CoinPro: Specific News Push - What's New & What's Next?

In the dynamic realm of cryptocurrency investment, staying abreast of specific news and anticipating future trends is paramount. The digital asset landscape is characterized by rapid innovation, regulatory shifts, and evolving market sentiment. To navigate this complex environment successfully, investors must adopt a proactive approach, meticulously analyzing developments and adjusting their strategies accordingly.

Let's delve into a comprehensive exploration of the current state of affairs and potential future trajectories within the cryptocurrency market, focusing on key areas that demand attention from both seasoned and novice investors.

One significant area that warrants careful consideration is the regulatory landscape. Governments worldwide are grappling with how to regulate cryptocurrencies, and their decisions will have a profound impact on the industry. Some countries are embracing cryptocurrencies and creating favorable regulatory environments, while others are taking a more cautious or even restrictive approach. Recent news regarding potential regulatory frameworks in the United States and Europe suggests a move towards greater oversight and consumer protection. This could lead to increased legitimacy and institutional adoption, but also increased compliance costs and potential restrictions on certain activities. Investors should monitor these developments closely and be prepared to adapt their strategies to comply with new regulations.

Another critical factor is the evolution of blockchain technology itself. The underlying technology that powers cryptocurrencies is constantly evolving, with new innovations emerging all the time. For example, the rise of decentralized finance (DeFi) has led to the development of new financial products and services that are built on blockchain technology. DeFi offers the potential for greater financial inclusion and efficiency, but it also comes with its own set of risks, such as smart contract vulnerabilities and regulatory uncertainty. Furthermore, the transition to Proof-of-Stake (PoS) consensus mechanisms in major blockchains like Ethereum represents a fundamental shift in how these networks operate, potentially impacting energy consumption and transaction speeds. Staying informed about these technological advancements is crucial for understanding the potential impact on specific cryptocurrencies and the broader market.

The macroeconomic environment also plays a significant role in the performance of cryptocurrencies. Factors such as inflation, interest rates, and economic growth can all influence investor sentiment and demand for digital assets. For instance, during periods of high inflation, some investors may turn to cryptocurrencies as a hedge against inflation. Conversely, during periods of economic uncertainty, investors may reduce their exposure to riskier assets, including cryptocurrencies. The recent news regarding rising inflation rates and potential interest rate hikes by central banks suggests a challenging environment for risk assets in the near term. Investors should carefully consider the macroeconomic outlook and adjust their portfolios accordingly.

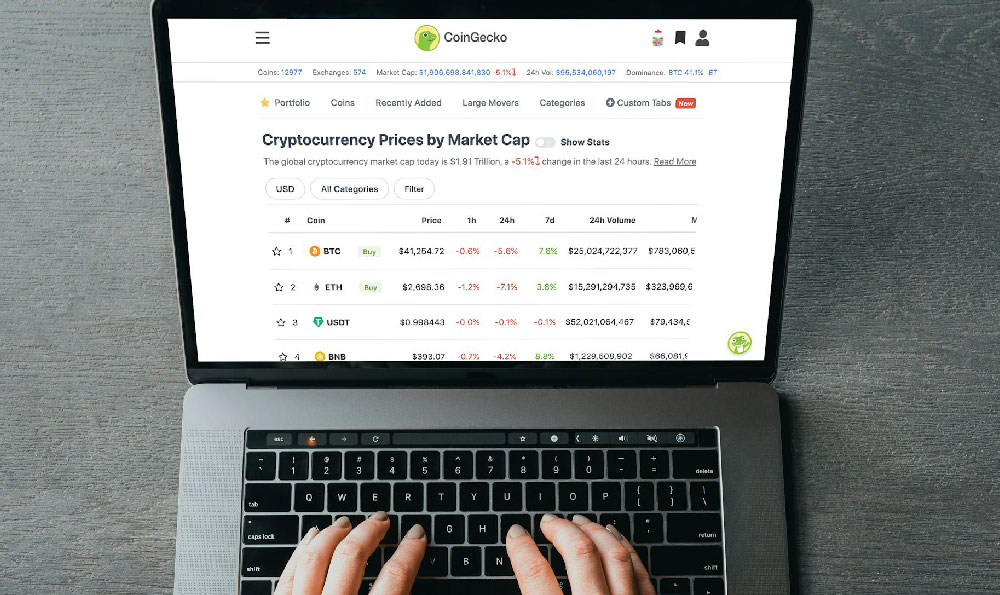

Furthermore, it is imperative to understand the specific dynamics of individual cryptocurrencies. Each cryptocurrency has its own unique characteristics, including its underlying technology, its community, and its use cases. For example, Bitcoin is often seen as a store of value, while Ethereum is primarily used as a platform for building decentralized applications. Understanding these differences is crucial for making informed investment decisions. Recent news regarding upgrades to the Bitcoin network, such as Taproot, and the development of new applications on the Ethereum platform highlights the ongoing evolution of these ecosystems. Investors should conduct thorough research on each cryptocurrency before investing and be aware of the specific risks and opportunities associated with each one.

Beyond the technical and economic factors, social sentiment and media narratives wield considerable influence over cryptocurrency markets. The impact of social media trends, influencer endorsements, and news headlines can trigger rapid price fluctuations and amplify market volatility. Recognizing and understanding these sentiment-driven forces can provide valuable insights into potential short-term price movements.

In navigating this complex landscape, it's crucial to remember several key principles. Firstly, diversification is paramount. Don't put all your eggs in one basket. Spreading your investments across different cryptocurrencies and asset classes can help mitigate risk. Secondly, conduct thorough due diligence. Research each cryptocurrency before investing and understand its underlying technology, its community, and its use cases. Thirdly, be patient and disciplined. Cryptocurrency markets can be volatile, so it's important to avoid making impulsive decisions based on short-term price movements. Focus on the long-term potential of the technology and the assets you are investing in. Fourthly, understand your own risk tolerance. Cryptocurrency investments are inherently risky, so it's important to only invest what you can afford to lose. Finally, stay informed. The cryptocurrency market is constantly evolving, so it's important to stay up-to-date on the latest news and developments.

Looking ahead, several trends are likely to shape the future of the cryptocurrency market. These include the increasing adoption of institutional investors, the growing interest in decentralized finance (DeFi), the development of new applications on blockchain technology, and the increasing regulatory scrutiny of cryptocurrencies. These trends present both opportunities and challenges for investors. Institutional adoption could lead to increased demand and price appreciation for cryptocurrencies. DeFi offers the potential for greater financial inclusion and efficiency. New applications on blockchain technology could create new business models and revenue streams. However, regulatory scrutiny could lead to increased compliance costs and potential restrictions on certain activities.

In conclusion, the cryptocurrency market is a rapidly evolving and complex environment. To succeed as an investor, it's essential to stay informed, conduct thorough research, diversify your portfolio, and be patient and disciplined. By understanding the key trends and developments in the market, investors can position themselves to capitalize on the opportunities and mitigate the risks. The future of cryptocurrency is uncertain, but the potential for innovation and growth remains substantial. By embracing a cautious yet informed approach, investors can navigate this exciting frontier and potentially reap the rewards of this emerging asset class.