Elon Musk Net Worth: Income and Wealth

Elon Musk's net worth, which stands at approximately $249 billion as of 2023, is a complex tapestry woven from the success of multiple ventures and the intricate interplay of financial markets. His wealth is not merely a function of stock prices alone but reflects a broader ecosystem of innovation, strategic investments, and the transformative impact of his companies on global industries. At the core of this financial stature lies his entrepreneurial acumen, which has enabled him to build and scale enterprises that are not only profitable but also redefining the boundaries of what is possible in technology and space exploration. The trajectory of his net worth is closely tied to the performance of Tesla, SpaceX, Neuralink, The Boring Company, and other ventures, each contributing differently to his overall financial profile.

Tesla, for instance, has been the most significant driver of Musk's wealth growth in recent years. As the CEO and largest shareholder of the electric vehicle and renewable energy company, his stake fluctuates with the stock's price movements. In 2020, when Tesla's stock surged, Musk's personal fortune skyrocketed, making him the world's richest person. However, the subsequent volatility, including Tesla's stock drop in early 2022 and the company's struggles with production and market competition, created a dramatic swing in his net worth. This underscores how the success of a single company can have profound implications for an individual's financial standing, especially when that individual holds a substantial portion of the company's equity. The recent turnaround, marked by Tesla's regain of its market leadership and innovation in products like the Cybertruck and Optimus, has once again elevated Musk's net worth to unprecedented levels, highlighting the cyclical nature of his wealth.

SpaceX, his aerospace company, also plays a crucial role in his financial portfolio. While the company is not publicly traded, Musk's ownership stake is valued through its projected revenue potential, government contracts, and the value of its technology. The successful launches of SpaceX's Falcon 9 and Starship rockets, along with its partnerships with NASA and other entities, have significantly bolstered the company's valuation. The recent breakthroughs, such as the development of fully reusable rockets and the establishment of a sustainable presence on Mars, have further enhanced the perceived value of SpaceX. This illustrates how private ventures, particularly those in high-growth sectors like space exploration, can contribute to a person's net worth through a combination of operational success and visionary projects.

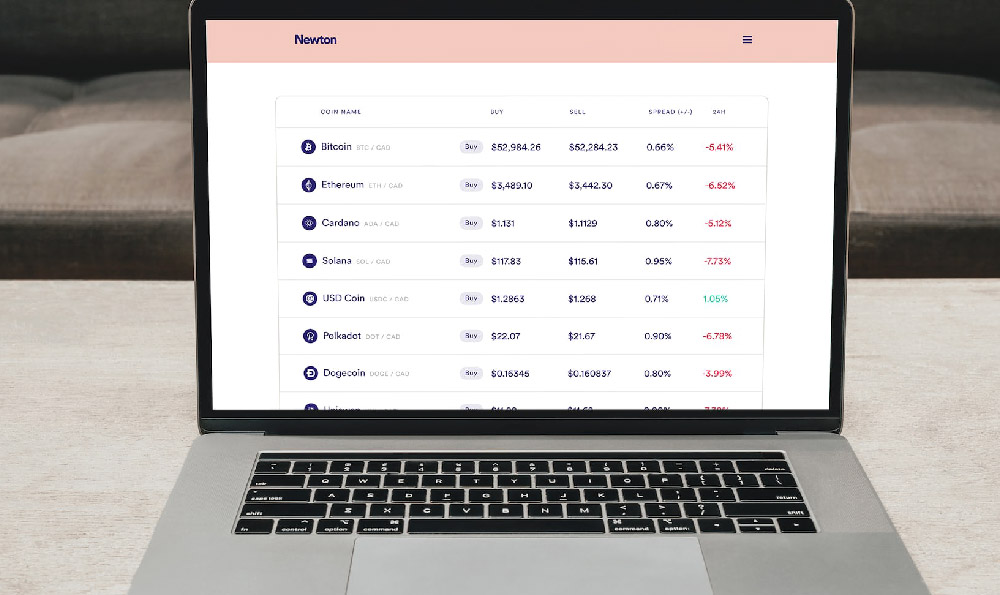

In addition to his business ventures, Musk's net worth is influenced by his personal investments and financial maneuvers. For example, in 2021, he invested over $1.5 billion in Bitcoin, which became a notable component of his assets. The subsequent fluctuations in Bitcoin's price, including a sharp decline followed by a recovery, have impacted his overall net worth. This decision reflects a blend of boldness and calculation, as Musk has always been known to take substantial risks in his financial strategies. His willingness to allocate a significant portion of his wealth to cryptocurrencies, despite the market's volatility, showcases his confidence in the long-term potential of such assets. However, as some of his Bitcoin holdings were liquidated in 2022, the net worth experienced a temporary dip, emphasizing the role of market conditions in shaping the fortunes of high-profile investors.

Moreover, Musk's net worth is a product of his ability to balance his roles as an entrepreneur and a savvy investor. He often reinvests his personal wealth back into his companies, a strategy that has allowed Tesla and SpaceX to grow at an accelerated pace. This circular investment model, where profits are channeled into expanding operations and developing new technologies, ensures that his wealth is not static but dynamic. For example, the proceeds from Tesla's stock sales have been used to fund the production of new vehicles and the development of the Gigafactory, which in turn enhances the company's profitability and, consequently, Musk's net worth. Similarly, the revenue from SpaceX's contracts has been reinvested into advancing space exploration initiatives, creating a self-sustaining cycle of growth.

The structure of Musk's wealth also reflects his approach to risk management and diversification. While his primary assets are concentrated in his companies, he has demonstrated a willingness to diversify across different sectors and asset classes. This includes investments in real estate, such as his purchase of a lavish home in Texas, and his ongoing ventures in artificial intelligence and sustainable energy. By spreading his investments across multiple domains, Musk reduces the risk associated with over-reliance on any single enterprise, ensuring that his net worth remains resilient against market fluctuations.

In the broader context, Musk's net worth serves as a benchmark for the potential of innovation-driven wealth creation. His ability to transform ambitious ideas into globally successful companies has not only amassed personal riches but also demonstrated the financial viability of long-term, high-risk investments. The story of his wealth is a testament to the power of vision, perseverance, and strategic planning in the world of finance. As markets continue to evolve, Musk's net worth will likely remain a subject of fascination, offering insights into how the intersection of technology and entrepreneurship can shape the financial landscape.