How to Earn Decent Money Fast with Easy Tips

Earning a significant amount of money quickly is a common aspiration, yet it often requires a combination of strategy, initiative, and awareness of opportunities that align with both personal strengths and market dynamics. While some methods may seem straightforward, their success depends on execution, timing, and the ability to leverage existing resources effectively. For those seeking to generate additional income without overextending their time or financial commitments, several avenues exist that blend simplicity with sustainability.

One of the most accessible routes to financial growth lies in harnessing digital skills, especially in an era where remote opportunities are abundant. Tasks such as freelance writing, graphic design, or online tutoring can be performed from anywhere, eliminating the need for physical presence in traditional jobs. Platforms like Fiverr, Upwork, or LinkedIn offer a marketplace where professionals can sell their expertise. Even basic skills, like creating social media content or managing online accounts, can be monetized through microtask platforms. The key lies in specializing in a niche that demands consistent demand, such as SEO optimization, video editing, or language translation, to establish a reliable income stream. However, success in this realm typically requires a certain level of proficiency, as clients often prioritize quality over cost.

Another strategy involves capitalizing on residual income opportunities, which allow individuals to generate money with minimal ongoing effort. Affiliate marketing, for instance, enables people to earn commissions by promoting products or services through unique referral links. By leveraging social media channels or creating content around topics with high engagement, earnings can accumulate over time. Similarly, rental income through short-term property investments or digital assets like domain names and online tools can provide passive returns. Some individuals opt for fractional investing, allocating smaller sums to multiple assets or projects to diversify risk while maximizing potential gains. While these approaches may not yield massive profits overnight, they offer a foundation for long-term financial stability.

For those with a knack for creativity, side hustles such as crafting handmade goods, designing digital products, or offering online services can be both lucrative and flexible. Platforms like Etsy allow artisans to sell their creations globally, while digital downloadable products, like templates or courses, require one-time effort but can generate ongoing revenue. Additionally, services like virtual assistance or remote customer support can be offered on a freelance basis, adapting to the needs of businesses that require temporary help. The critical factor in these ventures is understanding the target audience and ensuring the product or service meets a genuine need. This often involves research, iteration, and a commitment to quality, which can take time but ultimately lead to consistent income.

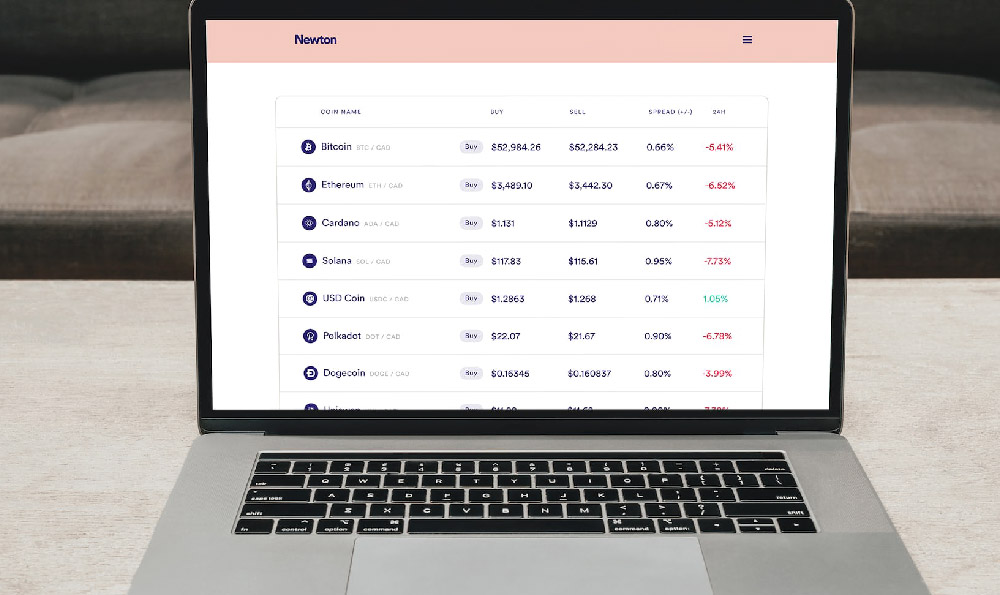

Investment strategies that involve minimal active participation can also be effective for generating returns with less direct involvement. Dividend stocks, for example, provide regular income through quarterly dividends, offering a predictable stream of returns without requiring constant monitoring. Similarly, index funds or ETFs allow investors to spread their capital across a basket of assets, reducing risk while benefiting from market growth. Some individuals take advantage of cryptocurrency staking or lending protocols to earn interest on their digital holdings, though these require a basic understanding of blockchain technology and market volatility. While investments inherently carry risks, diversifying across multiple avenues and maintaining a long-term perspective can mitigate potential losses and enhance returns.

For those with an interest in higher-risk ventures, certain opportunities may offer rapid returns, though they often come with increased uncertainty. Some people explore short-term trading in financial markets, such as buying and selling stocks, forex, or commodities based on market trends. Similarly, short-term rental properties or event-based investments, like crowdfunding for a startup, can yield substantial profits in a compressed timeframe. However, these methods require in-depth knowledge, careful risk management, and a willingness to accept potential downsides. Success in this space is not guaranteed, and individuals must approach these opportunities with caution and a well-defined plan.

Beyond these methods, networking and collaboration can play a crucial role in generating income quickly. Joining online communities or industry groups allows individuals to connect with potential clients, partners, or investors who may offer opportunities for monetization. Some people leverage their social media presence to promote products or services, while others collaborate with influencers or brands to create joint ventures that share profits. Additionally, contributing to open-source projects or earning through content creation on platforms like YouTube or TikTok can provide passive income sources that align with personal interests and skills. These strategies require time to build a credible presence, but the rewards can be substantial once the foundation is established.

Finally, the ability to identify and act on high-demand opportunities is essential for anyone seeking to generate income efficiently. This may involve recognizing emerging trends in technology, fashion, or entertainment that can be exploited with minimal investment. Some individuals start small by offering services in underserved markets, such as pet care, childcare, or local event planning, which can quickly gain traction with targeted efforts. Others focus on skill development in areas like coding, digital marketing, or financial analysis, positioning themselves for higher-paying roles or freelance opportunities. The key to success lies in a combination of adaptability, persistence, and the willingness to continually refine strategies based on market feedback.

In conclusion, generating smart money quickly requires a thoughtful approach that balances action with planning. Whether through digital skills, residual income strategies, or targeted investments, individuals can find ways to enhance their financial situation while minimizing risk. Success in these endeavors often depends on patience, consistency, and the ability to adapt to changing circumstances. By focusing on opportunities that align with personal strengths and market demands, individuals can create a pathway to financial growth that is both sustainable and rewarding.