Cryptocurrency Stocks: How and Why Invest Now?

The allure of cryptocurrency stocks is undeniable, especially in a market landscape constantly reshaped by technological advancements and evolving financial trends. For the astute investor, understanding how and why to consider incorporating these stocks into a portfolio requires a nuanced approach, one that goes beyond simple speculation and delves into the underlying fundamentals and potential risks.

Investing in cryptocurrency stocks is not the same as directly buying Bitcoin or Ethereum. It involves acquiring shares in companies that are involved in the cryptocurrency ecosystem. These could be companies that mine cryptocurrencies, develop blockchain technology, provide cryptocurrency exchange services, or even those that use cryptocurrencies as part of their core business model. This distinction is crucial because it offers a different risk-reward profile. Instead of being solely reliant on the price fluctuations of a specific cryptocurrency, you are betting on the overall growth and adoption of the technology and its related infrastructure.

One compelling reason to consider cryptocurrency stocks now is the continued institutional adoption of digital assets. Major financial institutions are increasingly exploring and integrating cryptocurrencies into their services, indicating a growing acceptance and maturity of the market. This influx of institutional capital and interest can drive demand for the services and technologies provided by cryptocurrency-related companies, ultimately boosting their stock prices. Moreover, regulatory frameworks are slowly becoming clearer, providing a more stable and predictable environment for these businesses to operate. While regulation can sometimes be perceived as a hindrance, it also legitimizes the industry and reduces uncertainty, paving the way for wider adoption and investment.

Furthermore, the underlying blockchain technology that powers cryptocurrencies is being applied to a wide range of industries beyond finance. From supply chain management to healthcare and voting systems, blockchain's decentralized and transparent nature offers innovative solutions to complex problems. Investing in companies that are at the forefront of these blockchain applications can provide exposure to a rapidly growing market with significant long-term potential. These companies are not simply riding the wave of cryptocurrency hype; they are building the infrastructure and applications that will define the future of the digital economy.

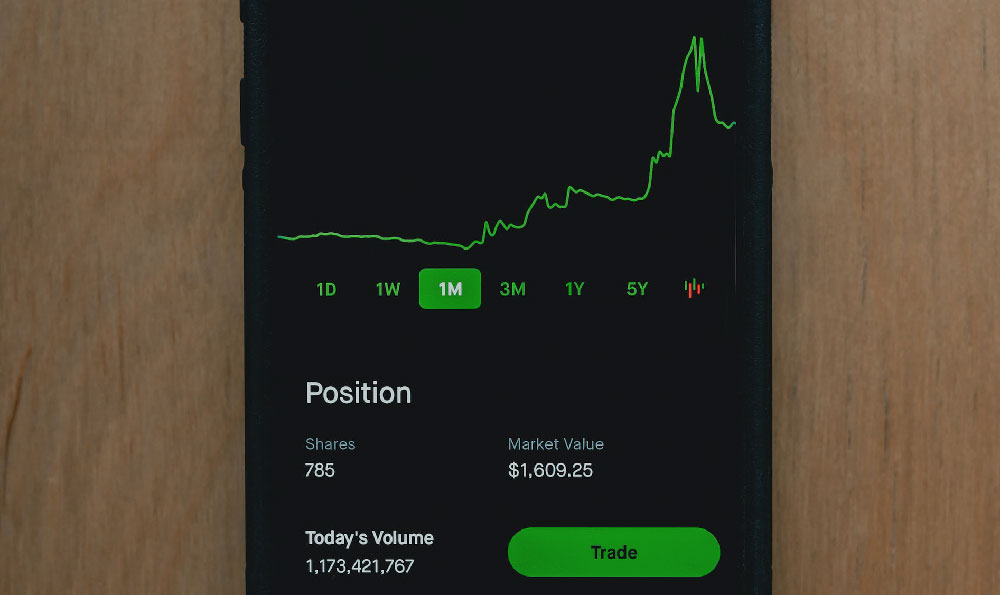

However, it's essential to approach cryptocurrency stocks with caution and a well-defined investment strategy. This market is still relatively new and volatile, and the performance of these stocks can be highly unpredictable. A thorough due diligence process is paramount. Investors should carefully research the companies they are considering investing in, examining their business models, financial health, management teams, and competitive landscape. Understanding the specific risks associated with each company is crucial for making informed investment decisions.

Another critical aspect is risk management. Cryptocurrency stocks should typically constitute a small portion of a well-diversified portfolio. Overexposure to this sector can significantly increase overall portfolio risk, especially given the inherent volatility of the market. It's prudent to set clear investment goals, risk tolerance levels, and exit strategies before investing. Regularly monitoring your investments and adjusting your portfolio as needed is also essential for managing risk effectively.

Moreover, it's crucial to differentiate between hype and substance. Many cryptocurrency-related companies are highly speculative, and their stock prices may be driven more by sentiment than by underlying fundamentals. Avoid chasing quick profits or investing based on rumors or social media trends. Focus on companies with solid business plans, demonstrable revenue streams, and a proven track record of execution. Look for companies that are building real-world solutions and have a clear competitive advantage in their respective markets.

In addition to individual company analysis, understanding the broader macroeconomic environment is also important. Factors such as interest rates, inflation, and geopolitical events can all impact the cryptocurrency market and the performance of cryptocurrency stocks. Staying informed about these trends and how they may affect your investments is crucial for making sound decisions.

Finally, remember that investing in cryptocurrency stocks is a long-term game. While there may be opportunities for short-term gains, the real potential lies in the long-term growth and adoption of blockchain technology and digital assets. Patience, discipline, and a long-term perspective are essential for success in this market. Don't be swayed by short-term market fluctuations or emotional decision-making. Stay focused on your investment goals and stick to your strategy.

In conclusion, while the cryptocurrency market presents substantial opportunities, it also requires a carefully considered and disciplined approach. By understanding the nuances of cryptocurrency stocks, conducting thorough research, managing risk effectively, and maintaining a long-term perspective, investors can potentially capitalize on the growth of this exciting and transformative industry. However, it is imperative to remember that past performance is not indicative of future results, and all investments carry inherent risks. Consult with a qualified financial advisor before making any investment decisions. The journey into cryptocurrency stocks requires careful navigation, a blend of informed decision-making and calculated risk-taking, ultimately aiming to position oneself advantageously in the evolving digital financial landscape.