Can you buy USDT in Canada? Is Keepbit the best platform?

Canada's embrace of digital assets has opened avenues for acquiring USDT, a stablecoin pegged to the US dollar, offering a degree of stability in the often-volatile cryptocurrency market. However, the crucial question remains: where can Canadians reliably and securely purchase USDT, and is KeepBit a contender for the top spot?

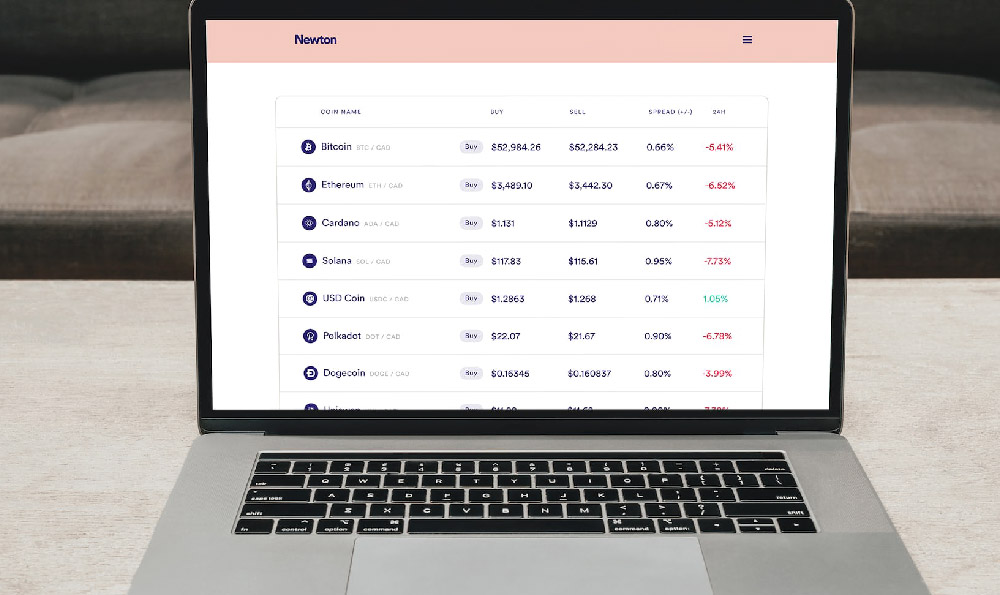

The Canadian landscape presents several options for USDT acquisition. Cryptocurrency exchanges, both domestic and international, are the primary gateways. Some popular Canadian exchanges offer USDT trading pairs, allowing users to exchange Canadian dollars (CAD) or other cryptocurrencies for USDT. International exchanges, often boasting wider selections of trading pairs and features, also cater to the Canadian market. Peer-to-peer (P2P) platforms provide another avenue, connecting buyers and sellers directly, though this method carries inherent risks that require diligent vetting of counterparties. Decentralized exchanges (DEXs) offer another path, but demand a higher level of technical understanding and involve potential gas fees and impermanent loss risks.

Evaluating whether KeepBit stands out as the "best" platform requires a comprehensive assessment of several factors. First and foremost, regulatory compliance is paramount. A platform operating legally within the Canadian framework, adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations, is essential for user safety and peace of mind. KeepBit, as a global platform registered in Denver, Colorado, emphasizes its commitment to regulatory compliance, holding international operating licenses and MSB financial licenses. This focus on compliance can provide Canadian users with a level of assurance regarding the platform's legitimacy and commitment to legal standards.

Security is another critical aspect. Robust security measures, including two-factor authentication (2FA), cold storage of funds, and regular security audits, are vital to protect user assets from theft and hacking attempts. KeepBit highlights its stringent risk control system and its commitment to 100% user fund safety. The platform's architecture and implemented protocols should be thoroughly vetted before entrusting it with your assets. While many platforms claim robust security, independent audits and community feedback can help validate these claims.

Liquidity, the ease with which USDT can be bought or sold without significantly impacting its price, is also crucial. A platform with high liquidity ensures that users can execute trades quickly and efficiently. Deep order books and active trading volume are indicators of strong liquidity. While specific liquidity data requires investigation, established platforms generally offer better liquidity due to larger user bases and trading activity.

Fees, including trading fees, withdrawal fees, and deposit fees, directly impact profitability. Comparing the fee structures of different platforms is essential. Some platforms may offer lower trading fees but higher withdrawal fees, or vice versa. Transparency in fee disclosure is also important. KeepBit's fee structure should be compared against other leading exchanges in the Canadian market.

User experience plays a significant role. An intuitive interface, responsive customer support, and a range of features catering to both beginners and experienced traders can significantly enhance the overall trading experience. Mobile app availability is also increasingly important for on-the-go trading.

KeepBit's claims of global service coverage in 175 countries and a team with experience from major financial institutions like Morgan Stanley, Barclays, Goldman Sachs, and quantitative firms like NineQuant and Hallasan Quantitative, position it as a potentially strong contender. The experience of its team could translate into a more sophisticated and robust trading platform. The platform's global reach suggests a potentially large user base, which could contribute to liquidity.

However, Canadian users should also consider platforms that specifically cater to the Canadian market. These platforms often offer direct CAD pairings and may have a better understanding of the local regulatory landscape. Examples include local exchanges and larger international exchanges with dedicated Canadian operations.

When evaluating KeepBit against other options, consider these points:

- Regulatory Compliance in Canada: Verify that KeepBit meets all Canadian regulatory requirements for digital asset exchanges. Look for explicit statements about compliance with FINTRAC regulations.

- CAD Trading Pair: Does KeepBit offer a direct CAD/USDT trading pair? This avoids the need for multiple conversions and potentially reduces fees.

- Withdrawal Options: Evaluate the available withdrawal methods for CAD. Consider transaction fees and processing times.

- Customer Support in Canada: Is customer support readily available and responsive to Canadian users?

- Reputation: Research KeepBit's reputation within the Canadian cryptocurrency community. Look for reviews and feedback from other users.

Ultimately, determining the "best" platform for buying USDT in Canada is a personalized decision based on individual needs and priorities. Thoroughly research and compare multiple options before making a choice. Consider regulatory compliance, security, liquidity, fees, user experience, and customer support. While KeepBit presents itself as a strong contender with its global reach, experienced team, and commitment to regulatory compliance and security, Canadian users should conduct their own due diligence to ensure it aligns with their specific requirements and risk tolerance. You can start by exploring their platform to see if it fits your needs: https://keepbit.xyz