Investing in Gold Online: Where and How?

Okay, I'm ready. Here's an article based on the title "Investing in Gold Online: Where and How?" written according to your specifications:

Investing in gold has been a strategy employed by investors for centuries, a means of preserving wealth during times of economic uncertainty, inflation, or geopolitical instability. In today's digital age, the process of acquiring gold has become significantly more accessible, with numerous platforms offering opportunities to invest in gold online. However, the ease of access also brings the need for careful consideration and due diligence. Navigating the online gold market requires understanding the available options, associated risks, and effective strategies.

One of the most straightforward ways to invest in gold online is through purchasing physical gold. This includes gold bullion, coins, and jewelry. Several reputable online dealers specialize in selling physical gold, offering a wide selection of products to suit various investment needs and budgets. When choosing a dealer, it’s crucial to verify their reputation through independent reviews and ratings from organizations like the Better Business Bureau. Look for dealers with a transparent pricing structure, secure storage options, and clear return policies. Be aware of premiums over spot price, which represents the difference between the current market price of gold and the price the dealer charges. These premiums can vary significantly between dealers, so comparison shopping is essential. Ensure that the dealer offers insured shipping to protect your investment during transit, and consider storing the gold in a secure location, either through the dealer's storage services or a private safe deposit box.

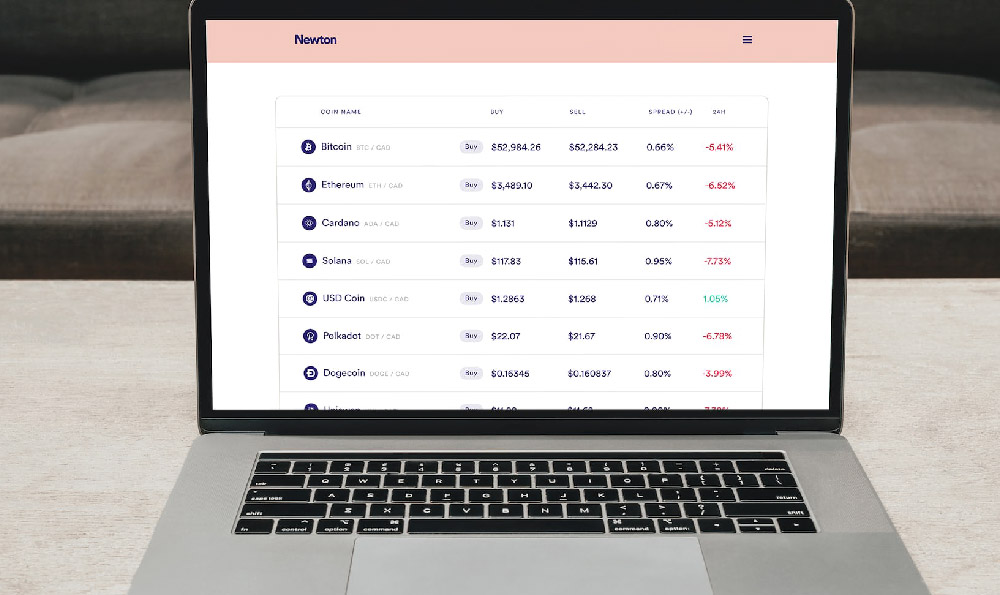

Beyond physical gold, investors can also gain exposure to gold through Exchange-Traded Funds (ETFs). Gold ETFs are investment funds that hold physical gold or gold futures contracts. They offer a convenient and liquid way to invest in gold without the need to physically store the metal. ETFs are traded on stock exchanges, making them easily bought and sold during market hours. Before investing in a gold ETF, carefully review the fund's prospectus to understand its investment strategy, expense ratio, and tracking error. The expense ratio is the annual fee charged by the fund to cover its operating expenses, and it can impact your overall returns. Tracking error measures how closely the ETF's performance matches the price of gold. Choose ETFs with low expense ratios and minimal tracking error to maximize your investment. Also, understand the difference between physically backed ETFs (holding actual gold) and synthetic ETFs (using derivatives). Physically backed ETFs are generally considered safer, but synthetic ETFs may offer slightly better tracking of gold's price movements.

Another avenue for online gold investment is through gold mining stocks. Investing in companies that mine gold can provide leveraged exposure to gold prices, as the profitability of these companies is directly tied to the price of gold. However, gold mining stocks are generally more volatile than physical gold or gold ETFs, as they are also subject to company-specific risks, such as operational challenges, regulatory issues, and exploration failures. Before investing in gold mining stocks, conduct thorough research on the company's financial health, management team, and mining operations. Look for companies with a proven track record of profitable gold production and a strong balance sheet. Diversifying your investments across multiple gold mining companies can help mitigate the risk associated with individual stocks.

Gold futures contracts provide a way to speculate on the future price of gold. These contracts obligate the buyer to purchase a specific quantity of gold at a predetermined price on a future date. Trading gold futures is a high-risk, high-reward strategy that is best suited for experienced investors who understand the complexities of futures markets. Futures contracts require margin, which is a deposit that covers potential losses. If the price of gold moves against your position, you may be required to deposit additional margin to maintain your contract. Failure to meet margin calls can result in the forced liquidation of your position.

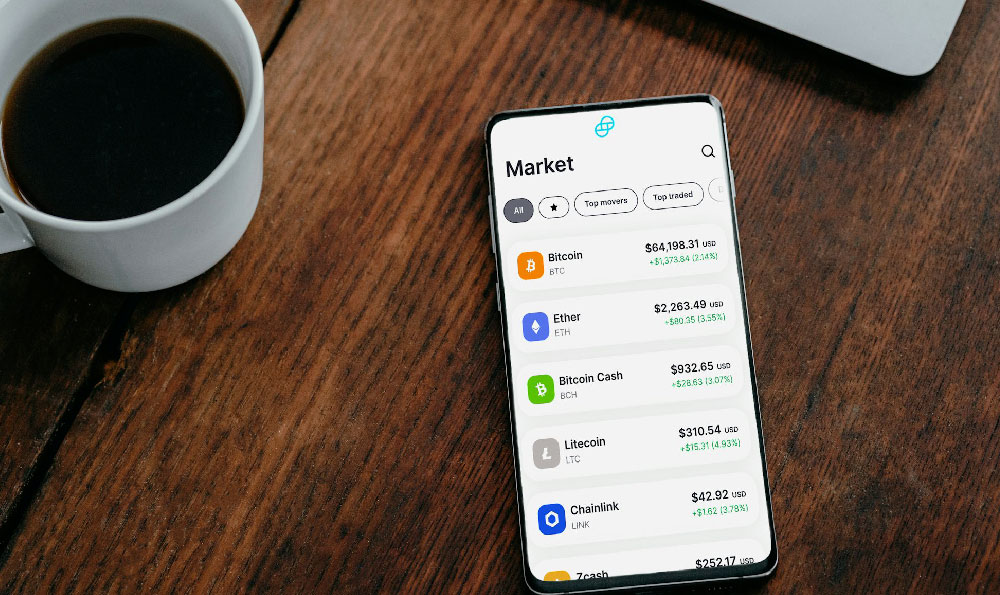

Online platforms also offer options for investing in gold through digital gold or gold-backed tokens. These platforms allow you to purchase fractions of gold, often starting with very small amounts. While convenient, it’s vital to understand the underlying mechanisms and security protocols of these platforms. Ensure that the gold backing these tokens is securely stored in reputable vaults and that the platform is regulated and transparent.

When investing in gold online, it’s crucial to be aware of the potential risks. Market risk is the possibility that the price of gold could decline, resulting in losses on your investment. Inflation risk is the possibility that the value of gold could be eroded by inflation. Counterparty risk is the risk that a dealer or platform could default on its obligations, resulting in losses for investors. Security risks include the possibility of fraud, theft, or cyberattacks. To mitigate these risks, conduct thorough research, diversify your investments, and use secure online platforms. Always be wary of unsolicited offers or promises of guaranteed returns, as these are often signs of scams.

Before making any investment decisions, it is always wise to consult with a qualified financial advisor who can help you assess your risk tolerance, investment goals, and financial situation. They can provide personalized advice on the best way to invest in gold online and ensure that your investment strategy aligns with your overall financial plan. Investing in gold should be part of a well-diversified portfolio that includes other asset classes, such as stocks, bonds, and real estate.

In conclusion, investing in gold online offers a range of options to suit different investment styles and risk appetites. Whether you prefer the tangibility of physical gold, the convenience of ETFs, the potential leverage of mining stocks, or the speculative nature of futures contracts, careful research, risk management, and professional advice are essential for success. The digital age has democratized access to gold investment, but the fundamental principles of sound investing remain paramount.