Is getting rich quick possible? How can I do it?

Okay, I understand. Here's an article in English addressing the question of "Is getting rich quick possible? How can I do it?" while adhering to your specific requirements regarding structure, language, and content.

``` The allure of amassing wealth rapidly is a siren song that has captivated humanity for centuries. The promise of escaping financial hardship and achieving a life of luxury with minimal effort is understandably tempting. However, the reality of "getting rich quick" is far more nuanced and, quite frankly, significantly less likely than many are led to believe.

The core question revolves around what "getting rich" truly means and the timeframe considered "quick." For some, it might mean achieving a level of financial independence where they can comfortably cover their expenses and pursue their passions without worrying about income. For others, it might signify accumulating vast sums of wealth that place them in the upper echelons of society. Similarly, "quick" can range from a few months to a few years. These definitions significantly impact the feasibility of the goal.

There's no denying that sudden wealth creation is possible. Lottery wins, inheritance, or a timely investment in a rapidly appreciating asset can indeed lead to a significant increase in net worth in a relatively short period. However, relying on such events is fundamentally a flawed strategy. Lotteries are statistically improbable, inheritances are unpredictable, and accurately timing the market with high-growth investments requires an exceptional blend of skill, research, and luck.

While the aforementioned routes are largely based on chance, certain avenues exist that, while demanding significant effort and carrying inherent risks, offer a higher probability of accelerated wealth accumulation.

One such path is entrepreneurship. Starting and scaling a successful business, particularly in a high-growth industry, can be a powerful engine for wealth creation. However, this requires more than just a good idea. It demands relentless dedication, a strong work ethic, the ability to manage risk, a deep understanding of the market, and the capacity to build and lead a team. Many startups fail, and even successful businesses often require years of reinvestment before generating substantial personal wealth for the founders. Think of the tech boom, where numerous companies rose rapidly, making their founders and early investors incredibly wealthy. However, countless others failed to gain traction and faded into obscurity.

Another potential route, often overlooked, lies in developing highly specialized skills that are in high demand. This could involve mastering a complex programming language, becoming an expert in a niche field of medicine, or acquiring proficiency in a valuable trade. The key is to identify skills that command a premium in the labor market and invest heavily in developing expertise in those areas. This approach, while not guaranteeing instant riches, provides a solid foundation for high earning potential and long-term financial security. It requires focused effort, continuous learning, and the ability to adapt to changing market demands.

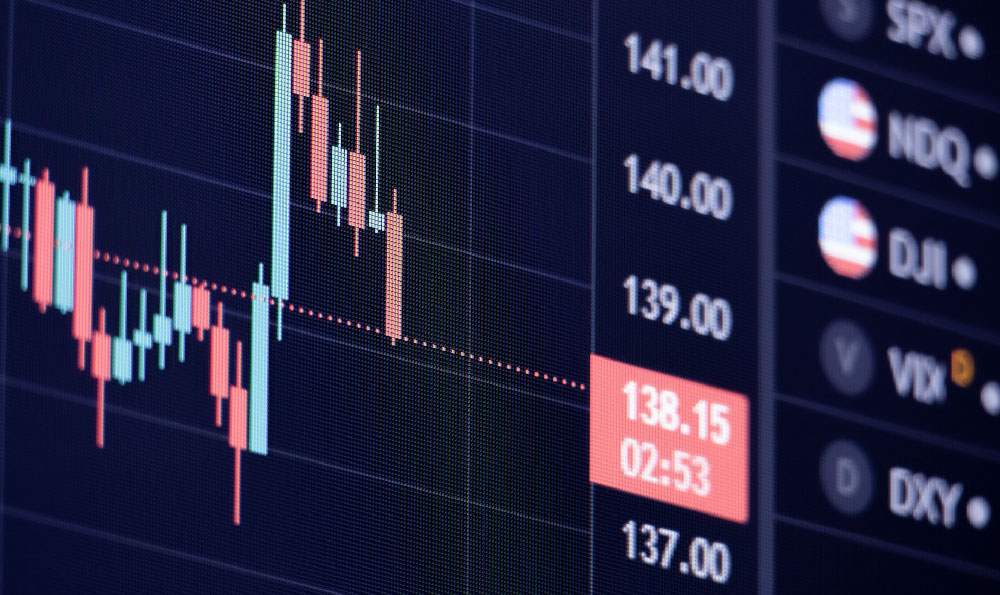

Investing in assets that have the potential for high growth is another strategy. Real estate, stocks, and even cryptocurrencies have, at times, offered opportunities for significant returns in a relatively short period. However, this approach is inherently risky. Market volatility, economic downturns, and unforeseen events can all lead to substantial losses. Successful investing requires a thorough understanding of the asset class, a disciplined approach to risk management, and the ability to resist emotional impulses. Simply chasing the latest "hot" stock or cryptocurrency without proper due diligence is a recipe for disaster.

Furthermore, it is crucial to be wary of schemes and promises that guarantee quick and easy riches. These are often scams designed to exploit people's desire for financial gain. Ponzi schemes, pyramid schemes, and other fraudulent investment opportunities abound, and they can quickly wipe out savings and leave victims in a worse financial position than before. Always conduct thorough research, seek independent financial advice, and be skeptical of anything that sounds too good to be true.

Building wealth quickly is often associated with taking on significant debt. While leveraging debt can amplify returns, it also magnifies risks. Overextending oneself with debt can lead to financial ruin if investments don't perform as expected. Responsible debt management is crucial, and it's important to avoid taking on more debt than one can comfortably repay.

Ultimately, the path to financial success is rarely a straight line. It requires a combination of hard work, smart decision-making, perseverance, and a willingness to learn from mistakes. While the allure of "getting rich quick" is understandable, a more realistic and sustainable approach involves focusing on building a solid financial foundation, developing valuable skills, managing risk effectively, and consistently working towards long-term financial goals. The journey may be longer and more challenging, but the rewards are far more likely to be realized. Instead of fixating on the "quick," concentrate on the "rich," defining it in a meaningful way and pursuing it with diligence and informed strategy. This shift in perspective will not only increase the likelihood of achieving financial security but also foster a more resilient and fulfilling life. ```