How Does Robinhood Profit, and What Are Its Revenue Streams?

Okay, I understand. Here's an article exploring how Robinhood profits and its various revenue streams.

Robinhood, the darling of millennial and Gen Z investors, disrupted the brokerage world with its commission-free trading platform. This simple promise—no fees to buy or sell stocks, options, and cryptocurrencies—attracted a massive user base, especially among younger generations eager to participate in the stock market without the traditional barriers of entry. But if Robinhood doesn't charge commissions, how does it actually make money? The answer lies in a multifaceted revenue model that might surprise some users.

Payment for order flow (PFOF) is by far the most significant revenue stream for Robinhood. This practice involves Robinhood routing its users' orders to market makers, such as Citadel Securities and Virtu Financial, who execute those trades. These market makers pay Robinhood for the privilege of receiving those orders. The rationale behind PFOF is that market makers can profit from the spread—the difference between the buying and selling price of a security—and from potential arbitrage opportunities. By handling a large volume of orders from Robinhood users, market makers can efficiently match buyers and sellers and potentially improve their overall profitability.

The controversial aspect of PFOF is whether it guarantees the best possible price for Robinhood users. Critics argue that market makers might prioritize executing orders quickly rather than finding the absolute best price available, potentially costing users a fraction of a cent per share. Over millions of trades, these fractions can add up significantly, benefiting the market maker and Robinhood at the potential expense of the user. Robinhood maintains that it is legally obligated to seek the best execution for its customers, and it monitors market makers to ensure they are providing competitive prices. However, the inherent conflict of interest within the PFOF model remains a subject of debate and regulatory scrutiny.

Beyond PFOF, Robinhood generates revenue through other avenues. Securities lending is a notable example. Robinhood lends shares of stock held by its users to other financial institutions, such as hedge funds, who need to borrow them for various purposes, including short selling. Robinhood receives a fee for lending these shares, and a portion of that fee is passed on to the user whose shares are being lent. This allows Robinhood to generate income from assets that would otherwise be sitting idle in user accounts. The risks associated with securities lending include the possibility that the borrower defaults on the loan, though Robinhood mitigates this risk through collateralization and other safeguards.

Robinhood Gold, the platform's premium subscription service, provides another significant revenue stream. For a monthly fee, Gold subscribers gain access to a suite of enhanced features, including higher instant deposit limits, margin trading capabilities, and access to more in-depth market data and research reports. Margin trading, in particular, allows users to borrow money from Robinhood to increase their purchasing power, amplifying both potential gains and losses. Robinhood charges interest on these margin loans, which contributes significantly to its overall revenue. While margin trading can be a powerful tool for experienced investors, it also carries substantial risk and is not suitable for all users, particularly those with limited investment experience.

Interest income also plays a role in Robinhood's profitability. The company holds a significant amount of cash in its brokerage accounts, and it earns interest on these balances. As interest rates rise, Robinhood's interest income also increases, providing a relatively stable and predictable source of revenue. This income is generated by investing user funds in low-risk, liquid assets.

Furthermore, Robinhood earns revenue through interchange fees. When users use their Robinhood debit cards, Robinhood receives a small percentage of each transaction from the merchant's bank. This is a common practice for debit and credit card issuers and contributes a small but steady stream of income.

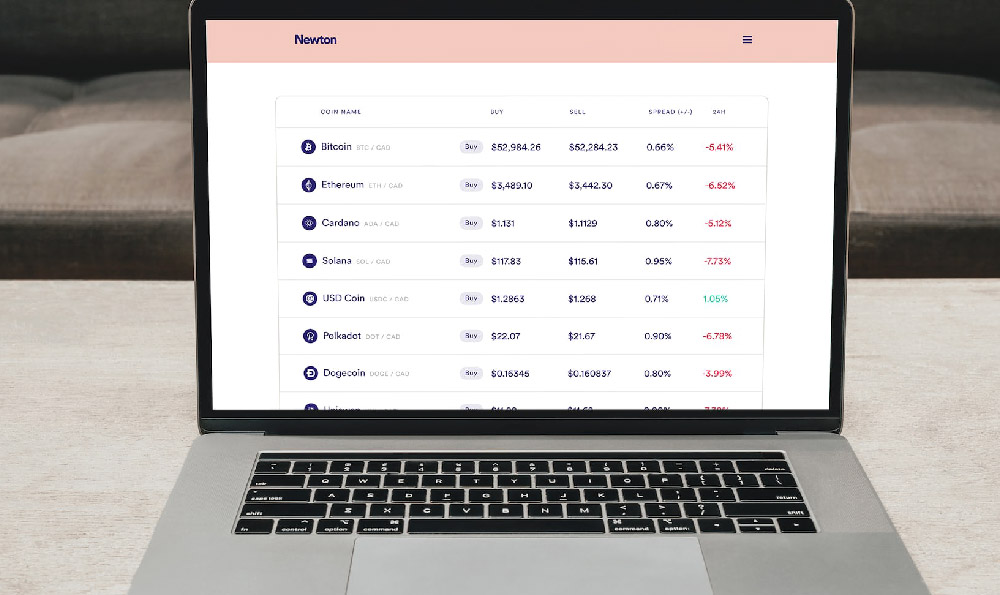

The growth of Robinhood's cryptocurrency trading platform has also added to its revenue. While cryptocurrency trading is also commission-free, Robinhood profits from the spread between the buying and selling prices of cryptocurrencies on its platform. This spread, while often small, can be substantial given the high volume of cryptocurrency trading activity on the platform.

It's important to understand that Robinhood's revenue model is inherently tied to the volume of trading activity on its platform. The more users trade, the more revenue Robinhood generates through PFOF, securities lending, and cryptocurrency spreads. This creates a potential incentive for Robinhood to encourage frequent trading, even if it is not in the best interests of its users. This has led to concerns about gamification and the potential for inexperienced investors to take on excessive risk. Regulators are actively scrutinizing Robinhood's practices to ensure that it is acting in the best interests of its customers and not simply prioritizing its own profitability.

In conclusion, Robinhood's commission-free trading model is supported by a complex network of revenue streams, primarily driven by payment for order flow. While Robinhood has democratized access to the stock market and made investing more accessible to a wider range of individuals, it's crucial for users to understand how the company makes money and the potential conflicts of interest that may arise. By understanding these dynamics, investors can make more informed decisions and protect themselves from potential risks. The platform's diversification into premium services, securities lending, and cryptocurrency trading further solidifies its financial foundation and allows it to continue offering commission-free trading. However, the ethical considerations surrounding PFOF and the encouragement of frequent trading will likely remain a subject of ongoing debate and regulatory attention.