Are Stocks the Way to Make Money? How Can You Do It?

Investing in the stock market has long been touted as a viable path towards wealth creation. While the allure of high returns can be tempting, it's essential to approach stock market investing with a clear understanding of its complexities and inherent risks. The answer to whether stocks are "the way" to make money isn't a simple yes or no; rather, it depends on various factors including individual financial goals, risk tolerance, investment horizon, and knowledge of the market.

Undeniably, stocks, especially over the long term, have historically provided returns that outpace other asset classes like bonds or savings accounts. This potential for growth is what attracts many investors. The logic is straightforward: you become a part-owner of a company by purchasing its stock. If the company performs well, its value increases, and consequently, the value of your shares rises. Furthermore, some companies distribute a portion of their profits to shareholders in the form of dividends, providing a regular income stream in addition to potential capital appreciation.

However, the stock market isn't a guaranteed money-making machine. It's subject to volatility, influenced by a multitude of factors ranging from macroeconomic trends and geopolitical events to company-specific news and investor sentiment. Market corrections and crashes are inevitable occurrences, and the value of your investments can fluctuate significantly. Therefore, the key to successfully navigating the stock market lies in understanding how to mitigate risks and maximize potential gains.

So, how can you approach stock market investing effectively? The first step is self-assessment. Determine your financial goals: are you saving for retirement, a down payment on a house, or a child's education? What is your risk tolerance? Are you comfortable with the possibility of losing a portion of your investment in exchange for the potential for higher returns, or do you prefer a more conservative approach? How long do you plan to invest? These factors will influence your investment strategy and the types of stocks you choose to invest in.

Once you've established your financial profile, it's time to learn the basics of stock market investing. Understand the different types of stocks, such as growth stocks (companies with high growth potential), value stocks (companies undervalued by the market), and dividend stocks (companies that pay regular dividends). Learn about market capitalization, which refers to the total value of a company's outstanding shares and can be used to categorize stocks into large-cap, mid-cap, and small-cap companies.

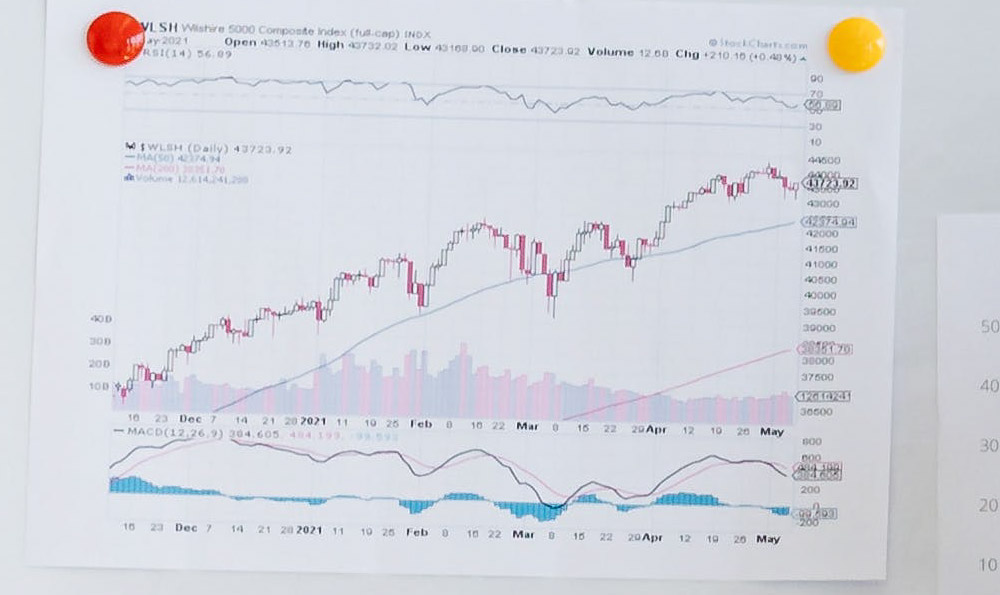

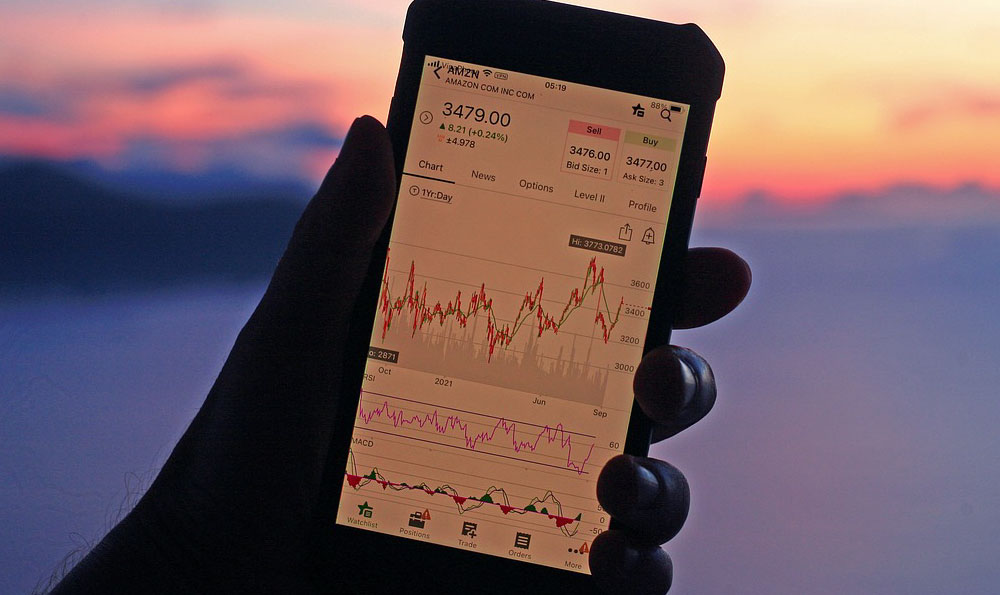

Several investment approaches can be employed. One is fundamental analysis, which involves evaluating a company's financial statements, management team, and competitive position to determine its intrinsic value. Another is technical analysis, which focuses on analyzing price charts and trading volume to identify patterns and predict future price movements. A third, and often recommended approach, is a blend of both. You should also understand basic financial ratios, such as Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Debt-to-Equity (D/E) ratio. These ratios can help you assess a company's financial health and compare it to its peers.

Diversification is crucial for risk management. Don't put all your eggs in one basket. Instead, spread your investments across different sectors, industries, and geographies. This reduces the impact of any single investment performing poorly. You can achieve diversification by investing in individual stocks or by investing in exchange-traded funds (ETFs) or mutual funds. ETFs and mutual funds are baskets of stocks that track a specific index or investment strategy, providing instant diversification. Consider investing in index funds, which aim to replicate the performance of a specific market index, such as the S&P 500. They generally have low expense ratios and offer broad market exposure.

Dollar-cost averaging is another valuable strategy. This involves investing a fixed amount of money at regular intervals, regardless of the stock's price. This helps to reduce the risk of investing a large sum of money at the wrong time. When prices are low, you buy more shares, and when prices are high, you buy fewer shares. Over time, this can lead to a lower average cost per share.

Remember to manage your emotions. The stock market can be a rollercoaster, and it's easy to get caught up in the hype or panic during market fluctuations. Avoid making impulsive decisions based on fear or greed. Stick to your investment strategy and don't let short-term market noise distract you from your long-term goals. It's also important to periodically review your portfolio and rebalance it as needed. This involves selling assets that have performed well and buying assets that have underperformed to maintain your desired asset allocation.

Before investing, research the company and understand its business model, competitive landscape, and financial performance. Be wary of "get rich quick" schemes and promises of guaranteed returns. If something sounds too good to be true, it probably is. Understand the fees and expenses associated with your investments. High fees can eat into your returns over time. Finally, consider seeking professional financial advice. A qualified financial advisor can help you develop a personalized investment strategy and provide guidance on managing your investments.

Investing in the stock market can be a powerful tool for wealth creation, but it requires knowledge, discipline, and a long-term perspective. By understanding the risks, developing a sound investment strategy, and managing your emotions, you can increase your chances of achieving your financial goals. While stocks are not necessarily "the way" to make money for everyone, they can be a valuable component of a well-diversified investment portfolio. Patience and continuous learning are the cornerstones of successful investing. The journey to financial success is a marathon, not a sprint.