How to Grow a Money Tree? & Can You Really Make Money From It?

Okay, I understand. Here's an article based on the provided title, aiming for richness, detail, and a cohesive narrative structure, exceeding 800 words and written in English.

The allure of a "money tree" is timeless. It speaks to the fundamental human desire for financial security and, perhaps more romantically, the possibility of passive income blooming into a bountiful harvest. While literally growing banknotes on branches remains firmly in the realm of fantasy, the metaphor of cultivating wealth through strategic investment and disciplined financial planning is very real. But how exactly do you nurture this figurative "money tree," and can you genuinely expect to reap substantial rewards?

The first step, akin to selecting the right seed, involves identifying your financial goals and risk tolerance. Are you aiming for rapid growth, accepting potentially higher volatility, or prioritizing long-term, stable returns? Knowing your objectives is crucial for choosing the appropriate "soil" and "fertilizer" for your financial garden. This translates into determining what kind of investments align with your needs – stocks, bonds, real estate, mutual funds, ETFs, or perhaps even alternative assets like cryptocurrency or art. Each of these investment vehicles presents different levels of risk and potential return, and understanding their characteristics is paramount.

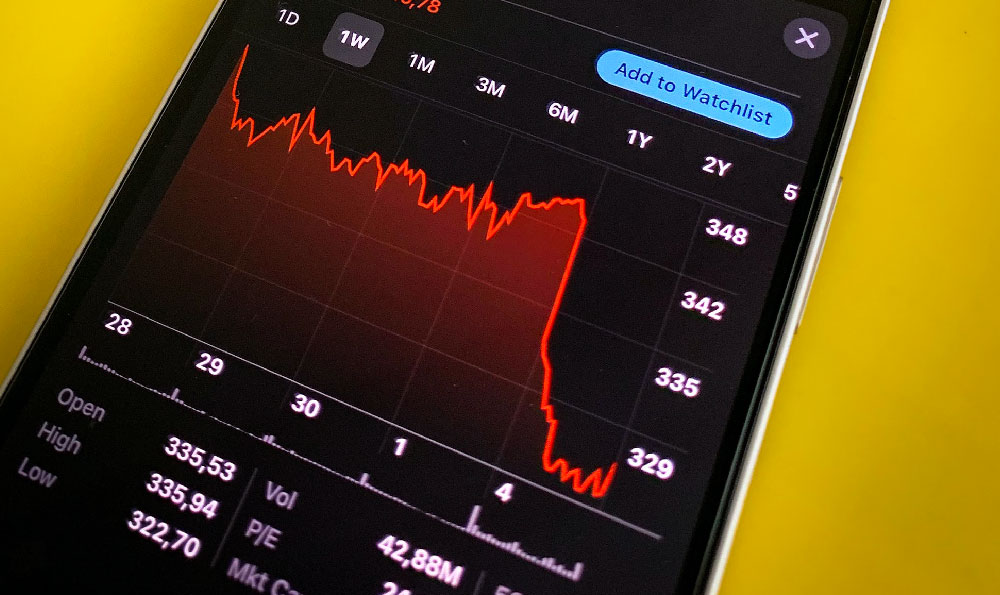

Consider, for instance, the stock market. Investing in individual stocks carries the potential for significant gains, but also the risk of substantial losses if the company performs poorly. Diversifying your portfolio by investing in a basket of stocks through a mutual fund or ETF can mitigate this risk. Bonds, on the other hand, are generally considered less risky than stocks, providing a more stable income stream, but with correspondingly lower growth potential. Real estate, although often requiring a larger initial investment, can offer both rental income and appreciation in value, but it also comes with the responsibilities of property management and the risk of fluctuating market conditions.

Once you have a clear understanding of your financial goals and risk tolerance, you need to develop a comprehensive financial plan. Think of this as designing the irrigation system for your "money tree." A well-structured plan should include budgeting, debt management, savings goals, and investment strategies. Creating a realistic budget allows you to track your income and expenses, identify areas where you can save money, and allocate funds for investment. Reducing high-interest debt, such as credit card debt, frees up more capital for investment and reduces the burden of interest payments. Setting specific, measurable, achievable, relevant, and time-bound (SMART) savings goals provides a clear roadmap for your financial journey.

The next crucial element is consistent investment, the equivalent of regular watering and fertilizing. The power of compounding, often referred to as the "eighth wonder of the world," is fundamental to growing wealth over time. Compounding refers to the process of earning returns not only on your initial investment but also on the accumulated interest or profits. The longer your money remains invested, the more significant the impact of compounding becomes. This highlights the importance of starting early and investing consistently, even if it's just a small amount at first. Think of it as planting a seed that, with time and care, will grow into a towering tree.

Beyond the initial investment decisions, actively managing your portfolio is essential for maintaining its health and ensuring it continues to grow in the right direction. This involves periodically reviewing your investments, rebalancing your portfolio to maintain your desired asset allocation, and adjusting your strategies as your financial goals and circumstances change. Market conditions can fluctuate, and it's important to stay informed and make adjustments as needed to protect your investments and capitalize on opportunities.

Furthermore, remember to consider the impact of taxes on your investment returns. Taxes can significantly erode your profits, so it's important to understand the tax implications of different investment vehicles and strategies. Consider utilizing tax-advantaged accounts, such as 401(k)s and IRAs, to reduce your tax burden and maximize your investment returns. Consulting with a financial advisor or tax professional can help you navigate the complex world of taxes and make informed decisions that align with your financial goals.

Now, addressing the question of whether you can really make money from your "money tree." The answer is a resounding yes, but with caveats. The success of your financial journey depends on a combination of factors, including your investment decisions, risk tolerance, time horizon, and market conditions. There are no guarantees of specific returns, and losses are always possible. However, by following a disciplined approach to financial planning, investing wisely, and managing your portfolio actively, you can significantly increase your chances of achieving your financial goals and building a substantial "money tree" over time.

It's also crucial to distinguish between legitimate investment opportunities and get-rich-quick schemes. Be wary of any investment that promises unrealistically high returns or guarantees profits. These are often scams designed to take advantage of unsuspecting investors. Always do your due diligence, research thoroughly, and seek advice from trusted financial professionals before investing in anything.

In conclusion, while a literal "money tree" remains a fantasy, the concept of cultivating wealth through strategic investment and disciplined financial planning is very real. By understanding your financial goals, developing a comprehensive financial plan, investing wisely, and managing your portfolio actively, you can nurture your own figurative "money tree" and reap the rewards of financial security and long-term growth. Remember, patience, consistency, and a willingness to learn are key to success in the world of investment. It's a journey, not a destination, and the rewards can be truly substantial over time. The real "magic" lies not in finding a mythical tree, but in the consistent and informed effort you put into growing your financial future.