From Zero to Hero: Making Money from Nothing? Is It Really Possible?

The allure of transforming nothing into something substantial, particularly in the volatile realm of cryptocurrency, is a siren song that captivates many. The promise of "From Zero to Hero" resonates deeply with those seeking financial independence or a quick path to wealth. While the idea of making money from nothing might seem fantastical, the reality is far more nuanced, demanding diligent research, strategic planning, and a healthy dose of risk management. It's less about conjuring wealth out of thin air and more about leveraging opportunities, understanding market dynamics, and making informed decisions.

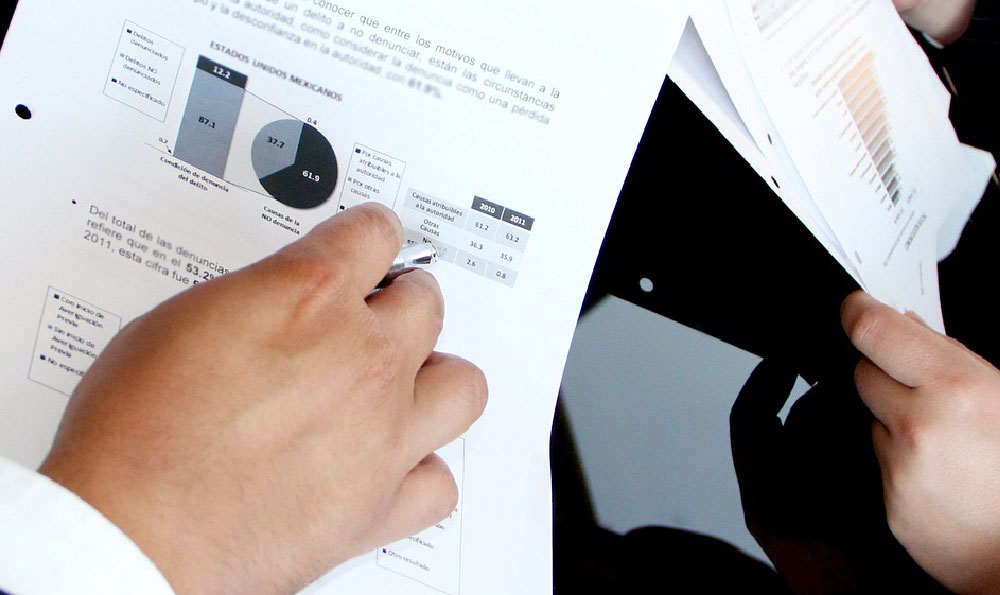

The initial step towards achieving any level of success in cryptocurrency is to dispel the notion of overnight riches. The stories of individuals becoming millionaires overnight, fueled by viral meme coins or unexpected market surges, are outliers, not the norm. Focusing on such narratives can lead to reckless decision-making and significant financial losses. Instead, a grounded approach begins with self-education. Understanding blockchain technology, the different types of cryptocurrencies, and the economic factors influencing their value are crucial foundational elements.

Numerous free and low-cost resources are available to build this base knowledge. Reputable cryptocurrency news websites, research papers, and online courses offered by accredited institutions can provide a comprehensive understanding of the crypto landscape. It is imperative to critically evaluate the information consumed, discerning credible sources from those promoting biased or misleading content.

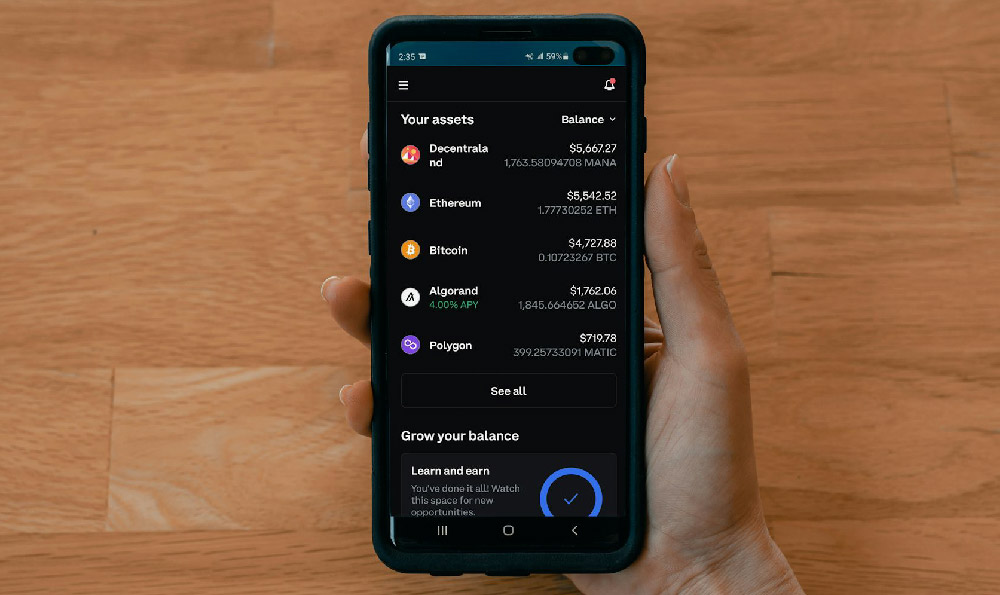

Once a fundamental understanding is established, the next phase involves defining investment goals and risk tolerance. Are you aiming for long-term growth, short-term profits, or a diversified portfolio that balances both? What percentage of your savings are you willing to risk? Answering these questions will dictate the types of cryptocurrencies you consider and the investment strategies you employ. A younger investor with a higher risk tolerance might be comfortable allocating a larger portion of their portfolio to emerging altcoins with high growth potential, while a more risk-averse individual might prefer established cryptocurrencies like Bitcoin or Ethereum.

Diversification is a cornerstone of sound investment practice, especially in the volatile cryptocurrency market. Putting all your eggs in one basket, regardless of how promising it may seem, is a recipe for potential disaster. Spreading investments across different cryptocurrencies with varying market capitalizations, use cases, and risk profiles can mitigate the impact of individual asset losses. Consider allocating funds to established cryptocurrencies, promising layer-2 scaling solutions, decentralized finance (DeFi) projects, and perhaps even a small allocation to higher-risk, higher-reward meme coins, but only after thorough research and a clear understanding of the inherent risks.

Technical analysis plays a significant role in identifying potential entry and exit points in the market. Analyzing price charts, trading volumes, and various technical indicators can provide insights into market trends and potential price movements. While technical analysis is not foolproof, it can be a valuable tool for making informed trading decisions. Familiarize yourself with concepts like support and resistance levels, moving averages, and relative strength index (RSI) to better understand market sentiment and identify potential trading opportunities. However, be wary of relying solely on technical analysis; it should be used in conjunction with fundamental analysis and a thorough understanding of market news and events.

Fundamental analysis involves evaluating the underlying value of a cryptocurrency by examining its technology, team, use case, and adoption rate. Understanding the fundamentals of a project can help you assess its long-term potential and make informed investment decisions. For example, analyzing the tokenomics of a cryptocurrency (the economic model governing its supply and distribution) can reveal potential inflationary pressures or deflationary mechanisms that could impact its price. Similarly, understanding the use case of a cryptocurrency can help you assess its long-term viability; is it solving a real-world problem? Is it attracting a growing user base?

Risk management is paramount in cryptocurrency investing. Implement stop-loss orders to automatically sell assets when they reach a certain price threshold, limiting potential losses. Avoid leveraging heavily, as it can amplify both gains and losses. Never invest more than you can afford to lose, and always prioritize your financial well-being. The cryptocurrency market is known for its sudden and unpredictable price swings, so it is crucial to have a plan in place to mitigate risk.

Beyond the technical and analytical aspects, it is essential to cultivate a disciplined and emotionally detached approach to investing. Avoid making impulsive decisions based on fear or greed. The cryptocurrency market is often driven by hype and speculation, which can lead to irrational price movements. Maintaining a calm and rational mindset will help you make sound decisions based on data and analysis, rather than emotions.

Recognize and avoid common investment traps. Pump-and-dump schemes, where groups artificially inflate the price of a cryptocurrency before selling their holdings for a profit, are prevalent in the crypto space. Research thoroughly before investing in any new project and be wary of promises of guaranteed returns or unrealistic gains. Similarly, be cautious of phishing scams and other fraudulent activities that are designed to steal your cryptocurrency or personal information. Use strong passwords, enable two-factor authentication, and store your cryptocurrency in a secure wallet.

Furthermore, staying informed about regulatory changes and the evolving legal landscape is crucial. Governments around the world are grappling with how to regulate cryptocurrencies, and new laws and regulations can significantly impact the market. Keeping abreast of these developments will help you avoid legal pitfalls and ensure that your investments are compliant with applicable laws.

The journey from zero to hero in cryptocurrency investing is not a sprint, but a marathon. It requires continuous learning, adaptation, and a commitment to risk management. While the potential for significant financial gains is real, it is essential to approach the market with a realistic perspective and a disciplined approach. By focusing on education, strategic planning, and risk management, you can increase your chances of success and achieve your financial goals in the dynamic world of cryptocurrency. The "zero" might not literally be nothing; it represents a starting point of knowledge, capital, and a well-defined strategy, while the "hero" embodies the financially independent and well-informed investor who navigated the complexities of the crypto world successfully.