Future Trading: How Much Profit Can You Earn?

Future trading has long captivated investors seeking high returns through leverage and market speculation. The question of how much profit can be earned in this complex arena often lingers in the minds of both novices and seasoned traders. While the potential for substantial gains exists, the answer is far from straightforward. It hinges on a multitude of factors, from the trader’s skill and strategy to the dynamics of global markets and the role of technology in modern trading environments.

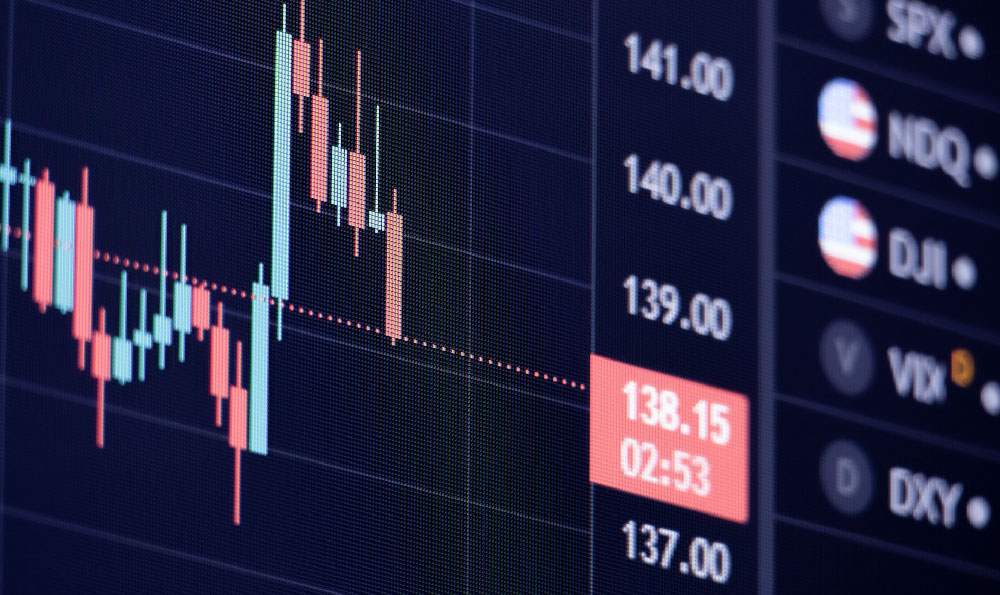

The allure of futures trading lies in its ability to amplify returns, but this comes with a proportional increase in risk. Futures contracts are standardized agreements to buy or sell an asset at a predetermined price and date, offering exposure to commodities, indices, currencies, and interest rates. The leverage inherent in futures allows traders to control large positions with relatively small capital, which can magnify profits. However, this same leverage can also magnify losses, sometimes leading to total exposure if not managed carefully. For instance, a trader using a 10:1 leverage ratio on a $10,000 margin could control a $100,000 position. If the market moves 2% in their favor, the profit could reach $2,000, yet a 2% adverse movement might result in a $2,000 loss—a stark reminder of the risk-reward balance.

Market volatility is a critical determinant of potential profits. Futures markets are known for their sensitivity to geopolitical events, economic data releases, and changes in supply and demand. A trader's ability to anticipate and react to these fluctuations can significantly impact their outcomes. For example, during periods of sharp increases or decreases in oil prices due to OPEC decisions or natural disasters, those who position themselves correctly may reap substantial rewards. However, unpredictable market shifts can also lead to rapid losses. This volatility underscores the importance of understanding market dynamics and utilizing tools like technical analysis or fundamental research to inform decisions.

The profitability of futures trading is also influenced by the trader's strategy. Some approaches prioritize short-term gains through day trading or swing trading, while others focus on long-term trends via position trading. Short-term strategies often rely on intraday price movements, which can be lucrative but require constant monitoring and quick decision-making. Conversely, long-term strategies may offer more stability, as they allow for the compounding of gains over time. For example, a trader holding a contract on a major index for several months could benefit from gradual price appreciation, even in a sideways market. However, both strategies demand significant discipline and expertise to avoid pitfalls like overtrading or emotional decisions.

Risk management plays a pivotal role in determining how much profit a trader can achieve. Establishing stop-loss orders, diversifying portfolios, and maintaining adequate risk reserves are essential practices. A disciplined approach to risk management can mitigate potential losses, allowing traders to withstand market downturns and continue pursuing profits. Conversely, inadequate risk control often leads to catastrophic outcomes, even for experienced traders. The psychological aspect of risk management cannot be overlooked; maintaining emotional equilibrium and adhering to a predefined plan are crucial for sustained success.

Technology and innovation have also reshaped the landscape of futures trading. Online platforms and algorithmic trading tools now provide access to real-time data, advanced analytics, and automated strategies, enabling traders to execute orders faster and more efficiently. The integration of artificial intelligence and machine learning has further enhanced predictive capabilities, offering insights into market behavior that were once inaccessible. These technological advancements have lowered entry barriers for retail traders but also increased the need for continuous learning and adaptation to stay competitive.

The profitability of futures trading is not solely dependent on market conditions or strategies. It also reflects the trader’s ability to adapt to changing environments and maintain a long-term perspective. Market trends, economic cycles, and geopolitical developments continuously influence the direction of futures prices, requiring traders to remain agile and informed. Furthermore, the concept of compounding returns becomes increasingly relevant, as consistent profits can be reinvested to generate even greater gains over time.

In conclusion, the answer to the question of how much profit can be earned in future trading is multifaceted. It depends on a combination of market conditions, the trader’s strategy, risk management techniques, and their ability to adapt to evolving trends. While futures trading offers the potential for significant financial growth, it is also fraught with challenges that demand careful consideration. As the markets become more interconnected and technology continues to advance, the opportunities and risks associated with futures trading will only intensify. For those willing to invest time, effort, and discipline, the rewards could be substantial, but the journey is not without its complexities.