Grow Your Money Fast: Proven Strategies to Increase Wealth and Earn More Quickly

Growing Your Money Fast: Proven Strategies to Increase Wealth and Earn More Quickly

The pursuit of financial growth is a journey that demands more than mere luck—it requires a blend of strategic thinking, discipline, and understanding of the markets. While the desire to accelerate wealth accumulation is natural, the path to achieving it is often obscured by misinformation, short-term thinking, and the allure of quick fixes. The foundation of sustainable growth lies in leveraging the power of compounding, crafting a diversified portfolio, and aligning investments with long-term objectives. Realizing wealth quickly is not about chasing the highest returns without regard for risk, but about optimizing every decision to create a system that steadily compounds over time.

Compounding, often referred to as the eighth wonder of the world, is a cornerstone of wealth building. The magic of compounding emerges from reinvesting earnings back into the original investment, allowing returns to generate additional returns. For instance, an initial investment of $10,000 growing at a 10% annual return would reach $30,000 in just 12 years if left untouched. This illustrates how time becomes a critical ally in wealth creation. However, the compounding effect is not automatic—it demands consistency and patience. It is crucial to prioritize even modest returns over extended periods rather than seeking large gains in the short term, as the latter often comes at the cost of significant risk.

Diversification is another essential principle that prevents the destruction of wealth through concentrated bets. By spreading investments across different asset classes—such as stocks, bonds, real estate, and commodities—individuals can mitigate the impact of volatility in any single area. For example, during periods of economic downturn, stocks may decline while bonds or cash equivalents could provide stability. Diversification does not guarantee profits nor shield against losses, but it reduces the overall risk profile of an investment strategy. A well-diversified portfolio should reflect an investor's risk tolerance, financial goals, and time horizon. This requires not only allocating funds across sectors or geographies but also balancing riskier assets with more conservative ones to maintain a steady rhythm of growth.

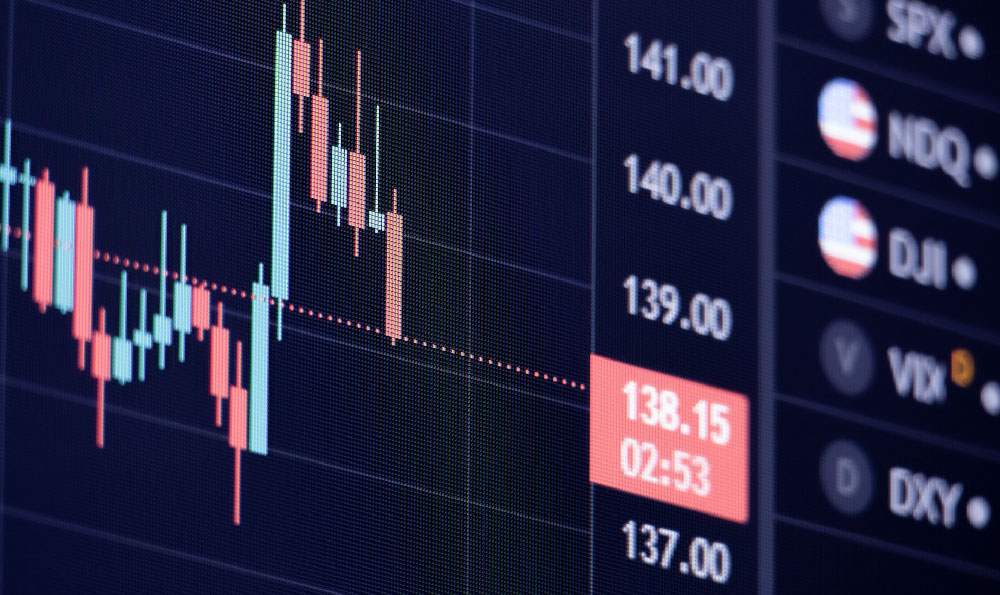

Timing the market is a common misconception, as attempting to predict short-term fluctuations often leads to suboptimal outcomes. Instead of trying to time the market, the focus should shift to understanding market cycles and investing with a long-term perspective. Historical data shows that the market tends to rise over time, even during periods of short-term contraction. Consistent investing, such as dollar-cost averaging, can help smooth out these fluctuations by purchasing assets at varying prices over time. This approach not only reduces the impact of market volatility but also fosters a mindset of regular contribution and compounding. Additionally, identifying companies or assets that demonstrate strong fundamentals, innovation, and resilience can lead to long-term appreciation without overexposure to speculative risks.

Risk management must be at the core of every investment strategy, especially when the goal is to grow wealth more swiftly. This involves setting clear financial goals with defined risk parameters, such as allocating a portion of the portfolio to high-risk assets while maintaining a buffer in low-risk instruments. For instance, a 20% allocation to equities, 30% to bonds, and 50% to cash or alternative investments can create a balanced approach that allows for growth while preserving capital. Moreover, understanding the importance of liquidity—ensuring that a portion of the portfolio remains accessible for emergencies or opportunities—is vital in maintaining flexibility. This requires not only diversifying assets but also adhering to a disciplined approach to managing debt and expenses.

Another overlooked strategy is the utilization of tax-advantaged accounts and instruments. By directing investments into vehicles such as retirement accounts, health savings accounts, or tax-deferred annuities, individuals can reduce the tax burden on their earnings, thereby increasing the net amount available for reinvestment. Additionally, capital gains tax rates often differ from ordinary income tax rates, and holding assets for longer periods can unlock these benefits. For example, long-term capital gains in many jurisdictions are taxed at a lower rate than short-term gains, making it advantageous to reinvest earnings rather than liquidate them.

Innovation and adaptability also play a significant role in accelerating wealth growth. This can involve exploring alternative investments such as real estate investment trusts (REITs), private equity, or peer-to-peer lending, which may offer higher returns than traditional options. However, these opportunities often come with unique risks and complexities, requiring thorough research and a clear understanding of the underlying assets. Furthermore, staying informed about macroeconomic trends, such as inflation, interest rates, and geopolitical events, enables investors to adjust their strategies in real-time. For example, in an inflationary environment, allocating funds to assets with inherent growth potential, such as stocks or real estate, can help preserve purchasing power.

Ultimately, the key to growing wealth quickly is not a single tactic but a holistic approach that integrates compounding, diversification, risk management, and adaptability. Success in this endeavor requires a commitment to continuous learning, patience in executing the strategy, and discipline in adhering to the plan. By embracing these principles, individuals can create a pathway to wealth growth that is both sustainable and resilient, allowing them to achieve financial freedom without compromising their long-term goals.

In the broader context, the journey to wealth growth is as much about mindset as it is about strategy. Cultivating a habit of saving, investing, and evaluating progress is essential. This involves setting aside a portion of monthly income for investments, regularly reviewing financial goals, and adjusting allocations as needed. It also demands the ability to resist the temptation of quick gains and instead focus on the structural aspects of wealth building. By doing so, individuals can transform their financial lives, creating a system that not only grows wealth but also ensures its preservation for future generations.

The path to financial success is not a sprint but a marathon, requiring sustained effort and a long-term vision. While the desire to grow money quickly is understandable, the most effective strategies often involve patience, consistency, and a calculated approach to risk. By integrating these elements into a comprehensive financial plan, individuals can unlock the potential for meaningful wealth growth, creating a legacy that extends beyond their immediate circumstances.