How to Travel and Make Money: Is It Possible?

The allure of globetrotting while simultaneously building wealth through cryptocurrency investments is a powerful dream. The internet age has blurred geographical boundaries, and the rise of digital assets has provided avenues for generating income from anywhere with a stable internet connection. While the prospect is enticing, navigating this landscape requires a blend of strategic planning, diligent risk management, and a realistic understanding of both travel and cryptocurrency markets.

The first, and perhaps most crucial, element is building a solid foundation of knowledge. Cryptocurrency investment is not a passive activity. It demands constant learning and adaptation. Understand the underlying technology of blockchain, the differences between various cryptocurrencies (Bitcoin, Ethereum, altcoins), and the factors that influence their price movements. Delve into technical analysis (chart patterns, trading indicators), fundamental analysis (project whitepapers, team credentials, market adoption), and sentiment analysis (news, social media trends). Numerous online resources, including reputable cryptocurrency exchanges, educational platforms, and financial news websites, offer a wealth of information. Remember that information changes rapidly in this space, so a commitment to continuous learning is paramount.

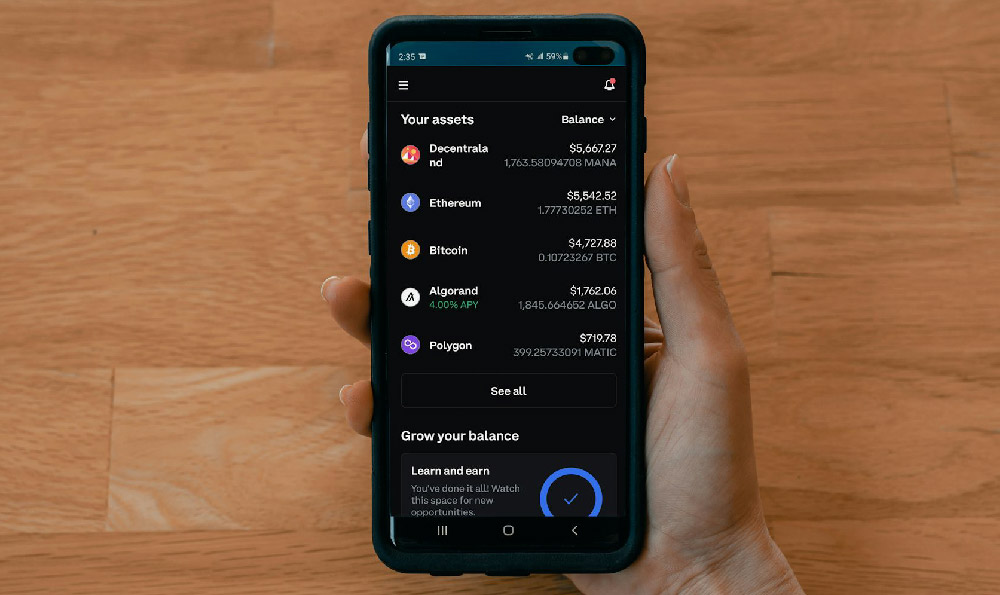

Once you have a basic understanding, consider your risk tolerance. Cryptocurrency investments are inherently volatile. Prices can swing dramatically in short periods, and the potential for loss is significant. Determine how much capital you are comfortable risking and never invest more than you can afford to lose. A responsible approach involves allocating a portion of your investment portfolio to cryptocurrencies, rather than putting all your eggs in one basket. Diversification is key to mitigating risk. Spread your investments across different cryptocurrencies and consider investing in other asset classes as well, such as stocks, bonds, or real estate.

With your risk tolerance established, you can begin developing a personalized investment strategy. There are several approaches to consider:

- Long-term holding (Hodling): This strategy involves buying cryptocurrencies with strong fundamentals and holding them for the long term, regardless of short-term price fluctuations. This approach is suitable for those who believe in the long-term potential of cryptocurrencies and are willing to weather market volatility.

- Trading: This strategy involves actively buying and selling cryptocurrencies to profit from short-term price movements. This approach requires a deeper understanding of technical analysis and market dynamics, as well as the ability to react quickly to changing market conditions. Day trading, swing trading, and arbitrage are all forms of trading.

- Staking and Lending: Many cryptocurrencies offer staking or lending programs, where you can earn rewards by holding and locking up your coins. Staking helps to validate transactions on the blockchain, while lending allows you to earn interest by lending your coins to others.

- Yield Farming: This more advanced strategy involves providing liquidity to decentralized finance (DeFi) platforms and earning rewards in the form of cryptocurrency tokens. Yield farming can be highly profitable, but it also carries significant risks, such as impermanent loss and smart contract vulnerabilities.

As you travel, access to reliable internet is crucial. Research countries and regions beforehand to ensure consistent connectivity. Public Wi-Fi networks can be vulnerable to security breaches, so invest in a Virtual Private Network (VPN) to encrypt your internet traffic and protect your personal information. Consider using a mobile hotspot as a backup option.

Maintaining security is paramount. Use strong, unique passwords for all your cryptocurrency accounts and enable two-factor authentication (2FA) whenever possible. Store your cryptocurrency in a secure wallet. Hardware wallets, which are physical devices that store your private keys offline, offer the highest level of security. Alternatively, consider using a reputable software wallet with robust security features. Be wary of phishing scams and never share your private keys with anyone. Regularly back up your wallet and keep your software up to date.

Tax implications are a critical consideration often overlooked. Cryptocurrency gains are typically subject to capital gains taxes. Keep accurate records of all your transactions, including the date, price, and amount of each transaction. Consult with a tax professional to understand your tax obligations in your country of residence. Laws regarding cryptocurrencies vary significantly around the globe and it is your responsibility to ensure you are compliant.

Beyond direct investment, other avenues exist for generating income while traveling with cryptocurrency. Consider offering your skills as a freelancer in the crypto space. Many blockchain companies and cryptocurrency projects are looking for writers, developers, marketers, and community managers. You can also participate in bounty programs, which reward you for completing specific tasks, such as testing software, writing articles, or promoting projects on social media. Teaching others about cryptocurrency through online courses or workshops can also be a viable source of income.

Finally, and perhaps most importantly, be patient and disciplined. Cryptocurrency investment is not a get-rich-quick scheme. It takes time, effort, and a consistent approach to build wealth. Avoid chasing hype and making impulsive decisions based on fear or greed. Stick to your investment strategy and rebalance your portfolio regularly. Remember that market downturns are inevitable. Use these opportunities to buy quality cryptocurrencies at discounted prices.

In conclusion, traveling and making money through cryptocurrency is a challenging but potentially rewarding endeavor. It requires a strong foundation of knowledge, a well-defined investment strategy, diligent risk management, and a commitment to continuous learning. By embracing a responsible and disciplined approach, you can increase your chances of achieving your financial goals while exploring the world. However, remember to consult with financial and tax professionals before making any investment decisions. The cryptocurrency landscape is constantly evolving, and expert advice can help you navigate the complexities and make informed choices.