What do top dog trainers earn & how is it possible?

The allure of financial independence through cryptocurrency investment is strong, but navigating this complex and volatile landscape requires more than just enthusiasm. It demands a calculated approach, a deep understanding of market dynamics, and a commitment to continuous learning. Let's dissect the key elements that separate successful crypto investors from those who fall prey to common pitfalls.

Firstly, understand that cryptocurrency isn't a monolithic entity. It's a diverse ecosystem comprising thousands of different coins and tokens, each with its own underlying technology, use case, and risk profile. Jumping in blindly, swayed by hype or fear of missing out (FOMO), is a recipe for disaster. Before investing in any cryptocurrency, conduct thorough due diligence. This involves researching the project's whitepaper, examining the team behind it, analyzing its market capitalization and trading volume, and assessing its potential for real-world adoption. Ask yourself: Does this project solve a genuine problem? Is it innovative? Does it have a strong community and developer support? If the answer to any of these questions is unclear or negative, proceed with extreme caution.

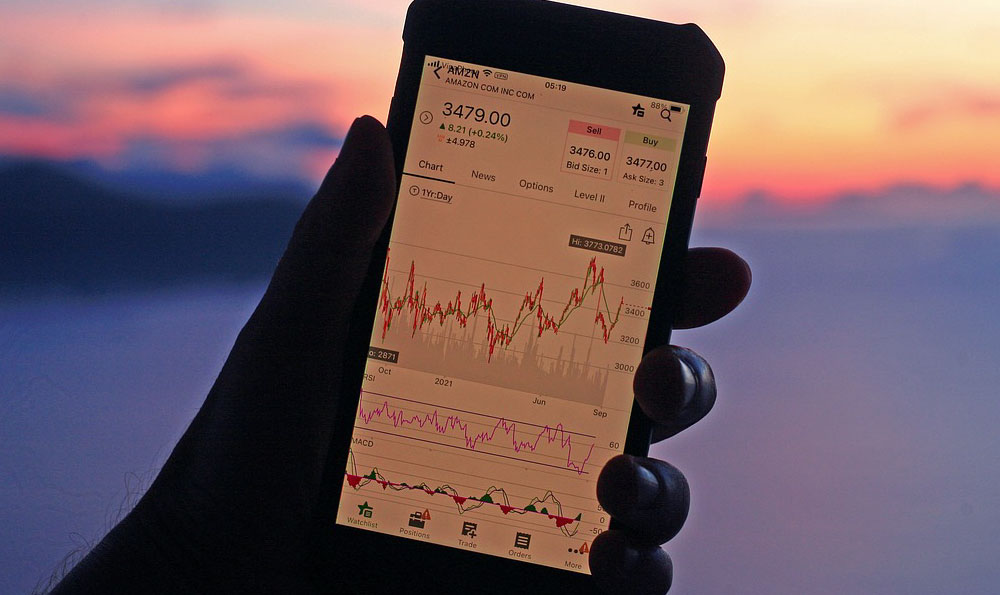

Beyond individual coin analysis, it's crucial to grasp the fundamental principles of technical analysis. This involves studying price charts, identifying patterns, and utilizing indicators to predict future price movements. While technical analysis is not foolproof, it can provide valuable insights into market sentiment and potential entry and exit points. Learn to interpret moving averages, support and resistance levels, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). Practice applying these tools to historical data to develop your analytical skills and refine your trading strategies. There are numerous online resources, courses, and books available to help you master technical analysis.

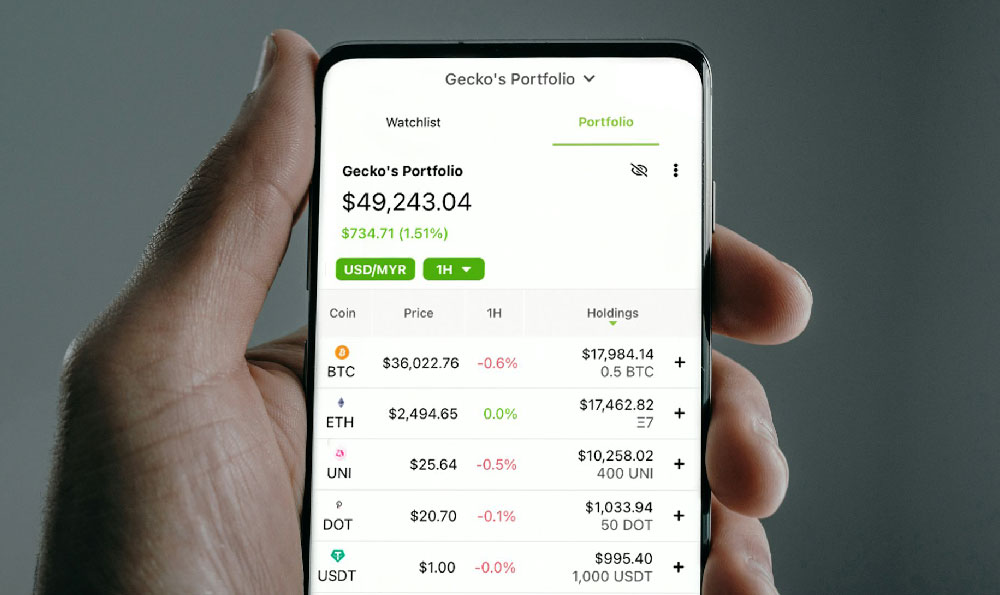

Diversification is another cornerstone of sound crypto investing. Just as you wouldn't put all your eggs in one basket in the traditional stock market, you shouldn't concentrate your entire crypto portfolio in a single coin. Spread your investments across a range of different cryptocurrencies with varying market caps and risk profiles. This strategy helps mitigate losses if one particular coin underperforms. Consider allocating a portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, which tend to be less volatile than smaller altcoins. At the same time, allocate a smaller portion to promising altcoins with high growth potential, understanding that these investments come with higher risk. Rebalance your portfolio periodically to maintain your desired asset allocation.

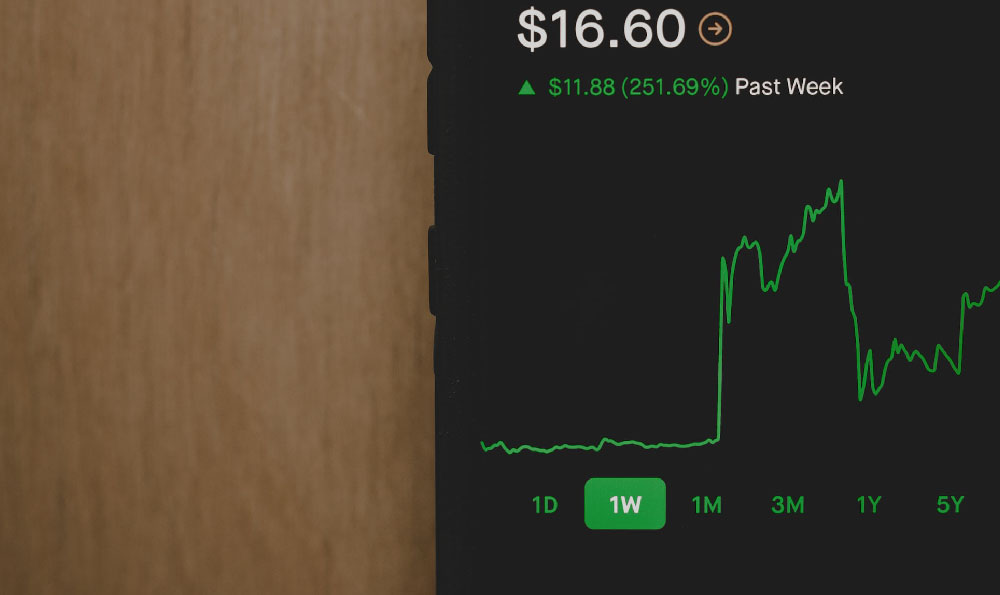

Risk management is paramount in the volatile world of cryptocurrency. Never invest more than you can afford to lose. Crypto prices can fluctuate dramatically in a short period, and it's essential to have a contingency plan in place. Set stop-loss orders to automatically sell your holdings if the price drops below a certain level. This helps limit your potential losses. Be wary of leverage trading, which amplifies both profits and losses. While leverage can increase your returns, it also significantly increases your risk of liquidation. Exercise caution when using leverage and only do so if you have a thorough understanding of the risks involved.

Furthermore, stay informed about the latest developments in the crypto industry. The regulatory landscape is constantly evolving, and new technologies and trends are emerging all the time. Follow reputable news sources, attend industry conferences, and engage with the crypto community to stay ahead of the curve. Be aware of potential scams and fraud. Cryptocurrency is a prime target for scammers, so be wary of unsolicited offers, promises of guaranteed returns, and projects that seem too good to be true. Never share your private keys with anyone, and always use strong passwords and two-factor authentication to protect your accounts.

Beyond the technical aspects, cultivate a disciplined and rational mindset. Emotional decision-making is a common pitfall for crypto investors. Avoid making impulsive trades based on fear or greed. Develop a long-term investment strategy and stick to it. Don't be swayed by short-term price fluctuations or market hype. Remember that investing in cryptocurrency is a marathon, not a sprint.

Finally, consider the long-term tax implications of your crypto investments. Consult with a tax professional to understand your tax obligations and ensure that you are compliant with all applicable regulations. Crypto taxation can be complex, and it's important to keep accurate records of your transactions.

In conclusion, successful cryptocurrency investing requires a combination of knowledge, discipline, and risk management. By conducting thorough due diligence, mastering technical analysis, diversifying your portfolio, managing your risk, staying informed, and cultivating a rational mindset, you can increase your chances of achieving your financial goals in the dynamic world of cryptocurrency. Remember that there are no guarantees in investing, but with a well-thought-out strategy and a commitment to continuous learning, you can navigate the complexities of the crypto market and potentially unlock significant long-term rewards. The key is to approach it like a professional, not a gambler.