How to Start a Blog and THEN Monetize It? A Complete Guide.

Okay, consider me your virtual crypto investment guru. Let's dive in, shall we?

The allure of cryptocurrency is undeniable. Fortunes have been made, and the promise of decentralized finance continues to draw in new participants daily. However, navigating this volatile landscape requires more than just a hunch and a prayer. It demands a strategic approach, a keen understanding of risk management, and a willingness to continuously learn and adapt. Let's break down how to approach crypto investment responsibly and potentially achieve financial growth.

Before even considering which coin to buy, it's crucial to establish a solid foundation. This begins with self-assessment. Are you looking for short-term gains or long-term investments? What is your risk tolerance? Are you comfortable with the possibility of losing a significant portion of your investment? Answering these questions honestly will inform your investment strategy and prevent emotional decision-making down the line.

Once you have a clear understanding of your risk profile, it's time to educate yourself. The crypto space is rife with jargon, complex technologies, and constantly evolving trends. Don't rely on hearsay or social media hype. Instead, seek out credible sources of information, such as research reports from reputable institutions, whitepapers of promising projects, and educational platforms dedicated to blockchain technology. Understand the underlying principles of different cryptocurrencies, their use cases, and the challenges they face. A deep understanding is your shield against misinformation and pump-and-dump schemes.

Now, let's talk strategy. Diversification is key. Don't put all your eggs in one basket, especially in a volatile market like crypto. Spread your investments across different types of cryptocurrencies, each with varying risk profiles and potential returns. For example, you might allocate a portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, which, while still volatile, are generally considered less risky than newer, smaller-cap altcoins. Another portion could be allocated to altcoins with promising technology or strong community support. Remember, though, that higher potential returns often come with higher risks.

Beyond diversification, consider dollar-cost averaging (DCA). This involves investing a fixed amount of money at regular intervals, regardless of the price of the asset. DCA helps to mitigate the impact of price volatility and can potentially lead to better average returns over time. For instance, instead of trying to time the market by buying a large amount of Bitcoin at what you think is the "bottom," you could invest a small amount each week or month, regardless of the price.

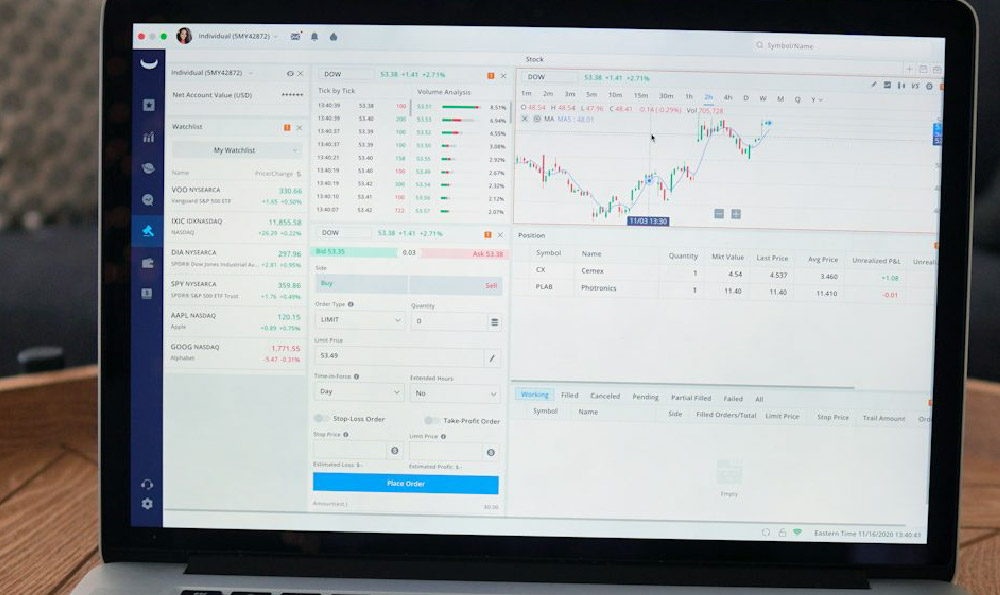

Technical analysis can be a valuable tool in identifying potential entry and exit points. This involves studying price charts and using various indicators to identify patterns and trends. While technical analysis is not foolproof, it can provide insights into market sentiment and help you make more informed trading decisions. Familiarize yourself with concepts like support and resistance levels, moving averages, and relative strength index (RSI). However, remember that technical analysis should be used in conjunction with fundamental analysis, which involves evaluating the underlying value and potential of a cryptocurrency based on its technology, team, and market adoption.

Beyond the technical aspects, it's crucial to stay informed about regulatory developments. Cryptocurrency regulations are constantly evolving, and changes in regulations can have a significant impact on the market. Follow news from reputable sources and be aware of any potential regulatory risks that could affect your investments.

Now, let's address risk management. Cryptocurrency is inherently risky, and it's essential to have a plan in place to protect your capital. One crucial step is to use secure wallets to store your cryptocurrencies. Choose a reputable wallet provider with strong security features, such as two-factor authentication and cold storage options. Cold storage involves storing your cryptocurrencies offline, which significantly reduces the risk of hacking.

Set stop-loss orders. A stop-loss order is an instruction to sell your cryptocurrency if it falls below a certain price. This can help to limit your losses in the event of a sudden market downturn. Determine your risk tolerance and set stop-loss orders accordingly.

Be wary of scams. The crypto space is unfortunately rife with scams, including phishing attacks, pump-and-dump schemes, and fake ICOs (Initial Coin Offerings). Be skeptical of any investment opportunity that seems too good to be true. Always do your own research and never invest more than you can afford to lose. Verify the legitimacy of any project before investing, and be cautious of unsolicited investment offers.

Finally, remember that cryptocurrency investment is a marathon, not a sprint. Don't expect to get rich overnight. It takes time, patience, and discipline to build a successful crypto portfolio. Stay informed, stay disciplined, and always be prepared to adapt to the ever-changing market conditions. Regular portfolio reviews are critical. Rebalance your portfolio periodically to maintain your desired asset allocation and adjust your strategy as needed based on market conditions and your own financial goals. Don't let emotions dictate your investment decisions. Stay rational and stick to your pre-defined strategy.

Investing in cryptocurrency can be a rewarding experience, but it's important to approach it with caution and a well-thought-out strategy. By educating yourself, diversifying your portfolio, managing your risks, and staying informed, you can increase your chances of success and potentially achieve your financial goals. Remember, this is not financial advice, and it's crucial to consult with a qualified financial advisor before making any investment decisions. Good luck, and may your crypto journey be profitable and secure.