How to Earn Money During Maternity Leave: Side Hustle Ideas

As the world continues to evolve, the concept of earning income beyond traditional employment has gained new significance, particularly for individuals navigating maternity leave. This period, while essential for rest and family bonding, often presents a unique opportunity to explore alternative financial strategies that align with personal goals and market trends. For those with an interest in digital assets, the cryptocurrency space offers a compelling avenue to generate passive income while managing time constraints. However, it is crucial to approach this with a strategic mindset, grounded in research, risk assessment, and long-term planning.

The foundation of any successful investment journey lies in understanding the fundamentals of the market. Cryptocurrencies operate on blockchain technology, which decentralizes value storage and enables peer-to-peer transactions without the need for intermediaries. This structure, while revolutionary, also introduces volatility that can impact short-term returns. During maternity leave, investors can leverage this volatility by adopting a patient approach, focusing on the underlying value of projects rather than daily price fluctuations. For example, sectors like blockchain infrastructure or decentralized finance (DeFi) may present opportunities for stable growth, as they address long-standing issues in traditional finance such as transparency and accessibility. By staying informed about technological advancements and community-driven initiatives, investors can identify assets with sustainable potential.

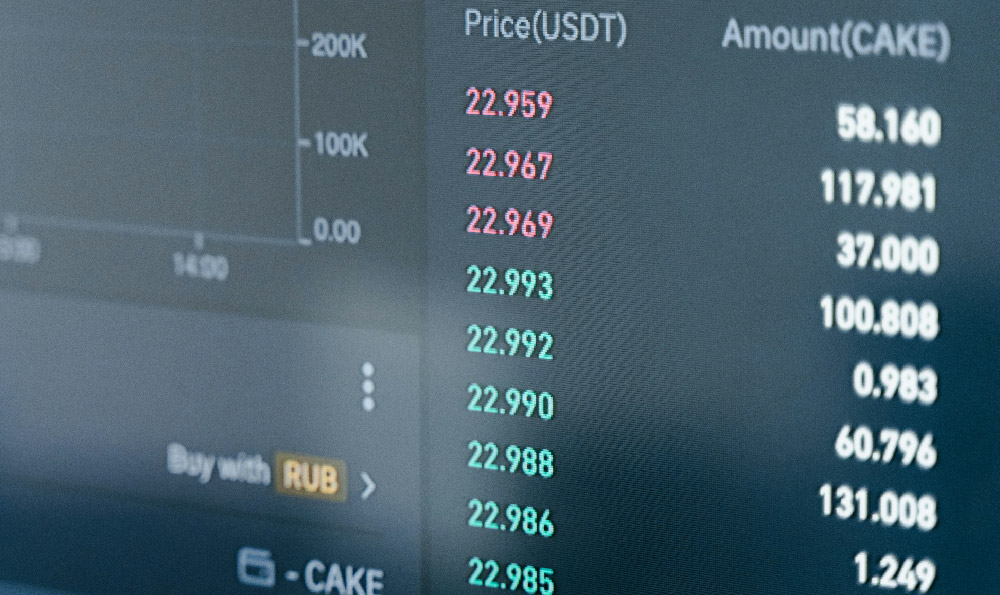

Selecting the right platforms is equally critical. Not all cryptocurrency exchanges or investment tools are created equal, and the distinction between legitimate opportunities and speculative traps can be subtle. During maternity leave, time management becomes a priority, so opting for user-friendly platforms with robust security measures is advisable. Automated trading tools, such as algorithmic platforms that execute trades based on predefined criteria, can help mitigate the need for constant monitoring. However, it is essential to understand the mechanics of these tools and avoid over-reliance on unverified algorithms, which may lead to unintended losses. Additionally, custodial wallets and regulated exchanges provide added layers of security, ensuring that digital assets are safeguarded against hacking and fraud.

Another key strategy is diversification. The cryptocurrency market is inherently risky, with the potential for rapid price changes and regulatory shifts. During maternity leave, diversifying across different asset classes can help balance risk and reward. For instance, combining long-term holdings in established cryptocurrencies like Bitcoin and Ethereum with short-term trades in emerging projects can create a more resilient portfolio. This approach not only spreads risk but also allows for flexibility in adapting to market conditions. Furthermore, investing in tokenized assets that represent real-world assets, such as real estate or commodities, can provide additional stability. These structured products often include a blend of traditional and digital elements, offering a bridge between familiar investments and new opportunities.

Education and risk management are the cornerstones of any effective investment strategy. During maternity leave, it is easier to allocate time to learning about the nuances of the market, such as technical indicators, market sentiment analysis, and fundamental evaluation techniques. For example, understanding resistance levels and volume trends can help anticipate potential market movements, enabling informed decision-making. However, it is important to emphasize that no strategy is foolproof, and the market is subject to unpredictable factors like regulatory changes and global economic events. By setting clear risk parameters, such as a maximum investment amount or a stop-loss threshold, investors can protect their capital while maintaining a long-term perspective.

Additionally, leveraging time to build a passive income stream can be a transformative approach. Many cryptocurrencies offer staking or yield farming opportunities, which allow investors to earn interest by holding or locking their assets. During maternity leave, these mechanisms can generate consistent returns without requiring active involvement. For example, staking Ethereum or participating in liquidity pools on DeFi platforms can provide monthly rewards, aligning with the need for regular income. However, it is crucial to research the specific terms of these opportunities, including inflation rates, security protocols, and exit strategies, to ensure they align with individual financial goals.

Ultimately, the cryptocurrency landscape offers a range of possibilities for earning income during maternity leave. Whether through long-term investments, automated strategies, or yield-generating opportunities, the key lies in thoughtful execution and continuous learning. By staying informed about market trends, selecting reliable platforms, and balancing risk with reward, investors can create a sustainable financial plan. This, in turn, not only addresses immediate needs but also lays the groundwork for future financial security, ensuring that the time spent on self-development translates into lasting returns.