how to earn extra money online: 10 tips to make cash fast

In the digital age, the opportunity to generate additional income has expanded beyond traditional avenues, offering individuals diverse pathways to monetize their time, skills, or resources. While the allure of quick cash can be tempting, it is crucial to approach these opportunities with a strategic mindset, balancing innovation with prudence to ensure long-term sustainability. For those navigating the complex world of cryptocurrency and digital finance, the key lies in understanding market dynamics, leveraging technology, and maintaining a disciplined framework to protect capital while exploring growth potential. Here, we delve into a comprehensive approach to capitalizing on online income opportunities, particularly within the high-growth yet volatile realm of digital assets, through actionable insights that blend analysis with practical execution.

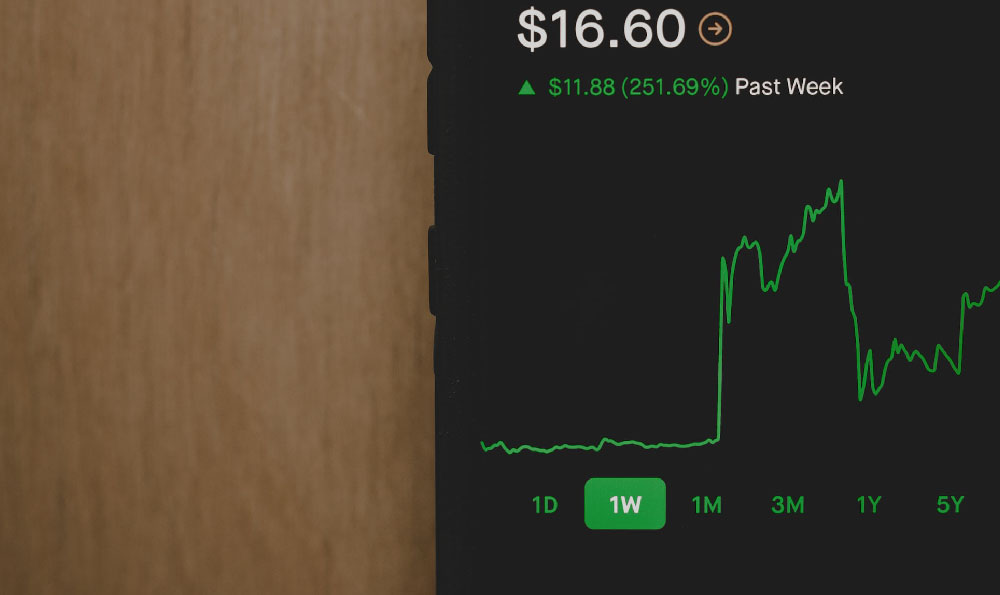

One of the most effective strategies involves capitalizing on the liquidity of cryptocurrency markets, which have demonstrated resilience even amid global economic fluctuations. By revisiting historical trends, such as the surge in Bitcoin and Ethereum values during the 2020 bull run or the recent stabilization following market corrections, investors can identify patterns that inform their decisions. It is advisable to analyze fundamental factors—like network adoption, blockchain innovation, and regulatory developments—to anticipate potential growth areas. For instance, the rise of decentralized finance (DeFi) platforms during the 2020 pandemic revealed new avenues for yield generation through liquidity provision and automated market-making, yet these opportunities often come with elevated risks due to smart contract vulnerabilities and market volatility. To mitigate this, diversifying across different coin types and projects can reduce exposure to any single asset's performance. A balanced portfolio that includes both stablecoins and high-growth tokens, backed by meticulous research, allows investors to ride the highs while safeguarding their assets during market downturns.

Another considered method is engaging in passive income generation through cryptocurrency staking and yield farming mechanisms. These protocols enable investors to earn rewards by validating transactions on the blockchain, a process that requires minimal active involvement. The key here is to evaluate the security and scalability of the underlying technology, as well as the reputation of the project team. Proprietary algorithms, such as those used in Proof-of-Stake (PoS) consensus models, have significantly reduced energy consumption compared to older Proof-of-Work (PoW) systems, making them more sustainable for long-term holdings. Moreover, many DeFi platforms offer compounded yields, which can amplify returns over time. However, it is essential to scrutinize the liquidity and governance structures of these projects, as poor management or liquidity crunches can jeopardize earnings. By selecting reputable platforms with transparent audits and robust security measures, investors can enhance their chances of success while minimizing the risk of capital loss.

The emergence of non-fungible tokens (NFTs) has also introduced new dimensions to online income generation, particularly in the realm of digital art and collectibles. While the NFT market has experienced significant fluctuations, its potential for value appreciation remains undeniable. To participate effectively, investors should focus on understanding the underlying culture and demand for specific NFTs, rather than chasing short-term trends. Researching the creators, sales history, and community engagement metrics can provide clarity on an NFT's long-term prospects. Additionally, exploring fractionalized ownership through NFT platforms allows individuals to invest in high-value digital assets without requiring large capital outlays. This approach can be particularly beneficial for those interested in niche markets, such as gaming or virtual real estate, where demand is steadily increasing. However, the volatile nature of NFT prices necessitates a cautious approach, with investors setting conservative profit targets and avoiding emotional decision-making.

For those seeking more capital-intensive opportunities, the potential of decentralized exchanges (DEXs) and initial coin offerings (ICOs) warrants exploration. These platforms democratize access to investment opportunities, allowing individuals to participate in projects without reliance on centralized financial institutions. However, the lack of regulatory oversight in these spaces can expose investors to fraud, market manipulation, and operational risks. To navigate this landscape, thorough due diligence is essential—examining the project's whitepaper, team credibility, and market traction can help identify legitimate opportunities. Additionally, investing in established DEXs with robust security protocols, such as automated market makers and cross-chain bridges, can reduce the risk of losing funds. Investors should also consider the potential for long-term value appreciation, rather than focusing solely on initial investment returns.

The rise of automated trading algorithms and robo-advisors in the cryptocurrency space offers another route for income generation. These tools utilize advanced machine learning models to analyze market data, identify trends, and execute trades with minimal human intervention. While they can enhance efficiency and reduce emotional bias in trading decisions, their effectiveness depends on the quality of the underlying data and the sophistication of the algorithms. To leverage this technology, investors should assess the track record of the algorithm developer, ensuring that their strategies are grounded in sound technical analysis and risk management principles. Moreover, integrating these tools into a broader investment strategy, such as diversifying across different market sectors and asset classes, can create a more resilient income stream.

The importance of continuous learning and adaptation cannot be overstated in the rapidly evolving digital finance landscape. Staying informed about regulatory changes, technological advancements, and macroeconomic trends is crucial for making informed investment decisions. Engaging with community-driven platforms, such as blockchain forums and NFT marketplaces, allows investors to gain insights from experienced participants and stay ahead of market shifts. Additionally, cultivating a long-term mindset enables investors to weather short-term volatility and capitalize on structural opportunities. For example, the shift toward environmentally sustainable blockchain solutions has increased the value of certain projects, highlighting the need for investors to stay attuned to industry developments.

By incorporating these strategies into a cohesive investment plan, individuals can explore a wide range of online income opportunities while mitigating potential risks. Success in these ventures requires a combination of strategic foresight, technical expertise, and emotional discipline, ensuring that capital is preserved and growth is maximized. For those who understand the intricacies of cryptocurrency markets, the path to financial growth is not merely about chasing quick returns but about building a resilient, diversified portfolio that aligns with long-term objectives. This approach not only safeguards against the pitfalls of short-term speculation but also positions investors to capitalize on the transformative potential of digital finance.