Will XRP Replace SWIFT? Is Keepbit Platform the Future?

The allure of cryptocurrency lies in its potential to disrupt traditional financial systems. Among the myriad of digital assets vying for dominance, Ripple's XRP stands out due to its ambition to revolutionize cross-border payments. Similarly, emerging platforms like Keepbit are positioning themselves as integral components of this evolving landscape. However, understanding whether XRP will definitively replace SWIFT and if Keepbit represents the future requires a nuanced examination of their capabilities, limitations, and the broader market forces at play.

XRP and the SWIFT Challenge: A Deep Dive

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) has been the backbone of international financial messaging for decades. It enables banks to securely communicate payment instructions, facilitating cross-border transactions. Despite its widespread adoption, SWIFT suffers from several drawbacks, including high transaction fees, slow processing times, and a complex network of correspondent banks. These inefficiencies often result in delays and increased costs for businesses and individuals engaging in international trade.

XRP, on the other hand, aims to address these shortcomings by providing a faster, cheaper, and more transparent alternative. Ripple, the company behind XRP, offers a suite of payment solutions that leverage XRP as a bridge currency. In this model, a financial institution can convert currency A into XRP, transfer the XRP across the Ripple network, and then convert it into currency B at the destination. This process bypasses the traditional correspondent banking system, potentially reducing transaction times from days to seconds and significantly lowering fees.

While XRP presents a compelling alternative, its path to replacing SWIFT is not without obstacles. One of the primary challenges is adoption. SWIFT has a deeply entrenched network of over 11,000 financial institutions worldwide. Convincing these institutions to abandon a system they have relied on for decades and adopt a new technology requires overcoming inertia, regulatory hurdles, and concerns about security and scalability.

Furthermore, XRP faces regulatory uncertainty in various jurisdictions. The legal classification of XRP as a security or a currency varies from country to country, creating confusion and hindering its widespread adoption. Ongoing legal battles between Ripple and regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, add further complexity to the situation.

Despite these challenges, XRP has made significant progress in establishing partnerships with financial institutions and payment processors around the globe. Companies like MoneyGram have integrated XRP into their payment systems, demonstrating the potential for faster and cheaper cross-border transactions. Moreover, the increasing demand for real-time payments and the growing dissatisfaction with the inefficiencies of SWIFT are creating a favorable environment for alternative solutions like XRP to gain traction.

It's unlikely that XRP will completely replace SWIFT in the immediate future. SWIFT is actively working to improve its own infrastructure and address its shortcomings. SWIFT gpi (global payments innovation) is a service that aims to enhance the speed, transparency, and predictability of cross-border payments within the SWIFT network. The most probable scenario involves a coexistence of both systems, with XRP and other blockchain-based solutions gradually gaining market share as they prove their reliability and efficiency. XRP will most likely carve out a niche in specific use cases, such as remittances and low-value cross-border payments, while SWIFT continues to handle larger, more complex transactions.

Keepbit: A Glimpse into the Future of Crypto Platforms?

Keepbit, like many other emerging platforms, aims to provide a comprehensive ecosystem for cryptocurrency trading, investment, and portfolio management. The specific features and functionalities of Keepbit are critical in evaluating its potential and comparing it to established players in the crypto space.

Factors to consider when assessing Keepbit include:

- Security Measures: The security of user funds is paramount in the cryptocurrency world. Keepbit's security protocols, including cold storage, multi-factor authentication, and insurance coverage, are crucial for building trust and attracting users.

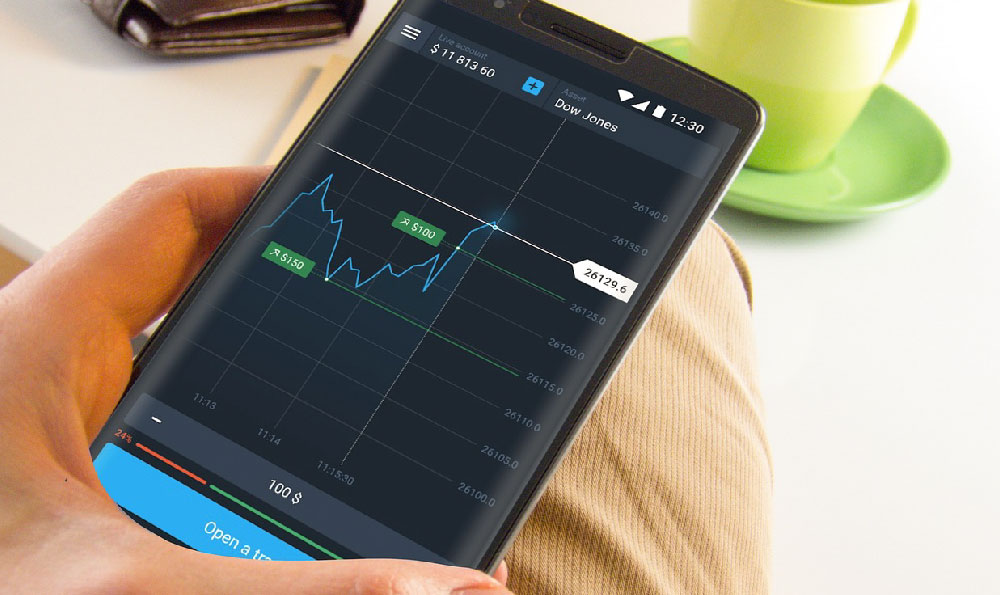

- User Interface and Experience: A user-friendly interface and intuitive navigation are essential for attracting both novice and experienced crypto investors. Keepbit's design and functionality should be accessible and easy to use.

- Trading Features and Tools: The platform should offer a range of trading features, such as spot trading, margin trading, futures trading, and advanced charting tools, to cater to different trading styles and risk appetites.

- Liquidity and Market Depth: Sufficient liquidity and market depth are essential for ensuring efficient trading and minimizing slippage. Keepbit should provide access to a wide range of cryptocurrencies and trading pairs with adequate liquidity.

- Regulatory Compliance: Compliance with relevant regulations is crucial for ensuring the long-term viability of the platform. Keepbit should operate in accordance with applicable laws and regulations in the jurisdictions where it operates.

- Community and Support: A strong community and responsive customer support are important for building trust and fostering user engagement. Keepbit should provide adequate channels for users to seek assistance and connect with other traders.

Whether Keepbit represents the future of crypto platforms depends on its ability to differentiate itself from its competitors and provide a superior user experience. The crypto space is highly competitive, with numerous established exchanges and platforms vying for market share. Keepbit needs to offer unique features, innovative services, or a more compelling value proposition to attract users and gain a competitive edge.

Platforms like Keepbit often try to stand out through novel offerings such as staking rewards, innovative trading bots, or integrations with decentralized finance (DeFi) protocols. By participating in DeFi, they can allow customers to earn interest on their holdings, thus bringing in more investors.

Conclusion: A Cautious Optimism

The cryptocurrency landscape is constantly evolving, and predicting the future with certainty is impossible. While XRP presents a compelling alternative to SWIFT, its path to widespread adoption is fraught with challenges. A more realistic scenario involves a gradual transition, with XRP carving out a niche in specific use cases while SWIFT continues to play a dominant role.

Whether Keepbit or similar new platforms represent the future depends on their ability to provide a secure, user-friendly, and feature-rich experience that attracts both new and experienced crypto investors. The success of these platforms hinges on their ability to adapt to evolving market conditions, comply with regulatory requirements, and foster a strong community. It is crucial for investors to conduct thorough research and exercise caution when investing in cryptocurrencies or using emerging platforms. The potential rewards are significant, but so are the risks.