Making Easy Money: Is It Possible, and How?

The allure of "easy money" is a siren song that has tempted investors for generations. The phrase conjures images of effortless riches, passive income streams flowing freely, and financial freedom achieved without significant effort or risk. While the reality is often more nuanced and demanding, the underlying desire for simpler, more accessible paths to wealth is understandable. Understanding the landscape of "easy money" requires a critical examination of both the possibilities and the potential pitfalls.

Firstly, it is crucial to define what we mean by "easy money." It is not synonymous with "free money" or "guaranteed money." Instead, it refers to investment strategies or opportunities that demand relatively less active management, technical expertise, or initial capital outlay compared to traditional investment routes like actively trading stocks or launching a business. It also implies a reasonable expectation of return proportionate to the risk involved. The pursuit of easy money should never overshadow the importance of thorough research, due diligence, and a realistic understanding of market dynamics.

One area often associated with the concept is dividend investing. By strategically selecting stocks that consistently pay out dividends, investors can generate a recurring income stream. This strategy is particularly appealing to those seeking passive income during retirement or as a supplement to their existing income. However, it's essential to look beyond the dividend yield alone. The financial health of the company, its long-term growth prospects, and its dividend payout history are all crucial factors to consider. A high dividend yield might be attractive, but it could also signal underlying financial distress or unsustainable payout practices. Furthermore, dividends are taxable, which should be factored into the overall return calculation.

Another avenue that often attracts those seeking easier returns is real estate investing, particularly through platforms that facilitate passive ownership. Real Estate Investment Trusts (REITs), for instance, allow investors to participate in the real estate market without directly managing properties. REITs are companies that own or finance income-producing real estate across various sectors, such as office buildings, shopping malls, apartments, and warehouses. By investing in REIT shares, individuals can receive a portion of the rental income generated by these properties, similar to receiving dividends from stocks. Moreover, crowdfunding platforms enable fractional ownership of real estate, allowing smaller investors to participate in larger commercial or residential projects with reduced capital requirements. However, even with these passive real estate options, due diligence is vital. Understanding the specific market conditions, the quality of the properties, and the management teams behind these investments is critical for long-term success. The real estate market is subject to fluctuations, and rental income can be affected by economic downturns or changes in local market dynamics.

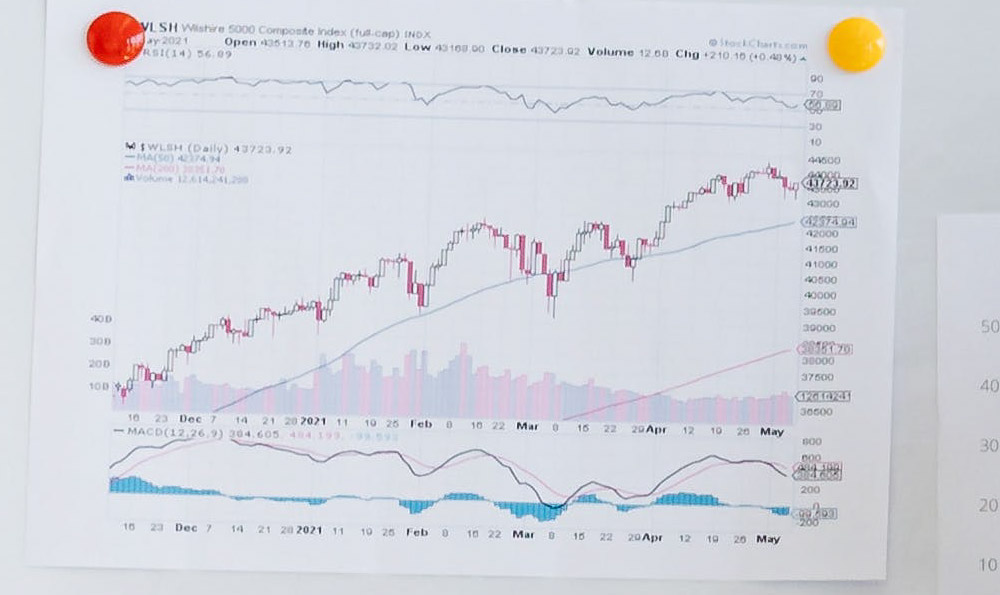

Index funds and Exchange-Traded Funds (ETFs) are also frequently touted as "easy money" options. These investment vehicles offer instant diversification by tracking a specific market index, such as the S&P 500. By investing in an index fund or ETF, investors gain exposure to a broad range of stocks or bonds with minimal effort. The low expense ratios associated with these funds make them particularly attractive to long-term investors. While index funds and ETFs generally provide stable returns over time, they are not immune to market volatility. During periods of economic uncertainty, the value of these investments can decline, reflecting the overall performance of the underlying market index. Therefore, a diversified portfolio that includes index funds or ETFs should be part of a broader financial strategy that aligns with the investor's risk tolerance and long-term goals. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, can help mitigate the risk of buying high during market peaks.

The digital age has ushered in new possibilities for generating passive income, such as through online platforms. Creating and selling digital products, such as e-books, online courses, or stock photos, can generate a continuous stream of income once the initial work is completed. Similarly, affiliate marketing, where individuals earn commissions by promoting other companies' products or services, can provide a relatively passive income stream. However, success in these ventures requires effort in creating high-quality products, building an audience, and effectively marketing the offerings. The online marketplace is competitive, and consistent effort is needed to maintain relevance and generate sales.

While these options may appear easier than starting a business from scratch or becoming a day trader, they are not without their challenges and risks. They all require some level of initial investment, whether it be time, money, or both. Furthermore, they all involve inherent risks, such as market fluctuations, changes in consumer demand, and the potential for fraud or mismanagement.

Ultimately, the pursuit of "easy money" should not be about seeking shortcuts or get-rich-quick schemes. Instead, it should be about identifying investment strategies that align with an individual's financial goals, risk tolerance, and time commitment. A well-diversified portfolio, a long-term investment horizon, and a commitment to continuous learning are essential for building sustainable wealth. Remember that even so-called "easy money" requires diligence, patience, and a healthy dose of skepticism. Before investing in any opportunity, thoroughly research the company, the market, and the potential risks involved. Seek advice from a qualified financial advisor if needed. The key is not to find a magical path to instant wealth but to make informed decisions that will help you achieve your financial goals over time. While the myth of effortless riches may persist, the reality is that building wealth requires a disciplined approach and a commitment to long-term financial planning.