how to make money with Bitcoin investing

Bitcoin investing has emerged as one of the most dynamic and controversial avenues for wealth generation in the digital age, offering both extraordinary opportunities and significant risks. For those considering entering this market, it's essential to approach it not as a quick fix for financial gain but as a complex asset class that requires strategic understanding, disciplined execution, and a long-term perspective. Unlike traditional investments, Bitcoin operates in a decentralized framework, driven by algorithmic rules and market sentiment rather than centralized institutions, which means its behavior is shaped by unique factors such as technological innovation, regulatory shifts, and macroeconomic trends. To navigate this landscape effectively, investors must first grasp the fundamentals of Bitcoin's value proposition and then align their strategies with their financial goals, risk tolerance, and time horizons.

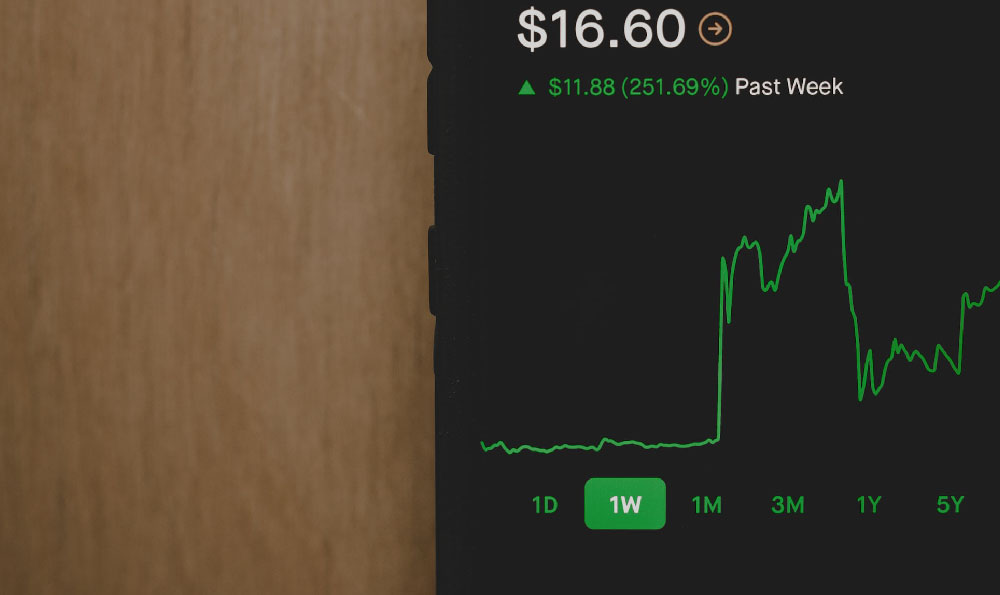

At the core of Bitcoin's appeal lies its potential for high returns. Over the past decade, Bitcoin has demonstrated volatility that is unmatched by most conventional assets, with price swings often exceeding 50% in a single day. This extreme variability is a double-edged sword, as it can lead to substantial gains for those who time their entries and exits correctly but also exposes investors to catastrophic losses if they fail to manage risk. Historical data shows that Bitcoin has experienced multiple bull markets, with notable peaks in 2017, 2020, and 2021, each driven by a combination of factors such as institutional adoption, limited supply, and macroeconomic conditions like inflation or fiat currency devaluation. However, these gains have been preceded by sharp corrections, underscoring the importance of understanding the market's cyclical nature and not viewing it as a linear path to wealth.

A critical component of successful Bitcoin investing is identifying the right entry and exit points. While some investors rely on fundamental analysis, such as tracking adoption rates, transaction volume, or network growth, others employ technical analysis to decipher price patterns and market trends. Tools like the Relative Strength Index (RSI), Moving Averages, and Fibonacci retracements are frequently used to gauge overbought or oversold conditions, although their reliability in a volatile market like Bitcoin remains debated. It's also important to consider macroeconomic indicators, such as interest rates, geopolitical events, and technological advancements, which can influence Bitcoin's demand and supply dynamics. For instance, a decline in fiat currency value or a rise in global inflationary pressures may drive investors toward Bitcoin as a hedge against traditional financial systems, while regulatory crackdowns can introduce uncertainty and trigger sell-offs.

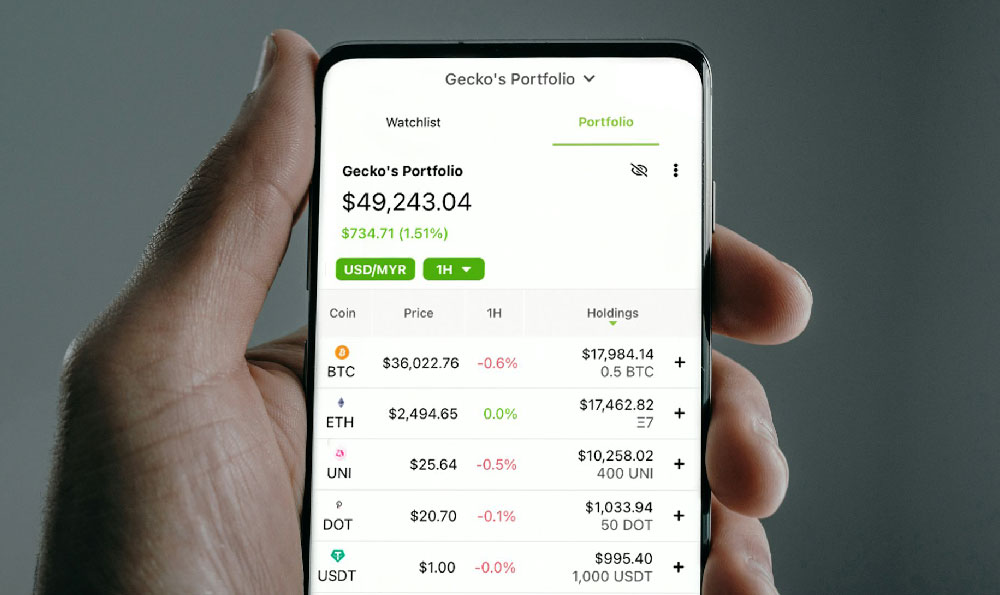

Risk management is paramount in Bitcoin investing, as the asset's price movements are often driven by speculative behavior and market psychology. Investors should prioritize setting clear stop-loss orders to limit potential losses, diversifying their portfolios to avoid overconcentration in a single asset or sector, and maintaining a margin of safety by only investing capital they can afford to lose. The concept of dollar-cost averaging (DCA) can also be beneficial, as it involves investing a fixed amount at regular intervals regardless of price fluctuations, thereby reducing the impact of timing risks. Additionally, understanding the bid-ask spread and transaction fees is crucial, as these costs can significantly erode returns over time, especially for frequent traders.

The long-term perspective is arguably the most effective strategy for Bitcoin investing, as the asset's scarcity and limited supply suggest that its value may continue to appreciate over time. Bitcoin's maximum supply of 21 million coins creates a deflationary mechanism, which could become increasingly relevant in an environment of persistent inflation. However, this long-term potential is not guaranteed, and investors must be prepared for short-term volatility when adopting such a strategy. The key is to balance patience with vigilance, staying informed about developments in the cryptocurrency space while resisting the urge to react impulsively to price fluctuations.

Regulatory considerations also play a pivotal role in shaping Bitcoin's future and determining investment outcomes. Governments and financial authorities around the world are still grappling with how to regulate cryptocurrencies, leading to a patchwork of policies that can create uncertainty for investors. For example, the introduction of stricter anti-money laundering (AML) laws or the implementation of central bank digital currencies (CBDCs) could influence Bitcoin's trajectory. Staying abreast of these developments and considering the implications for market structure is essential for making informed investment decisions.

In conclusion, Bitcoin investing is a multifaceted endeavor that demands a blend of technical proficiency, strategic foresight, and emotional discipline. While the asset offers the potential for significant returns, its volatility and regulatory uncertainties necessitate a careful approach. By combining fundamental and technical analysis, implementing robust risk management practices, and maintaining a long-term perspective, investors can navigate the complexities of the Bitcoin market and position themselves for sustainable growth. However, it's equally important to recognize that Bitcoin is not a guaranteed path to wealth, and its success is closely tied to the broader macroeconomic, technological, and regulatory environment. For those willing to embrace its challenges and commit to continuous learning, Bitcoin could serve as a powerful tool for diversifying their investments and achieving financial goals.