Is making money ASAP possible? What's the best way to do it?

The allure of rapidly accumulating wealth, especially in the volatile world of cryptocurrency, is undeniable. Everyone desires financial freedom, and the potential for exponential gains in the crypto market makes it an enticing, albeit risky, avenue. However, the question of whether making money "ASAP" is possible, and what the "best" way to do it is, demands a nuanced and cautious response. The truth is, the pursuit of quick riches often leads to poor decision-making and significant losses. While rapid gains are possible, they are far from probable and should not be the cornerstone of any sound investment strategy.

Instead of focusing on get-rich-quick schemes, a more realistic and sustainable approach to crypto investing involves a combination of thorough research, risk management, and a long-term perspective. The very idea of "ASAP" contradicts the principles of prudent investment, which emphasize patience, diversification, and continuous learning. Let's explore some strategies, framed not as shortcuts, but as responsible approaches to potentially accelerating wealth creation in the crypto space.

One of the most fundamental aspects of crypto investing is understanding the underlying technology and economics of the projects you are considering. Avoid blindly following hype or relying solely on social media buzz. Instead, delve into the whitepapers, analyze the team behind the project, understand the tokenomics (supply, distribution, burning mechanisms, etc.), and evaluate the use case and its potential for real-world adoption. Coins and tokens with strong fundamentals and solving a genuine problem are far more likely to experience sustained growth than those based on pure speculation. This fundamental analysis takes time and effort, but it's a crucial safeguard against investing in scams or projects with little long-term viability.

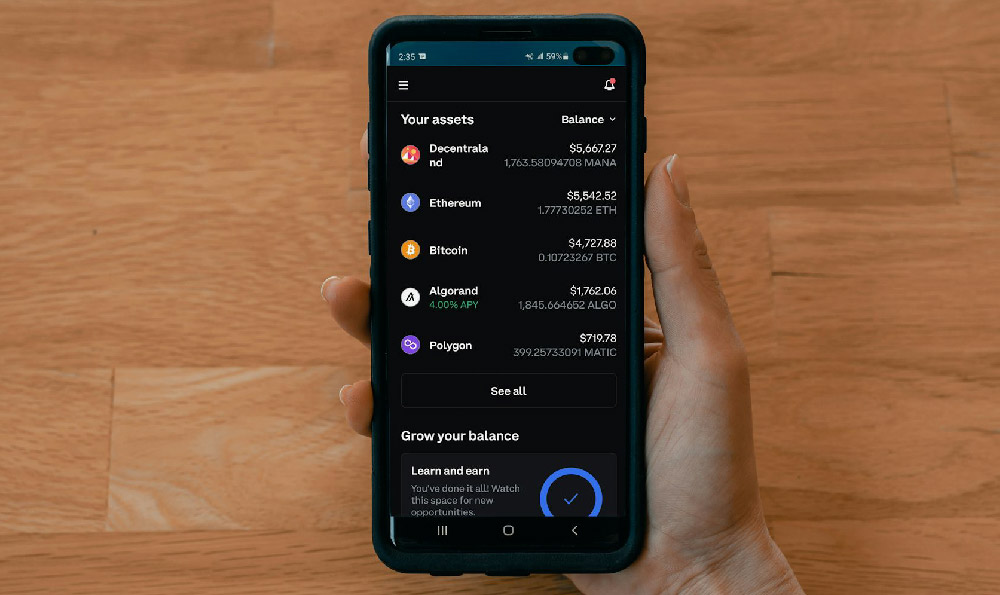

Diversification is another critical principle. Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies, sectors (e.g., DeFi, NFTs, metaverse), and even asset classes (stocks, bonds, real estate). This mitigates the risk of significant losses if one particular investment performs poorly. While a concentrated portfolio could lead to faster gains if your chosen asset skyrockets, it also exposes you to immense downside risk. A well-diversified portfolio smooths out the volatility and allows you to participate in the overall growth of the crypto market while minimizing the impact of individual failures.

Trading strategies, such as day trading or swing trading, are often touted as ways to make quick money. However, these approaches are inherently risky and require a significant amount of time, knowledge, and discipline. The crypto market operates 24/7, meaning constant monitoring is necessary. Furthermore, technical analysis, chart patterns, and order book reading are essential skills to navigate these short-term strategies successfully. The vast majority of retail traders lose money in the long run, especially in a volatile market like cryptocurrency. If you are determined to pursue trading, start with a small amount of capital that you are prepared to lose, and thoroughly educate yourself before risking larger sums. Consider paper trading (simulated trading with no real money) to hone your skills before entering the real market.

Another avenue for potentially accelerating gains is participating in Initial Coin Offerings (ICOs), Initial Dex Offerings (IDOs), or other early-stage funding rounds. These offer the opportunity to invest in projects with potentially high growth potential before they become widely available. However, this also comes with significant risk. Many ICOs and IDOs are scams or fail to deliver on their promises. Thorough due diligence is paramount. Investigate the team, the technology, the tokenomics, and the community support before committing any capital. Only invest what you can afford to lose, as the vast majority of early-stage projects fail.

Staking and yield farming are other options for generating passive income from your crypto holdings. Staking involves locking up your crypto in a blockchain network to support its operations and earn rewards in return. Yield farming involves providing liquidity to decentralized exchanges (DEXs) and earning fees from traders. Both staking and yield farming can offer attractive returns, but they also come with risks, such as impermanent loss (in yield farming), smart contract vulnerabilities, and regulatory uncertainty. Thoroughly research the protocols and understand the associated risks before participating.

Beyond specific strategies, the most crucial factor in achieving long-term success in crypto investing is education and continuous learning. The crypto landscape is constantly evolving, with new technologies, regulations, and market trends emerging all the time. Stay informed by reading reputable news sources, following industry experts, attending webinars and conferences, and actively participating in online communities. A deep understanding of the market and the underlying technologies is essential for making informed investment decisions and avoiding costly mistakes.

Ultimately, the pursuit of making money "ASAP" in crypto is a dangerous and often counterproductive mindset. While rapid gains are possible, they are the exception, not the rule. A more sustainable and responsible approach involves a combination of thorough research, risk management, diversification, continuous learning, and a long-term perspective. Focus on building a solid foundation of knowledge and understanding, and resist the temptation to chase quick riches. Remember, slow and steady often wins the race. Be patient, be diligent, and be prepared to adapt to the ever-changing landscape of the cryptocurrency market. The key is not to get rich quick, but to build wealth sustainably over time.