How to Get Rich? What Are the Best Strategies for Wealth?

The pursuit of wealth is a common aspiration, a driving force behind many of our choices. While luck and circumstance can play a role, accumulating wealth consistently requires a strategic approach, disciplined habits, and a thorough understanding of financial principles. There isn't a single magic formula, but rather a collection of interconnected strategies that, when implemented thoughtfully, can significantly increase your chances of achieving financial independence.

One of the foundational pillars of wealth creation is adopting a mindset of saving and investing early. Time is arguably your most valuable asset when it comes to compounding returns. The power of compound interest, often referred to as the "eighth wonder of the world," lies in the snowball effect of earning returns not only on your initial investment but also on the accumulated interest or dividends. Starting early, even with small amounts, allows time to work its magic, exponentially growing your wealth over the long term. This involves diligently tracking your income and expenses, identifying areas where you can reduce spending, and allocating those savings towards income-generating assets. Avoid the trap of lifestyle inflation, where increased income leads to a corresponding increase in spending, negating the potential for wealth accumulation.

Closely tied to saving is the practice of living below your means. This doesn’t necessarily mean depriving yourself, but rather making conscious choices about where your money goes. It means distinguishing between needs and wants, prioritizing essential expenses, and consciously reducing discretionary spending. Regularly reviewing your budget and identifying areas for improvement is crucial. Automating your savings can be an effective strategy. Setting up automatic transfers from your checking account to your savings or investment accounts ensures that you consistently save a portion of your income before you have the opportunity to spend it. This "pay yourself first" approach prioritizes your financial future.

Beyond saving, strategic investment is paramount. This requires careful consideration of your risk tolerance, time horizon, and financial goals. Diversification is a key principle in mitigating risk. Avoid putting all your eggs in one basket by spreading your investments across different asset classes, industries, and geographical regions. Asset allocation, the process of dividing your investments among different asset classes such as stocks, bonds, and real estate, should be tailored to your individual circumstances. Younger investors with a longer time horizon can typically afford to take on more risk by allocating a larger portion of their portfolio to stocks, which historically have offered higher returns than bonds over the long term. As you approach retirement, it's generally advisable to gradually shift towards a more conservative allocation with a greater emphasis on bonds to preserve capital.

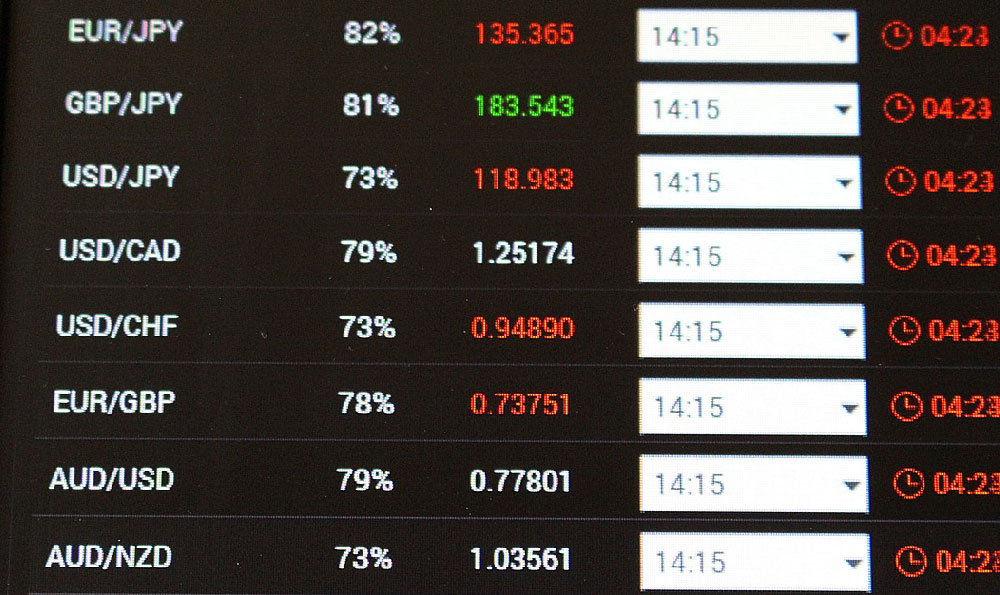

Investing in stocks, particularly through index funds or exchange-traded funds (ETFs), offers exposure to the potential for significant capital appreciation. Index funds track a specific market index, such as the S&P 500, providing broad diversification at a low cost. ETFs offer similar diversification benefits but trade like individual stocks, providing greater flexibility. While stocks can be volatile in the short term, they have historically outperformed other asset classes over the long term. Thorough research is essential before investing in individual stocks. Understanding a company's financials, competitive landscape, and management team is crucial for making informed investment decisions.

Real estate can be another valuable component of a wealth-building strategy. Investing in rental properties can generate passive income through rental payments and potential appreciation in property value. However, real estate investing requires significant capital upfront and involves responsibilities such as property management and maintenance. Thorough due diligence is crucial before investing in real estate, including assessing the local market, evaluating the property's condition, and understanding the legal and regulatory requirements.

Beyond traditional investments, consider investing in yourself. Acquiring new skills, pursuing higher education, or starting a business can significantly increase your earning potential. Continuously learning and adapting to the changing demands of the job market is essential for career advancement and long-term financial security. Entrepreneurship can be a path to significant wealth creation, but it also involves substantial risk and requires dedication, perseverance, and a willingness to learn from failures. Starting a business that solves a real problem and provides value to customers can generate significant income and create lasting wealth.

Managing debt effectively is another crucial aspect of building wealth. High-interest debt, such as credit card debt, can quickly erode your wealth. Prioritize paying down high-interest debt as quickly as possible. Consider consolidating debt or transferring balances to lower-interest credit cards. Avoid accumulating unnecessary debt by making conscious spending choices and living within your means. Understand the terms and conditions of any loans you take out, including the interest rate, repayment schedule, and any associated fees.

Protecting your wealth is equally important. Having adequate insurance coverage, including health insurance, life insurance, and property insurance, can protect you from financial ruin in the event of unexpected events. Estate planning, including creating a will and establishing trusts, ensures that your assets are distributed according to your wishes and can minimize estate taxes. Regularly review your insurance coverage and estate plan to ensure they are aligned with your current circumstances and financial goals.

Finally, remaining disciplined and patient is essential for long-term success. Building wealth is a marathon, not a sprint. Avoid making impulsive investment decisions based on short-term market fluctuations. Stay focused on your long-term goals and stick to your investment strategy. Regularly monitor your portfolio and make adjustments as needed, but avoid the temptation to constantly trade or chase short-term gains. Understanding that market corrections and economic downturns are inevitable parts of the investment cycle is crucial for maintaining a long-term perspective. By staying disciplined, patient, and focused on your financial goals, you can significantly increase your chances of achieving financial independence and building lasting wealth.