How Do Companies Benefit From Stocks, And Why Should You Care?

Issuing stock, or equity, is a cornerstone of corporate finance, enabling companies to fuel growth, innovation, and expansion. Understanding how companies benefit from stocks, and subsequently, why individuals should care about this mechanism, is crucial for both the companies themselves and anyone seeking to participate in the financial markets.

One of the most significant benefits for a company issuing stocks is access to capital. Unlike debt financing, where the company is obligated to repay the borrowed amount with interest, equity financing represents ownership in the company. When a company sells shares of stock to investors, it receives capital in exchange for a portion of its ownership. This capital can be used for a myriad of purposes, such as funding research and development, expanding operations into new markets, acquiring other businesses, or simply bolstering its financial stability. Without the readily available capital from stock offerings, many companies, especially startups and those in rapidly evolving industries, would struggle to survive, let alone thrive. The ability to raise substantial funds without incurring debt allows companies to take calculated risks and pursue opportunities that would otherwise be unattainable.

Moreover, issuing stock often enhances a company's credibility and visibility. Becoming a publicly traded company subjects it to greater scrutiny from regulators, analysts, and the public. This increased transparency can build trust with customers, suppliers, and other stakeholders. Publicly listed companies are required to adhere to strict reporting requirements, providing investors with regular updates on their financial performance and business operations. This transparency can attract a wider range of investors, including institutional investors like mutual funds and pension funds, who typically prefer to invest in companies with established track records and clear governance structures. Furthermore, the public trading of shares can increase brand awareness and attract media attention, which can further enhance the company's reputation and market position.

A key advantage of equity financing is its impact on a company's balance sheet. By raising capital through stock offerings, a company can improve its debt-to-equity ratio, making it more financially resilient. A lower debt-to-equity ratio indicates that the company relies less on debt and more on equity to finance its operations, which is generally viewed favorably by lenders and investors. This can make it easier for the company to secure future financing at more favorable terms, as lenders perceive it as a lower-risk borrower. Additionally, equity financing can provide a buffer against unexpected financial challenges, as the company is not burdened by the immediate obligation to repay debt. This financial flexibility allows the company to navigate economic downturns and industry disruptions more effectively.

Beyond the immediate financial benefits, issuing stock can also align the interests of employees and shareholders. Companies often grant stock options or restricted stock units (RSUs) to employees as part of their compensation packages. This gives employees a stake in the company's success and incentivizes them to work towards its long-term growth. When employees are shareholders, they are more likely to be motivated and engaged, as their own financial well-being is directly tied to the company's performance. This alignment of interests can foster a stronger corporate culture and improve employee retention.

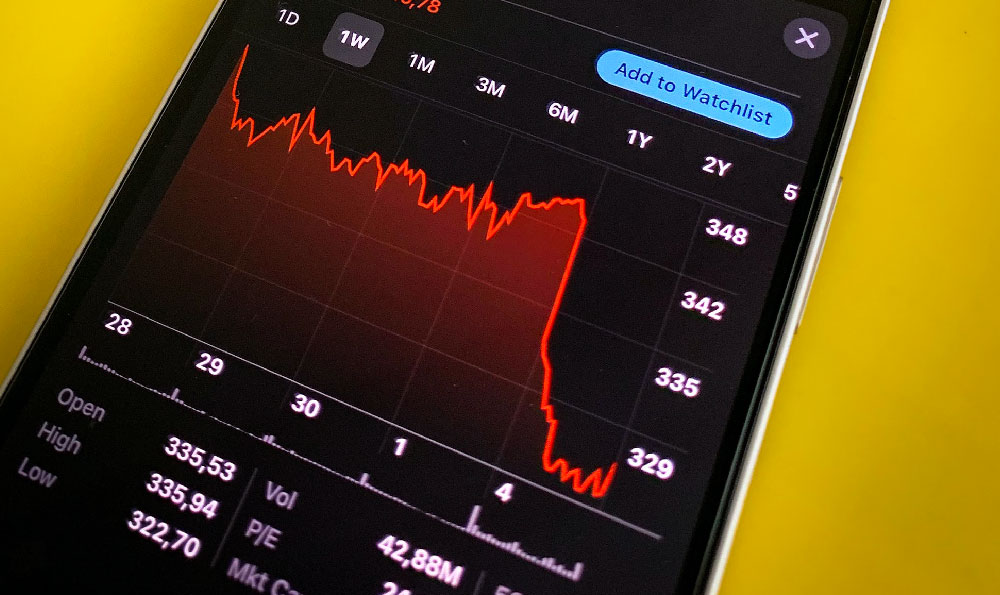

Now, why should you, as an individual, care about how companies benefit from stocks? The answer lies in the opportunities for wealth creation and participation in the growth of the economy. Investing in the stock market allows individuals to become part-owners of publicly traded companies and share in their profits. When a company performs well, its stock price tends to increase, benefiting shareholders who have invested in the company. This is a powerful way to grow wealth over time, especially when considering the potential for compounding returns.

Furthermore, understanding how companies benefit from issuing stock can help you make more informed investment decisions. By analyzing a company's financial statements and understanding its capital structure, you can assess its financial health and growth potential. This can help you identify companies that are likely to generate strong returns for shareholders. Investing in companies that are effectively using equity financing to grow and innovate can be a rewarding way to participate in the economy's dynamism.

Investing in the stock market also allows individuals to diversify their portfolios. By allocating a portion of their savings to stocks, investors can reduce their overall risk and potentially increase their returns. Diversification is a key principle of sound financial planning, as it helps to mitigate the impact of any single investment on the overall portfolio. Stocks, when combined with other asset classes like bonds and real estate, can provide a well-rounded portfolio that is better positioned to weather market volatility.

Finally, the stock market plays a crucial role in the economy by channeling capital to productive businesses. When individuals invest in stocks, they are providing companies with the resources they need to grow, innovate, and create jobs. This, in turn, stimulates economic growth and benefits society as a whole. By participating in the stock market, you are not only pursuing your own financial goals but also contributing to the overall health and prosperity of the economy.

In conclusion, issuing stock offers numerous benefits for companies, including access to capital, enhanced credibility, improved balance sheet, and alignment of employee and shareholder interests. Understanding these benefits is essential for anyone seeking to invest in the stock market, as it can help you make more informed decisions and potentially achieve your financial goals. By participating in the stock market, you can become part of the engine that drives economic growth and innovation.