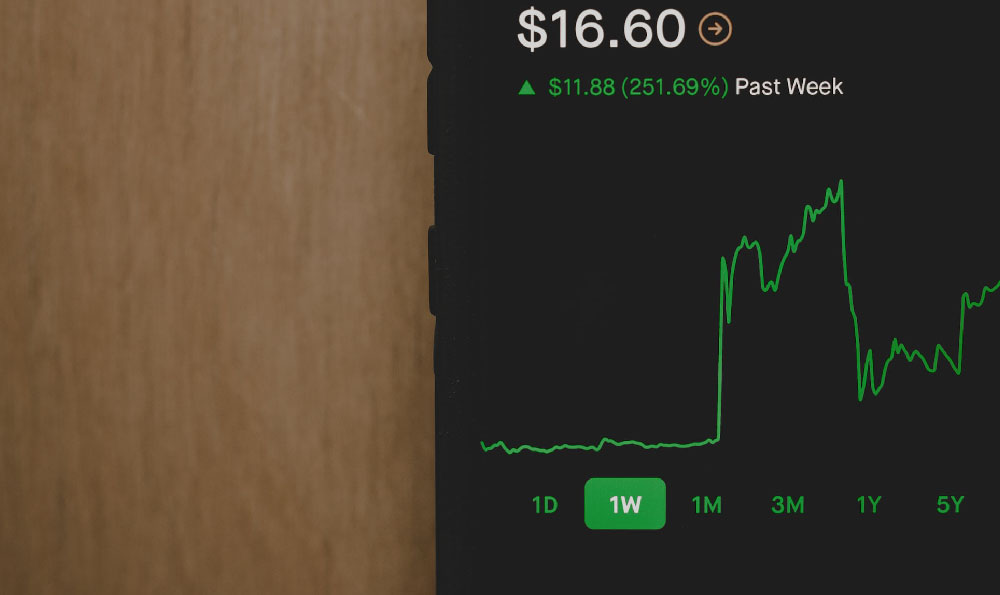

Another avenue for earning is crypto trading, which involves actively buying and selling cryptocurrencies to capitalize on short-term price movements. This approach demands a higher level of skill and expertise, including a strong understanding of technical analysis, chart patterns, and market indicators. Successful traders employ strategies such as day trading, swing trading, and scalping, all of which require constant monitoring of market trends and the ability to react quickly to changing conditions. Trading carries significant risks, and it's crucial to start with a small amount of capital and gradually increase your investment as your skills and confidence grow. Risk management is paramount, and traders should always use stop-loss orders to limit potential losses. Avoid trading on emotion, and stick to a well-defined trading plan.

Staking presents a more passive way to earn income from home. Certain cryptocurrencies operate on a Proof-of-Stake (PoS) consensus mechanism, which allows users to earn rewards by holding and "staking" their coins. Staking involves locking up your cryptocurrency holdings in a wallet or on a staking platform to help validate transactions on the blockchain. In return for your participation, you receive staking rewards, typically in the form of additional coins. Staking requires less active involvement than trading and can provide a steady stream of passive income. However, it's essential to research the staking requirements, lock-up periods, and potential risks associated with each cryptocurrency before participating.

Yield farming takes the concept of staking a step further. It involves lending or borrowing cryptocurrencies on decentralized finance (DeFi) platforms to earn interest or rewards. Yield farmers provide liquidity to these platforms, which are then used to facilitate trading and other DeFi activities. In return for their contributions, liquidity providers receive tokens that represent their share of the liquidity pool, as well as a portion of the trading fees generated by the platform. Yield farming can be highly lucrative, but it also carries significant risks, including impermanent loss, smart contract vulnerabilities, and regulatory uncertainty. Thorough research and a deep understanding of DeFi protocols are essential before participating in yield farming.

Mining is the process of verifying and adding new transactions to a cryptocurrency's blockchain. Miners use powerful computers to solve complex mathematical problems, and in return for their efforts, they receive cryptocurrency rewards. Mining can be a profitable way to earn income from home, but it requires a significant upfront investment in specialized hardware, as well as ongoing electricity costs. Mining difficulty varies depending on the cryptocurrency and the number of miners participating in the network. Moreover, environmental concerns related to the energy consumption of mining operations are growing, prompting a shift towards more energy-efficient consensus mechanisms like Proof-of-Stake.

Beyond these core strategies, there are other avenues for earning from home in the cryptocurrency space. These include:

- Crypto lending: Lending your cryptocurrency holdings to borrowers on lending platforms and earning interest.

- Airdrops and bounties: Participating in airdrops and bounty programs, where cryptocurrency projects distribute free tokens to users in exchange for completing certain tasks.

- Affiliate marketing: Promoting cryptocurrency products or services and earning commissions on sales or referrals.

- Creating and selling crypto-related content: Writing articles, creating videos, or developing educational resources about cryptocurrencies.

Regardless of the chosen strategy, certain principles are crucial for success.

Risk Management is Key: Cryptocurrency investments are inherently volatile. Never invest more than you can afford to lose. Diversify your portfolio across multiple cryptocurrencies and asset classes to mitigate risk. Use stop-loss orders to limit potential losses when trading.

Due Diligence is Essential: Thoroughly research any cryptocurrency or platform before investing. Understand the underlying technology, the team behind the project, the market adoption, and the potential risks. Read whitepapers, analyze charts, and follow reputable sources of information.

Security is Paramount: Protect your cryptocurrency holdings by using strong passwords, enabling two-factor authentication, and storing your coins in secure wallets. Be wary of phishing scams and other online threats.

Stay Informed: The cryptocurrency market is constantly evolving. Stay up-to-date on the latest news, trends, and regulations. Follow reputable sources of information and engage with the cryptocurrency community.

Start Small: Begin with a small amount of capital and gradually increase your investment as your knowledge and confidence grow. Don't be afraid to experiment with different strategies, but always proceed with caution.

Be Patient: Earning significant income from cryptocurrencies takes time and effort. Don't expect to get rich quick. Focus on building your knowledge, developing a solid investment strategy, and managing your risk effectively.

In conclusion, earning from home through virtual currencies is a viable option, but it requires a commitment to learning, strategic planning, and diligent risk management. By carefully considering the various avenues available, conducting thorough research, and adhering to sound investment principles, individuals can potentially generate income from the comfort of their homes while navigating the exciting, albeit volatile, world of cryptocurrencies. Remember, the most prudent approach is one that balances the pursuit of profit with a responsible and informed approach to risk. The landscape is dynamic, demanding constant learning and adaptation.